Companies unfazed by new taxes

Foreign investments into China are not expected to be adversely affected by the cancellation of some of the country's preferential tax policies which came into effect this month.

A spokesperson for the European Chamber of Commerce in China said the fact that foreign companies are gradually being treated the same as their local counterparts sends a strong signal that China's investment environment and policies are maturing.

"European companies have been well prepared for the change. We have no reason to complain about the additional taxes," the spokesperson said.

"But we will be paying close attention to how China will continue opening to foreign businesses in the future."

Late last month, the State Council - the nation's Cabinet - announced that China will charge foreign firms in China two other taxes, construction tax and education surcharge, from Dec 1.

With the measures, most taxes imposed on domestic and international companies have been unified.

But foreign companies took the move in their stride.

The Philippines-based SM, also that country's largest retailer, is planning to invest more than $1 billion (764 million euros) in China's second-tier cities in the next five years to establish super shopping malls.

And Uwe Raschke, deputy member of the Board of Management of Bosch, Germany's leading industry group, said China will be given priority when it comes to investment overseas.

The Swedish construction equipment provider Volvo Group is planning to invest more than $100 million in emerging markets, with the majority going to China.

"The company's business in Asia has doubled this year, with China acting as the pillar contributor," said Olof Persson, president and chief executive of Volvo Construction Equipment.

Analysts said the effect on foreign investors is limited, and they must adapt to the new situations in China and regard it as a market rather than just a low-cost production center

Wang Zhile, director of the research center on transnational corporations under the Ministry of Commerce, said he did not think the taxes would have any negative impact on foreign direct investment (FDI) in China.

"China's robust economic growth and boosting domestic consumption will continuously help the market maintain its appeal to the foreign businesses," Wang said.

Ding Yifan, member of China Economic and Social Council with the State Council, agreed.

"Besides tax policies, there are many other factors including consumption market size, labor resources and economic growth that could decide a nation's attractiveness as an investment destination," Ding said.

"And the measure itself will help to create a fair tax environment for companies at home and abroad."

At an early stage of China's reform and opening-up, the nation introduced some tax preferential policies tailored for the international companies in a bid to propel economic growth.

Foreign companies were exempt from some taxes such as corporate tax, construction tax and education surcharge. Over the past few years, however, preferential policies were gradually phased out and a set of unified standards for companies at home and abroad was introduced.

The Ministry of Commerce said that from January to October, China's FDI grew by 16 percent from a year earlier, and October is also the 15th consecutive month the FDI registered positive growth since the 2008 financial crisis.

In June, the European Chamber of Commerce in China released a confidence survey, highlighting that 70 percent of its members believed China will be in their top three investment destinations in five years.

The tax measures come after China's investment environment was widely blamed by foreign businesses over the past months, and their complaints mostly centered on China's calling off "super" preferential policies during the past few years.

In 2007, China unified the corporate income tax charged on domestic and foreign companies to 25 percent. Before that, corporate income tax for foreign firms was 15 percent, 18 percentage points lower than their local counterparts.

The move marked a turning point for the "super" preferential policies that the internationals had enjoyed for about two decades.

In April, China launched a new FDI guideline, in which the government encourages foreign companies to invest in service and high-tech sectors rather than manufacturing, and to invest in China's central and western regions.

"It's understandable that they need time to adapt to the changes, but China also has reasons to adjust investment policies to support the economic development mode," said Wang.

Premier Wen Jiabao has on many occasions confirmed that China welcomes foreign enterprises and will provide them with the same treatment as domestic companies.

"China is patiently listening to their voices, and will continue to take advice from them and create a more open environment for them as foreign enterprises to act as a significant growth engine for China's economy," Wang said.

Since August, China's foreign direct investment growth has remained at single-digit levels, which contrasts with the 30 percent rate in the first half of this year.

Concerns have also been raised about whether the high-level growth could be sustained.

"China has outperformed the others in absorbing the FDI and there is no doubt that FDI will continue to grow in the coming years," said Hao Hongmei, a researcher at the department of foreign investment of Chinese Academy of International Trade and Economic Cooperation under the Ministry of Commerce.

"But thanks to the global economic downturn and the nation's transformation, China's FDI growth will probably moderate and even decelerate somewhat."

A report released by the United Nations Conference on Trade and Development in September shows that China continues to be the world's most attractive FDI destination.

China's economy has grown more than 9 percent in the past five quarters ending in September as the government stimulus paid off. The International Monetary Fund predicts China will expand by 9.6 percent in 2011, four times the pace of the United States and six times that of the euro area.

China continued to be ahead of Japan as the world's second-largest economy for the second straight quarter in the three months ending in September.

Li Fangfang and Zhou Siyu contributed to this story.

Today's Top News

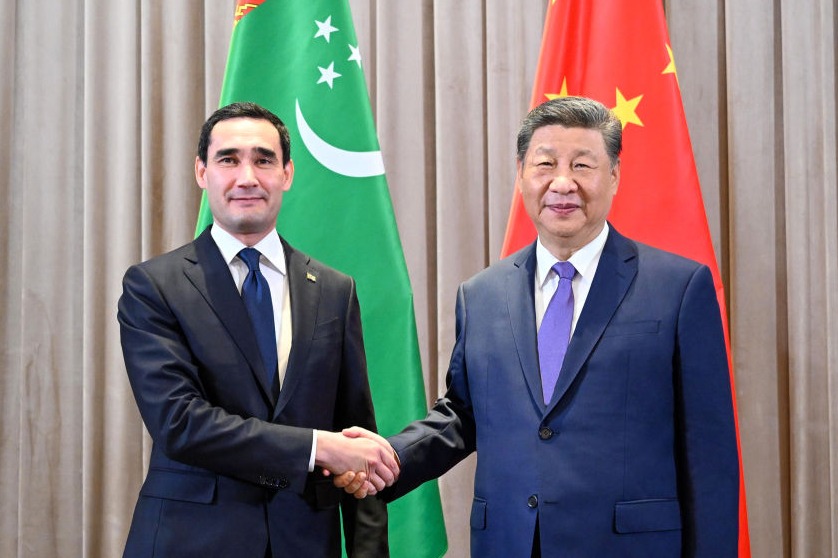

- Xi meets Turkmen President Serdar Berdimuhamedov

- Xi calls on China, Tajikistan to expand scale of bilateral trade, investment

- Xi says China-Kyrgyzstan cooperation holds great potential

- Xi meets Uzbek President Shavkat Mirziyoyev

- Xi meets Turkmen President Serdar Berdimuhamedov

- Xi meets Tajik President Emomali Rahmon