Policies can create growth momentum

Foreign investments have had a long history of facilitating industrialization in China. In the early 1980s, China expanded its preferential policies to attract foreign investment, and the inflow of much-needed foreign equipment and capital at that time helped expand China's industrial capacity and sophistication.

That could be the case again, but to a much lesser extent, as senior Chinese officials embark on a reinvigorated mission to develop "new quality productive forces" through innovation this time round.

Why to a lesser extent?

Historically, foreign capital was able to generate higher returns on industrial projects, and there was also significant productive technology transfer in the process. Over the past decade, however, the "pull" of foreign capital has diminished.

For one, Chinese domestic enterprises have increased in numbers and improved in terms of management and product sophistication, and Chinese manufacturers (for the most part) remain competitive in exports and international markets. Also, the domestic financial markets have matured, allowing domestic enterprises to raise their own funds rather than rely on foreign capital.

Besides, manufacturing supply chains are becoming more indigenous, as authorities seek to "onshore" key intermediate production processes. For example, in their current manufacturing push, Chinese authorities are encouraging companies to buy Chinese parts — as industry processes are to be driven, to the best possible extent, by "local resources" and "local demand needs".

Across the new industries of alternative energy vehicles, batteries and renewables, China has developed its own indigenous brands that are increasingly capturing bigger market shares both domestically and abroad. These include BYD,CATL and Huawei.

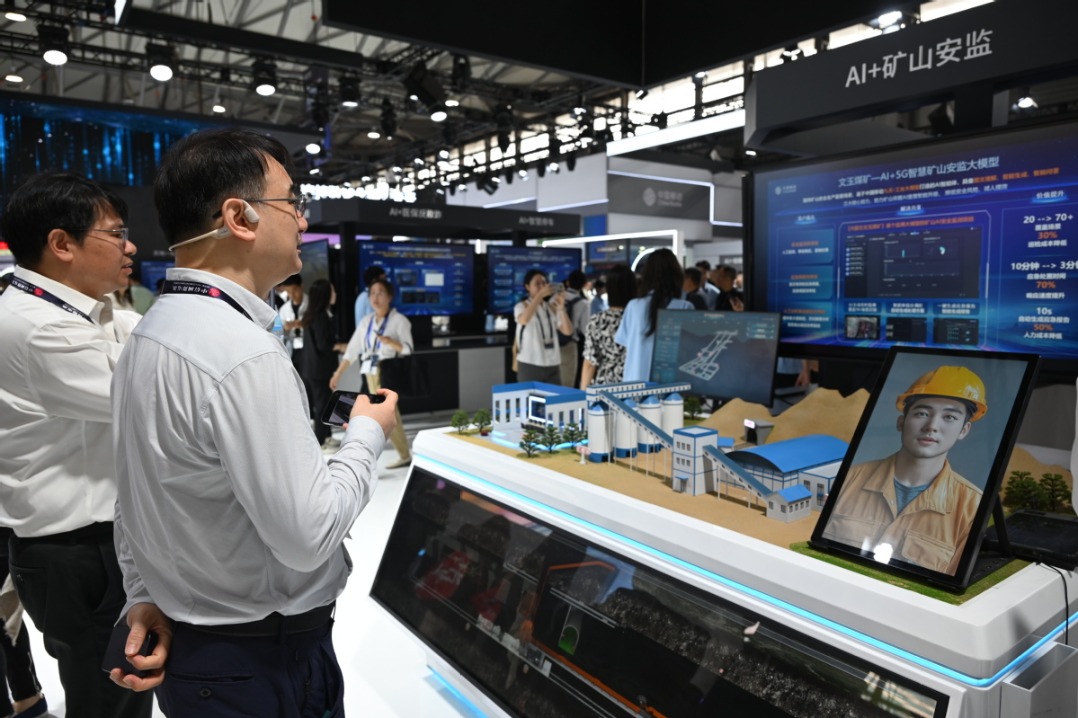

Finally, in industries involving data security, such as high-tech areas of science, artificial intelligence and cloud computing, domestic substitution, rather than relying on foreign-funded enterprises, appear to be the way forward.

In that context, China's need for foreign investments for pushing forward new quality productive forces is much smaller than in previous industrial cycles. Consequently, we (at Oxford Economics) are less concerned by the decline in net foreign direct investment to a record low of $33 billion in 2023.

Yet the authorities clearly understand the need for a market-driven, globally-competitive industrial base. In March, Premier Li Qiang pledged to allow greater market access to foreign companies, including decisions to relax some data transfer restrictions for cross-border payments and trade. The follow-through on these concrete measures will be critical in restoring the confidence of foreign investors.

To continue to attract foreign capital to propel China's manufacturing drive, there needs to be greater policy predictability in the country's regulatory environment, particularly for private enterprises.

On the one hand, the authorities have successfully played a big role in safeguarding issues of public and social welfare over the years, thus ensuring broad social stability. On the other hand, they have been far less successful at leveling the playing field on market entry and resources for the private sector, with recent policies on tech, education and healthcare compounding investor unease.

Our recent analysis shows anecdotal company intent to diversify and reconfigure supply chains for multinational companies operating onshore, which ultimately could undermine China's pace of capital accumulation.

Further financial liberalization, continuing the trend of the past two decades in liberalizing financial services and opening up the market to foreign investors, would be hugely beneficial. The use of capital controls to manage the currency has at times deterred foreign investments, while cyclically, fierce headwinds for domestic sentiment — including lingering uncertainties surrounding policy stimulus, rising disinflationary pressures and the extent of macro spillovers from real estate -have dampened private sector confidence and compounded capital outflow pressures.

Where private confidence remains weak, the onus falls on public investment to decisively stabilize domestic economic fundamentals and successfully pivot toward higher-value adding and strategic growth drivers. Doing so may improve the medium-term outlook of the economy, thereby crowding in private foreign investments more sustainably.

The author is lead economist at Oxford Economics.

The views don't necessarily represent those of China Daily.