Via intermediates

Despite Washington's push for decoupling, the US and China continue to maintain close trade relations through third parties

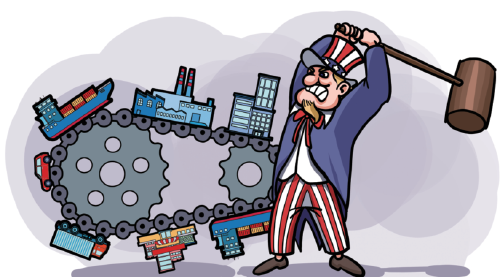

Deglobalization, trade frictions and geopolitical conflicts have led to a reshuffle of the global industry and value chains. Amid the changing international division of labor and trade structure, the United States' push for "decoupling" from China is affecting the future of the international division of labor.

For several decades before the global financial crisis, world trade had been growing almost uninterruptedly, before the US-China trade frictions, the COVID-19 pandemic, and the Ukraine crisis accelerated the restructuring of the global industry and supply chains.

In 2018, the Donald Trump administration imposed high tariffs on Chinese goods, and it subsequently expanded them from high-tech manufacturing such as machinery, electronics, pharmaceuticals and automobiles to raw materials such as chemicals and metals, and even end-user products such as clothing and food. The Joe Biden administration has largely maintained the high tariffs levied on about $300 billion worth of Chinese goods.

The outbreak of the COVID-19 pandemic in 2020 prompted many governments to prioritize the resilience of global supply chains. Countries such as the US and Japan are actively pursuing a "de-risking "strategy, diversifying their supply chains aiming to reduce their reliance on China. However, this has expanded the list of industries with high economic risks.

The restructuring of the global industry and value chains and geopolitical factors have severely impacted US-China economic and trade relations in terms of scale and structure.

First, the US-China trade volume has significantly declined. In 2023, bilateral trade was $664.45 billion, down 11.6 percent year-on-year. Specifically, China exports totaled $500.29 billion, down 13.1 percent; imports from the US totaled $164.16 billion, down 6.8 percent; China's trade surplus with the US was $336.1 billion, down 16.8 percent year-on-year, and the US trade deficit with China fell to its lowest level in more than a decade.

Second, bilateral trade dependence has decreased. From 2018 to 2022, the share of the US imports from China was 21.2 percent, 18 percent, 18.6 percent, 17.8 percent, and 16.5 percent of its total imports. In 2023, the percentage further dropped to around 14 percent, which is 7 percentage points lower than the pre-trade war figure in 2018. China has dropped to be the second-largest source of US imports.

In 2023, the share of Chinese capital goods and intermediate goods in US imports was 16.1 percent and 9.2 percent, respectively, a drop of 15.2 percentage points and 4.6 percentage points from 2017. Specifically, capital goods and parts and accessories (except transport equipment), as well as industrial supplies experienced the largest falls.

Third, both China and the US are shifting trade elsewhere. In recent years, the US has drastically cut its exports of semiconductors, liquefied natural gas, and coal to China. The US' manufacturing "reshoring "and supply chain "nearshoring "and "friend-shoring" have led to the sourcing of some products from places other than China.

Similarly, China has shifted some foreign purchases away from the US. Since 2023, China has exported increasingly more intermediate and capital goods to the Association of Southeast Asian Nations and Mexico, and has formed closer industry ties with ASEAN and other emerging economies.

While tariffs have altered the bilateral trade volume between the US and China, they have not significantly changed their positions in the global trade landscape. Though influenced by the Biden administration's substantial industrial subsidies and supply chain reshoring efforts, and the US has entered a "super investment cycle" over the past two years, Chinese manufacturing remains competitive globally.

The US is pursuing "decoupling "from China under the guise of "de-risking", but the changes mentioned above do not represent the entirety of US-China trade relations. The US and China continue to maintain close trade relations through third parties.

Although external shocks have accelerated the restructuring of global value chains, the core factors driving this restructuring are technological advancements and market optimization behaviors.

With further analysis, it can be seen that China is actually gaining a greater share in the indirect trade of US capital goods and intermediate goods. This means that the direct bilateral trade between the US and China is occurring through intermediate third parties and the industry and value chains between the two countries have been extended. The trade surplus of China with the US has shifted to countries such as Vietnam, India and Mexico, known as "friend-shoring "and "nearshoring" substitutes.

Here is the paradox: the US tariffs and decoupling efforts against China have boosted China's industry and value chain relations with emerging economies; with these third-party countries as intermediaries, indirect trade ties between the US and China have actually been strengthened.

From 2019 to 2022, China-Mexico trade grew at an average annual rate of 15.2 percent. China is now Mexico's second-largest global trading partner, second-largest source of imports and third-largest export destination.

In 2022, the trade volume between China and Mexico approached $95 billion, up 9.8 percent year-on-year, with Chinese exports to Mexico growing by 15.1 percent. China maintains a trade surplus, while Mexico faces big trade deficit challenges.

China's top exports to the Mexican market include telephones, LCD equipment, computer parts, electronic integrated circuits, auto parts, power transformers, and parts for telephone and television transmitters and receivers.

The share of added value created by China in Mexican exports to the US has risen from 5.9 percent in 2017 to 8.4 percent in 2021, an increase of 2.5 percentage points, while the share of added value from the US has fallen from 20.1 percent in 2017 to 18 percent in 2021.

Among the electronic and optical products exported from Mexico to the US, the share of added value from China has increased by 5.0 percentage points, while that from the US has decreased by 4.2 percentage points. In terms of transportation equipment, the share of Chinese added value has increased by 2.7 percentage points, while that from the US has decreased by 1.8 percentage points.

Moreover, while the US has been promoting India as a substitute for China, Sino-Indian trade has maintained rapid growth. In particular, Indian imports from China have surged, with top imports including electromechanical products, chemicals, auto parts and intermediate products.

"Friend-shoring" and "nearshoring" may have had strong impacts on direct US-China trade relations, but when indirect trade is taken into consideration, decoupling is no easy task. It will incur additional costs and distort the market's allocation of resources.

According to a 2023 research report by the US National Bureau of Economic Research, from 2017 to 2022, for every 1 percentage point decline in China's share of US imports, the unit prices of imports from Vietnam rose by 2 percent, those of Mexico by 0.6 percent, and those of the Republic of Korea, Singapore and China's Taiwan region by 0.5 percentage points. This is a loss of efficiency in the international division of labor, as well as a disruption to the collaboration among the global industry, supply and value chains.

The author is deputy director at the Institute of American and European Studies at the China Center for International Economic Exchanges. The author contributed this article to China Watch, a think tank powered by China Daily.

The views don't necessarily reflect those of China Daily.

Contact the editor at editor@chinawatch.cn.