Early data suggests China’s resilience but rising global uncertainty

As the crisis momentum is shifting from China to foreign countries, efforts to politicize the crisis and inadequate preparedness are translating to new international economic uncertainty and market volatility.

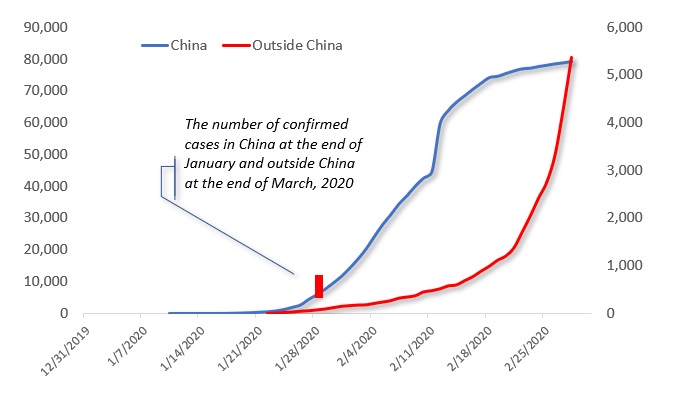

Worldwide, the number of confirmed novel coronavirus (COVID-19) cases could exceed 100,000 in a week or so. In early February, I predicted a turnaround in the growth rate of new virus cases in China, but acceleration internationally (see China Daily, Feb 10, 2020). That's now the new normal. The number of confirmed cases outside China is now about the same as it was in China a month ago (Figure).

Figure - The Shift in the Outbreak Momentum from China to Outside China

Economic scenarios, early data

After mid-January, I projected three probable virus impact scenarios in China. Let’s take a closer look at those scenarios in light of the new evidence.

In the first scenario of “SARS-like impact,” a sharp quarterly effect, accounting for much of the damage, would be followed by a rebound. The broader impact would be relatively low and regional. In the second scenario of “extended impact,” the adverse impact would last at least two quarters. The broader impact would be more severe and have an effect on global prospects, with rebound only in the summer. In the third scenario of “accelerated impact,” adverse damage would be far steeper with dire consequences in the global economy.

Recently, IMF projected China's growth to fall to 5.6 percent in 2020, while global growth would fall 0.1 percentage points from the expected 3.3 percent. In China, the rebound story is still possible, as long as fiscal and monetary support is adequate. And if the small- and midium-size enterprises (SMEs) can jumpstart production soon. The SMEs account for over four-fifths of nationwide employment and more than half of the GDP.

In light of the international outbreaks, the IMF’s global estimate may be too optimistic. The big question is whether other major affected economies - US, EU/UK, Japan and largest emerging countries - can achieve China-like fast containment.

According to new data, factory activity in China contracted at the fastest pace on record as the Purchasing Managers’ Index (PMI) fell to a record low of 35.7 from 50.0 in January. The same went for the services sector activity. Yet, both plunges were to be expected. Economic shocks translate to contractions. The question is the strength of the post-shock rebound.

In China, the expectation in January was that the first quarter would be penalized by a reduction of 1.2 percentage points to 5 percent or less, while the second quarter rebound would offset much (but not all) of the losses. March data could still prove high, given the low starting-point. It is these assumptions of the first scenario that fuel the bold projections by J.P. Morgan that the Chinese first quarter could go down to -4 percent, but second quarter would go up to +15 percent.

Recently, the IMF projected US growth to suffer a 0.4 percent slowdown in the annualized growth; that is, from 2.0 percent to 1.6 percent. But that is predicated on success in outbreak containment – and early mistakes in US containment measures are not promising.

International challenges

Today, the first and most benign “SARS-like impact” scenario is no longer likely. But nor is the second “extended impact” scenario inevitable if China gets back to business in March.

Yet, uncertainty is now beginning to grip the rest of the world, as evidenced by the recent multi-trillion-dollar market corrections in US and elsewhere. Too many countries are starting containment mobilization far too belatedly, despite elevated warnings since mid-January.

What has made a challenging situation worse is that, instead of timely mobilization against the virus, Washington has sought to politicize China’s outbreaks.

In light of almost two months of outbreaks, most observers have underestimated China's long-term resilience, while overestimating the ability of advanced economies to avert the outbreaks. The net effect is that as China is now on its way back to business, economic uncertainty and market volatility may still intensify in Europe and the United States.

Dr. Dan Steinbock is an internationally recognized strategist of the multipolar world and the founder of Difference Group. He has served at the India, China and America Institute (USA), Shanghai Institutes for International Studies (China) and the EU Center (Singapore).

The opinions expressed here are those of the writer and do not represent the views of China Daily and China Daily website.