Trade conflict: Speaking truth from facts

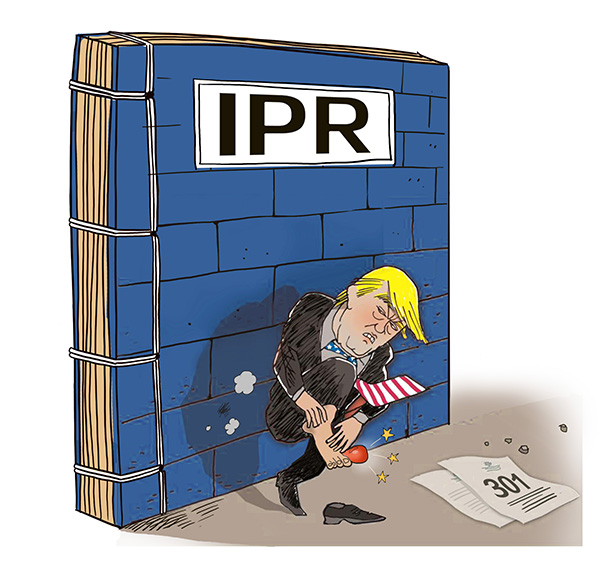

US President Donald Trump's unilateral and high-handed actions have soured China-US relations and almost ignited a trade war. On Tuesday, the Trump administration announced 25 percent tariffs on about $50 billion worth of Chinese exports to the US. This is in addition to the high tariffs he has already announced on Chinese imports under Section 301 of the Trade act of 1974.

First, Trump wants to punish China for the so-called damage caused by its alleged theft of US intellectual property and forced technology transfers. Second, his aim is to hamper China's efforts to upgrade its manufacturing sector. And third, it seems the US wants to shift the global value chain from China since the tariffs cover many typical global value chain goods such as electronics, telecommunications, machinery, and transportation equipment.

In response, China announced similar tariffs on some 106 US items worth $50 billion.

The US has resorted to the beggar-thy-neighbor policy, and now it wants to punish China for responding to its action. And on Thursday, Trump instructed the US Trade Representative to consider an additional $100 billion tariffs on Chinese imports.

The two countries' actions conform to the game theory, in which two parties are forced to follow each other's actions. The current situation reminds one of the irresponsible government actions leading to the Great Depression in the 1930s. I believe misinformation has played a big role in creating this lose-lose situation. I say "misinformation" because the US public has been misled by perceptions, not by truth, about China's investment environment. The fact is, China's investment environment is not unfavorable to the US companies, though improvements can be made.

China a favorable location for US investors

Is China an important country for US direct investment abroad? Considering the size of US direct investment in China, the answer is "not so important", because US direct investment in China lags behind that in countries such as the Netherlands, the United Kingdom, Luxembourg, Ireland and even Japan. By the end of 2016, US total direct investment in China was only $93 billion, similar to that in Mexico, with about 67,000 US companies in operation, while in the Netherlands and Ireland, cumulative US direct investment amounted to $847 billion and $387 billion. China is only the 15th largest recipient of US direct investment.

US companies prefer to invest in European countries and other economies rather than in China, perhaps because American investors are wary of China's economic system. Which, to say the least, is unfounded, especially because US direct investment in China has outperformed those in other countries.

According to US Bureau of Economic Analysis data, the total sales of the US companies operating in China amounted to $356 billion in 2015, and ironically the figure was more than the US trade deficit of $335 billion with China that year.

What implications does this figure have? Although the US companies invest relatively less in China than in the Netherlands, Luxembourg, Japan, Australia and Mexico, they have sold more goods in China than in those seemingly more favorable economies. China is the 15th largest recipient of US direct investment, but it is the 6th most favorable location for the US investors-after the UK, Canada, Singapore, Ireland and Germany. In terms of value added produced by the US companies, China's investment environment is highly competitive, as the US companies produced $68 billion value-added in China in 2015. This would put China alongside the UK, Canada and Germany-the four highest value-added producing countries for the US companies.

Besides, if China is a country where intellectual property theft is common and if the US companies were unable to protect their trade secrets without the US government's interventions, they should have ceased their research and development activities in China long ago.

Investment in China offers US higher returns

But what is the truth? The US companies, not surprisingly, have performed more R&D activities in China than in those countries highly valued by the US public and officials, such as the Netherlands, Luxembourg, Ireland, Australia, France, Singapore and Japan. In 2015, the R&D activities of the US companies in China were worth $31 billion (similar to the top three countries-Germany, the UK and Canada).

If you look at the average sales of per dollar of investment (equivalent to average return of investment in economics), the US companies in China are most successful-compared with all those economies favored by the US public and officials-with 1 dollar of investment generating up to $4.7 in sales in 2014 and $4.2 in 2015. The corresponding figure for the UK was only $0.99, Canada $1.6, Ireland $1.1 and Luxembourg $0.12.

Now let us look at the profitability ranking of the US companies in China relative to other locations. Taking net income from each dollar invested as a measure of profitability, in 2014 the US companies enjoyed the highest profitability in Ireland for their investment-each dollar invested could generate $0.42 in profit. And second on the list was China, with a rate of return at $0.35 per dollar invested-significantly higher than Canada at $0.19, the UK at $0.13, the Netherlands at $0.20 and Japan at $0.19.

And what about the effectiveness of value added and investment income generated by the US companies for each invested dollar? The US companies generated an average of $0.92 value added for each dollar invested in China, while the average of seven major economies-Canada, the UK, Ireland, the Netherlands, Germany, France and Japan-was only $0.41.

Besides, the US companies received the highest investment income from each dollar invested in China in 2014-an average of $0.15, that is, 200 percent more than that in Germany and 67 percent more than in Japan.

Country more suited to R&D activities

What about R&D activities? The latest figures show that an average of $0.08 for each invested dollar was used for R&D activities in Germany, while the corresponding figure for China was $0.04. Comparing these numbers with those in other favored economies, we see a striking difference. In the UK and the Netherlands, only $0.01 and $0.002 of each invested dollar was committed to R&D activities, while in Luxembourg, one of the most favored economies for US direct investment, an average of $0.0004 of each invested dollar was allocated to R&D activities.

Two main conclusions can be drawn from these facts. First, the US companies operating in China have performed better than in those economies favored by the US officials and public. In terms of sales, net income, value added, investment income and R&D activities, the outstanding performance of the US companies in China give the lie to the accusations of some US officials that China's so-called unfair practices have inflicted substantial damage to US business interests, and therefore tariffs on $50 billion of Chinese imports should be imposed.

Second, with its market size and vast pool of skilled labor, China is a market characterized by a high rate of return for investment. China's market is a boon rather a curse for the US investors as it provides highly profitable opportunities for the US companies.

To quote Adam Smith from The Wealth of Nations: "Man is an animal that makes bargains: no other animal does this-no dog exchanges bones with another." And therein lies the answer to the US riddle.

The author is chief economist at the Academy of China Open Economy Studies of University of International Business and Economics.