Banker warns Washington not to open investment war with China

LOS ANGELES - An influential banker warned Monday that the Trump administration would likely target investment next in the US-China trade war, but that would only further hurt America's interests and economic welfare.

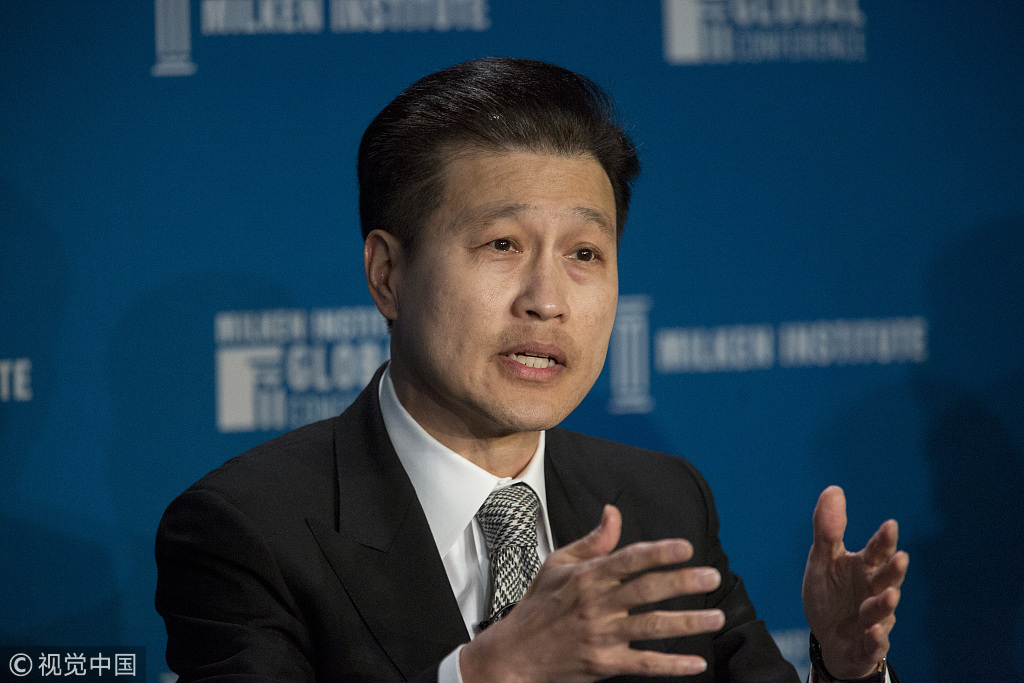

Dominic Ng, CEO of the Los Angeles-based East West Bank, made the remarks in an article sent to Xinhua. The East West Bank is among the top five on Forbes annual list of America's Best Banks 2018.

Ng said an investment war is possible, "given this President's confrontational and unpredictable approach towards China and the international economy in general."

Citing vague and inconsistent statements by President Donald Trump and his senior officials, Ng said the Trump administration could politicize legislation to expand the screening of foreign investments, using national security as an excuse.

He said such investment restrictions will further diminish the already shrinking Chinese investment in the United States, as well as the associated benefits on the US side.

The banker noticed a sharp drop in the Chinese direct investment in the United States this year. According to a Rhodium Group report issued in late June, Chinese direct investment in the United States was estimated to be $1.8 billion in the first five months of 2018, 90 percent down from the same period last year.

Ng blamed the investment decline on "most importantly tougher and longer CFIUS (Committee on Foreign Investment in the United States) reviews and a confrontational policy stance toward China."

"China's global outbound investment has bounced back to pre-2016 levels, and it is recovering strongly in Europe - a stark contrast to the picture in the US" Ng commented, adding that additional restrictions on Chinese firms will further divert Chinese capital to Europe and other economies.

As there is no mechanism or government agency legally tasked to implement investment restrictions on a case-by-case basis, he said, the restrictions could finally close the US door to the productive and beneficial foreign direct investment that it really needs.

In the article, the banker cited the US restrictions on Chinese automotive investment as an example, saying it could result in killing investments like Fuyao's auto glass plant in Ohio or Giti Tire's plant in South Carolina, which "each supports hundreds of the blue-collar jobs so important to President Trump." In addition, he said imposing targeted investment restrictions on one country will also break the US tradition of the indiscriminating openness that has been a pillar of the US economic strength by supporting almost 7 million jobs and generating nearly 900 billion dollars in annual economic output.

"For example, companies from Germany - which has also drawn President Trump's ire due to perceived unfair trade practices - will wonder if they will be the next targets," he added.

In the article, Ng warned the Trump administration against underestimating China's ability to respond, saying China's retaliation could force US companies currently enjoying profits from China's vast market to deal with potential negative consequences.

Ng called on the US Congress to make sure the new Foreign Investment Risk Review Modernization Act legislation will keep the CFIUS mandate narrowly focused on national security and not economic criteria.

"They must also ensure that any law is then implemented in a narrow and transparent way to minimize politicization and abuse, bolstering the predictability that foreign investors need," Ng said.

Meanwhile, the banker advised the Trump administration to refrain from imposing restrictions specifically discriminating against Chinese investors since "it will only further impinge beneficial investment, erode foreign confidence in the US economy and lead to real economic harm for US firms and citizens."