Nations discuss monetary reform

| French President Nicolas Sarkozy says it will be "an enormous challenge" to build a more stable and robust international monetary system. Feng Yongbin / China Daily |

NANJING - The reform of the international monetary system (IMS) is a necessary requirement to promote the world's trade and capital flow, but it will be a long and complicated process, said China's Vice-Premier Wang Qishan on Thursday.

Wang made the comment at the opening ceremony of a one-day seminar on the IMS held in Nanjing, in eastern China's Jiangsu province.

"Reform and improvement of the IMS is needed for the sustainable development of global trade, orderly capital flows and to prevent large fluctuations in exchange rates and commodity prices," said Wang.

The assembled leaders, officials and academicians at the seminar, which aimed to pave the way for November's G20 Summit deliberated on how to reform the IMS.

"To build a more stable and more robust international monetary system is an enormous challenge, and a collective challenge," said the French President Nicolas Sarkozy in his opening remarks.

"The international monetary system must gradually evolve to reflect the major trends that we have observed in the world economy," he said.

Participants agreed on broadening the Special Drawing Right (SDR) basket by including the currencies of some emerging markets including China,

but they did not discuss a timetable, said Christine Lagarde, the French finance minister, at a press briefing.

The SDR is a unit of account derived from the values of the dollar, yen, pound and euro.

Economists and officials from home and abroad also said the role of China's currency in the global market should be bigger by including the yuan in the SDR basket.

While the dollar, which is weakening due to the US quantitative easing policy, is considered to be a major source of the world's financial ills, the SDR is widely seen as a possible tool to replace the dollar to help stabilize the financial system.

The SDR is an international reserve asset, created by the International Monetary Fund (IMF) in 1969, to support the expansion of international trade.

Economists have argued that the financial system should reflect the power of emerging markets, including China.

On Thursday, France called on the G20 to agree a timetable for enlarging the SDR basket by including the yuan. Sarkozy asked: "Is it not time today to reach agreement on the timetable for enlarging the basket of SDRs to include new emerging currencies, such as the yuan?"

The US Treasury Secretary Timothy F. Geithner agreed. "Currencies of large economies heavily used in international trade and financial transactions should become part of the SDR basket," he said during the seminar.

But, "to achieve this objective, the concerned countries should have flexible exchange-rate systems, independent central banks and permit the free movement of capital flows", he said, in a veiled reference to China and its monetary system.

The participants also suggested "convertibility and flexibility of the currencies and relatively independence of the central banks" should be preconditions for the inclusion of the yuan into the SDR basket.

But the governor of the People's Bank of China Zhou Xiaochuan was quoted by Dow Jones as saying that the international community should focus on long-term reform of the international monetary system, rather than quick fixes.

The IMF refused to include the yuan in its SDR basket in November, saying the currency doesn't meet the required "freely usable" criterium.

The SDR basket is reviewed every five years by the IMF's executive board.

Xia Bin, a central bank monetary policy committee member, told China Daily that China is "happy" to see the yuan included in the SDR basket because the move could help to address the deficiencies of the IMS, but it will "take time".

Xia also emphasized that China cannot agree to yuan convertibility being a precondition of the currency's inclusion in the SDR basket. "We cannot accept such bargaining," Xiao said.

"The SDR basket should include the yuan, but the convertibility of the yuan should not be connected with its inclusion in the SDR," said Li Daokui, another advisor to the central bank's monetary committee.

China Daily

(China Daily 04/01/2011 page1)

Today's Top News

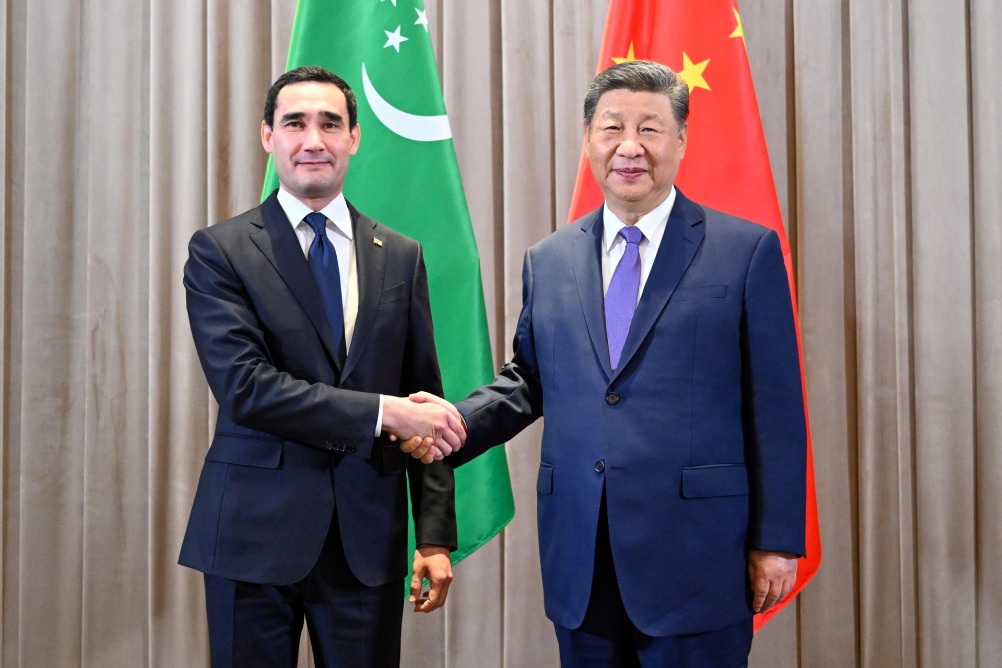

- Xi returns to Beijing after attending 2nd China-Central Asia Summit

- Xi leaves Astana after attending 2nd China-Central Asia Summit

- Multifaceted partnership has entered a new stage

- Global firms optimistic about China's market potential

- Xi calls for de-escalation of tensions in Middle East

- China-Central Asia Spirit forged