De-dollarization: its causes and implications

One unintended consequence of growing division in global geopolitics is the emerging awareness of the concentrated risk of relying on a single currency in international transactions. This is especially apparent among some large, so-called "Global South", countries which are not allies of the United States and the West.

The desire to reduce US dollar exposure has, for example, led China to ramp up its promotion of the yuan as a global reserve currency; Russia and Saudi Arabia have denominated some of their energy trade in non-dollar currencies; and Brazil and Argentina are mulling the creation of a common currency for South America. The world may be witnessing the beginning of the end of the US dollar's dominance in the international monetary system.

To be sure, the position of the dollar is unlikely to be replaced any time soon. The talk of the Renmini as an immediate challenger to the dollar is exaggerated given the inertia of the dollar in international usage and the yuan is not yet fully convertible. The euro has never lived up to expectations of being a peer competitor to the dollar given the deep flaws in the currency union, while the use of the yen and sterling has dwindled over time to now accounting for only a small proportion of global trade.

Hence, the chance of the US dollar being displaced by a new dominant currency is slim. Rather, it is more likely that the global monetary system will transition from a uni-polar regime -- centered on the US dollar -- to a multi-polar regime, whereby the dollar, euro, yuan and possibly some other currency alliances all play important roles. This will be the greatest change in global finance since the collapse of the Bretton Woods system, but unlike the latter, it will likely be a more gradual process and not dictated by the US.

To see why the US dollar is losing its lure as the currency of choice, one has to go back to the basics of what makes a reserve currency. Here are three important characteristics:

The first is credibility, manifested in the government of the reserve currency responsibly managing macro-economic policies and is not seen as abusing the "exorbitant privilege" of the reserve currency status.

The second is the network effect, which expands as more people use it to exchange for goods and services. The larger the network, the greater the role it plays as a medium of exchange.

Finally, as a store of wealth, there needs to be large and deep capital market that enables holders of the currency to earn respective returns at given a level of risk.

The current de-dollarisation trend is, in my view, mainly a result of the USD losing credibility. On the policy front, the US government has not been managing its fiscal positions responsibly. Public-sector debt as a share of GDP has more than doubled since the global financial crisis to over 120 percent, and is projected to top 200 percent in the coming decades. Besides the inability to curb debt addiction, confidence in the US's ability to service this debt has also been challenged by the repeated debt-ceiling saga.

On the monetary side, the Fed has rarely managed its policy with the externalities of the US dollar in mind. Hence, the ebb and flow of the US monetary cycle has historically been a great amplifier of booms and busts in many emerging market economies. The great monetary experiment of the Fed in the last three years -- with extraordinary policy easing during the pandemic and rapid tightening thereafter -- has once again taken the world on a rollercoaster ride.

But perhaps the most important catalyst for the dollar's demise is the growing tendency of the US government to use it for geopolitical gains. Through sanctions, freezing of assets and exclusion from critical payment infrastructures, users of the dollar are not only required to accept US monetary and fiscal policies, but also increasingly forced to be aligned with US foreign policy too. The weaponization of the US dollar is awaking national security concerns among many Global South countries, leading to their desires to diversify currency use.

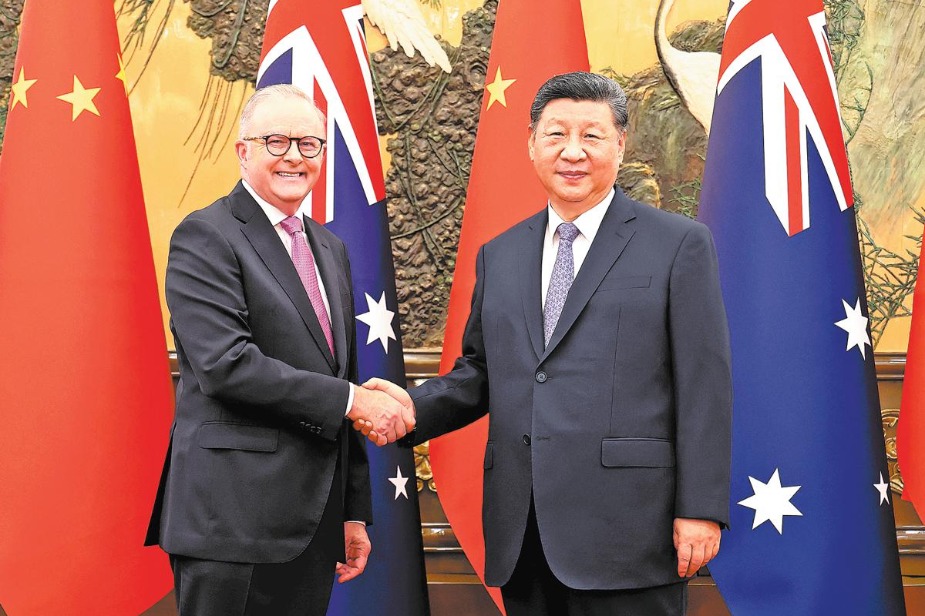

It is against this backdrop the yuan has gained recognition as a possible alternative to the US dollar. China's rise as a trusted economic partner of many emerging market countries has gained credibility for the RMB, with the network of the currency also expanding as more countries use it to price trade.

However, the absolute share of the RMB in cross-border transactions remains tiny compared to that of the US dollar. Not to mention, the currency is not yet fully convertible and capital flows in and out of China are still subject to controls.

Hence, the dollar's decline as the world's preeminent reserve currency is not a guarantee that the yuan will rise to fill its gap. Instead, a more likely evolution for the coming decade(s) is for the current uni-polar monetary system to be replaced by a multi-polar system, where the dollar shares the stage with multiple other currencies to reflect the new economic and political reality of the world. The journey to this new equilibrium will likely to be bumpy and profoundly consequential for all.

The author Aidan Yao is an experienced economist based in Hong Kong.

The opinions expressed here are those of the writer and do not necessarily represent the views of China Daily and China Daily website.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.