Investment environment has been improving, not deteriorating

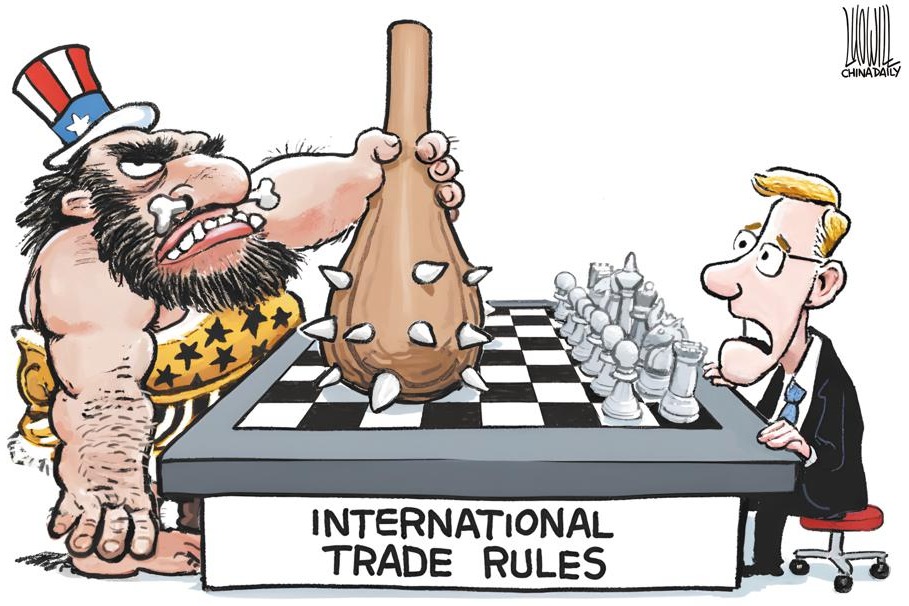

Some Western media and politicians have been spreading rumors about "China's deteriorating investment environment" and "investment risks" in the Chinese market, and claiming that China's focus on safeguarding national security may "deter" foreign investment.

Such sordid attempts to tarnish China's investment environment and downplay China's economic prospects appear to be part of a campaign orchestrated by the US-led West to attract investments away from China, expedite "reshoring" of manufacturing enterprises, and promote the "de-risking" strategy by influencing public opinion and waging a psychological warfare.

In fact, the investment atmosphere in China is quite the opposite. In recent years, China has taken coordinated measures to improve the business environment for foreign investment and promote institutional openness. Foreign businesses can now more easily access the Chinese market thanks to measures such as shortening of the negative list.

The authorities have shortened the negative list for foreign investment seven times since 2013, removing all items related to manufacturing, and further opened up the service sector. The items on the negative list for foreign investment have been reduced from 48 in 2018 to 31 at present. And for free trade zones, the items on the negative list for foreign investment have been reduced from the initial 190 to 27.

The State Council, China's Cabinet, recently issued the "Opinions on Further Optimizing the Business Environment for Foreign Investment and Further Attracting Foreign Investment", which comprises 24 policy measures aimed at improving the utilization of foreign direct investment, extending national treatment to foreign-invested enterprises, and better protecting FDI from six different aspects.

The measures not only demonstrate the authorities' commitment to improve the business environment for foreign investment and promote high-level opening-up, but also help boost the confidence of multinational corporations in the Chinese market and project China as an ideal market for investment.

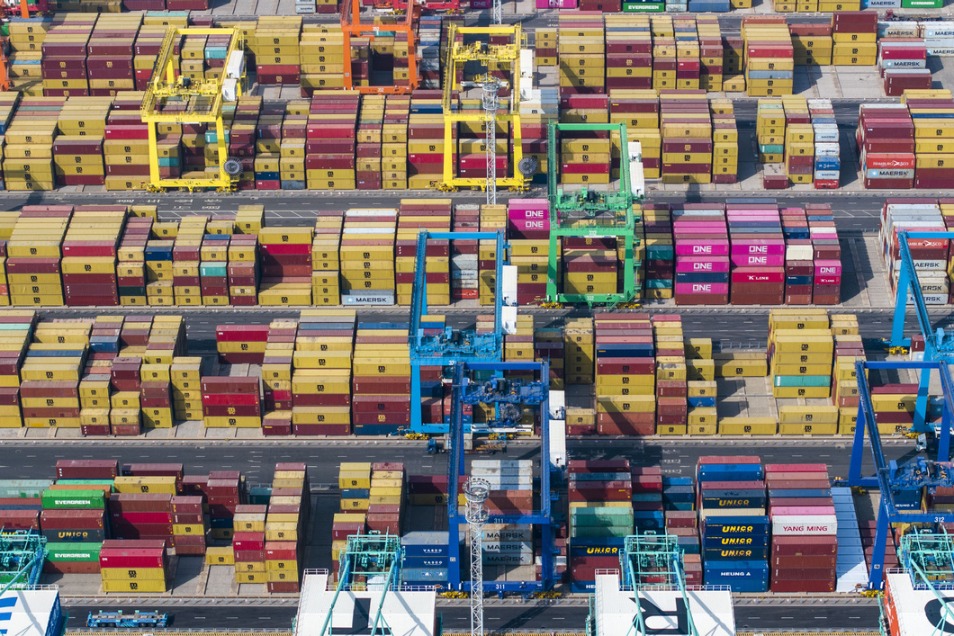

As a matter of fact, China has been steadily attracting FDI and maintaining a healthy growth rate because the government has been continuously expanding its strategic initiatives and widening its institutional opening-up even amid sluggish global growth and geopolitical uncertainties, and intensifying "reshoring" efforts by US- and EU-based manufacturing enterprises.

Since 2022, China has maintained a leading position both in terms of scale and growth in inward FDI. According to Ministry of Commerce data, in the first three quarters of this year, China attracted 919.97 billion yuan ($125.90 billion) in FDI, and saw 37,814 new foreign-invested enterprises set up shop in the country, which is an increase of 32.4 percent year-on-year.

"Innovating with China" has become an important strategy for some multinational companies to gain a competitive edge in the market. Many multinational companies have adopted development strategies such as "In China, for China" and "In China, for the world", while others have transitioned from initially importing products to manufacturing locally and exporting products overseas. And after localizing their value chain, they have leveraged the Chinese market to expand globally.

According to data from fDi Markets, the share of high-tech manufacturing in the total FDI in manufacturing increased from $9.89 billion in 2017 to $12.06 billion in 2021, that is, from 29.5 percent to 35.8 percent. Besides, industries in the high-tech manufacturing sector such as electronic industrial equipment and general instrument manufacturing have seen significant improvement in the utilization of FDI.

In the first three quarters, actual FDI in high-tech manufacturing increased by 12.8 percent, with those in medical equipment and instrument manufacturing, and electronic and communications equipment manufacturing rising by 37.1 percent and 21.5 percent respectively.

Since China's service sector market is massive in scale and has huge potential, foreign companies are interested in either investing in it or setting up service-providing businesses. No wonder the service sector now attracts the highest percentage of FDI.

But compared with developed economies' markets, China's service market still has room for improvement, especially in terms of openness in areas such as finance, telecommunications, digital services, culture, education and healthcare.

China also lacks a unified negative list for service trade on a national level. True, China has established a negative list management system for fields such as cross-border supply. But some restrictions still exist in areas like the movement of natural persons. As such, China needs to focus on improving the transparency of the service sector.

Over the past 40 years, China's approach to opening-up has been characterized by policy-driven opening-up, but now it is shifting toward institutional opening-up, with its main feature being the establishment of an open, transparent, stable and predictable system. This shift is expected to have a lasting impact on the confidence of both domestic and foreign market participants, including foreign investors, and will promote the long-term development of the Chinese market.

As for the narratives of a "deteriorating investment environment" and "investment risks" in China, they are likely to fade away as China continues to open its door wider to FDI.

The views don't necessarily reflect those of China Daily.