Banks offer series of loans to boost growth

Hangzhou Mufan Textile Co Ltd, a mattress fabric and home textile fabric supplier, will also shift its focus to the domestic market.

Last year, Thailand, a major importer of the company's products, constituted nearly half of its sales volume of more than 20 million yuan, as many tourists visiting the Southeast Asian country returned home with the company's products.

The novel coronavirus outbreak has struck a heavy blow to Thailand's tourism sector and relevant market entities. Shen Jianhua, general manager of Mufan Textile, said he estimated that the sales volume of the company will drop to 12 to 15 million yuan this year.

"I don't expect to make a profit this year. All I want for my company is to survive," Shen said.

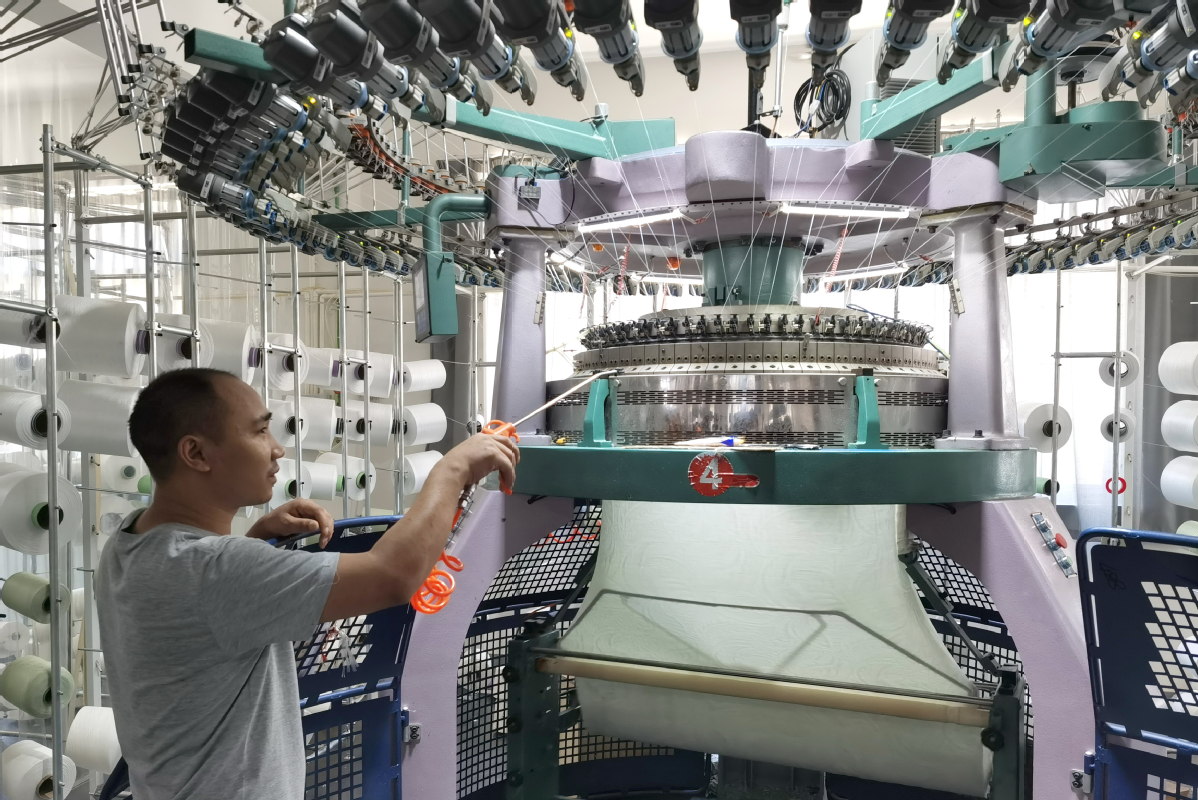

Before the pandemic, he planned a business expansion and bought four textile-making machines at over 400,000 yuan a piece. Fabrics woven by the new equipment will be finer, smoother and more competitive in the market.

Since the pandemic broke out, Shen has adjusted his plan and is preparing to target middle-to-higher income customers in the domestic market.

"If the pandemic abates at the beginning of next year, I will buy another four pieces of textile equipment, rent more space for production and hire more workers. Then I will apply for a loan to meet my needs of funding between 1 million yuan and 2 million yuan," he said.

The company has been granted a collateral-free credit line of 1 million yuan by Bank of Taizhou Co Ltd, a city commercial lender and a leading provider of small business financing services. When Shen started his business in 2016, the bank offered him a one-year working capital loan of 300,000 yuan, with his brother-in-law serving as the guarantor.

In recent years, Bank of Taizhou pushed ahead to establish roots in villages and rural areas. It has also been active in major industries in different regions to improve customer recruitment, enhance customer support and respond to customer needs more quickly, said Xu Haijun, vice-president of the bank's branch in Hangzhou, Zhejiang province.

By Aug 1, the number of licensed small business and individually-owned business clients exceeded 16,000 at Bank of Taizhou's Hangzhou branch, accounting for 78 percent of its total number of clients. Its average outstanding balance of loans provided to the above-mentioned clients was 493,300 yuan per borrower.

About 60 percent of Bank of Taizhou's new clients are first-time borrowers that have never taken out bank loans before. At its Hangzhou branch, the volume of loans for terms of more than one year accounted for 37.5 percent of the total, and the volume of collateral-free loans accounted for 38.5 percent of the total.

"From March to July, our staff visited 27,000 corporate clients and individually owned business clients that have deposits or loans at our branch to learn their business conditions, the impact of COVID-19 on their businesses and their needs and suggestions. We reassessed these clients based on the investigations and kept supporting the businesses that were running normally but were facing temporary difficulties due to the pandemic," Xu said.

Bank of Taizhou took measures to effectively cut operating costs and reduce risk with the help of big data. It used data provided by Qichacha, a platform delivering business data and analytics on China-based companies, to facilitate client screening.

"Small clients do not necessarily mean high risks. Whether the risk is high depends on our risk control technologies, risk management capacity and knowledge of our clients," Xu said.

As of Aug 1, the NPL ratio of the bank's Hangzhou branch was 0.98 percent, well below the NPL ratio of 1.94 percent for China's banking sector as a whole at the end of the second quarter.

Ma Zhenhuan in Hangzhou contributed to this story.