Regulations not too taxing for platform economy

The central taxation and market regulatory departments have started soliciting public opinions on draft regulations on the reporting of tax-related information by internet platform enterprises. Due to the taxation authorities' lack of the platform enterprises' tax-related information, some enterprises have colluded with platforms to split income in an attempt to evade taxes. Some people even set up fake platforms to engage in illegal activities such as false invoicing and money laundering.

The regulations are conducive to promoting the healthy development of the platform economy, preventing tax evasion, combating noncompliant business practices, such as false marketing, and protecting the legitimate rights and interests of law-abiding operators and consumers.

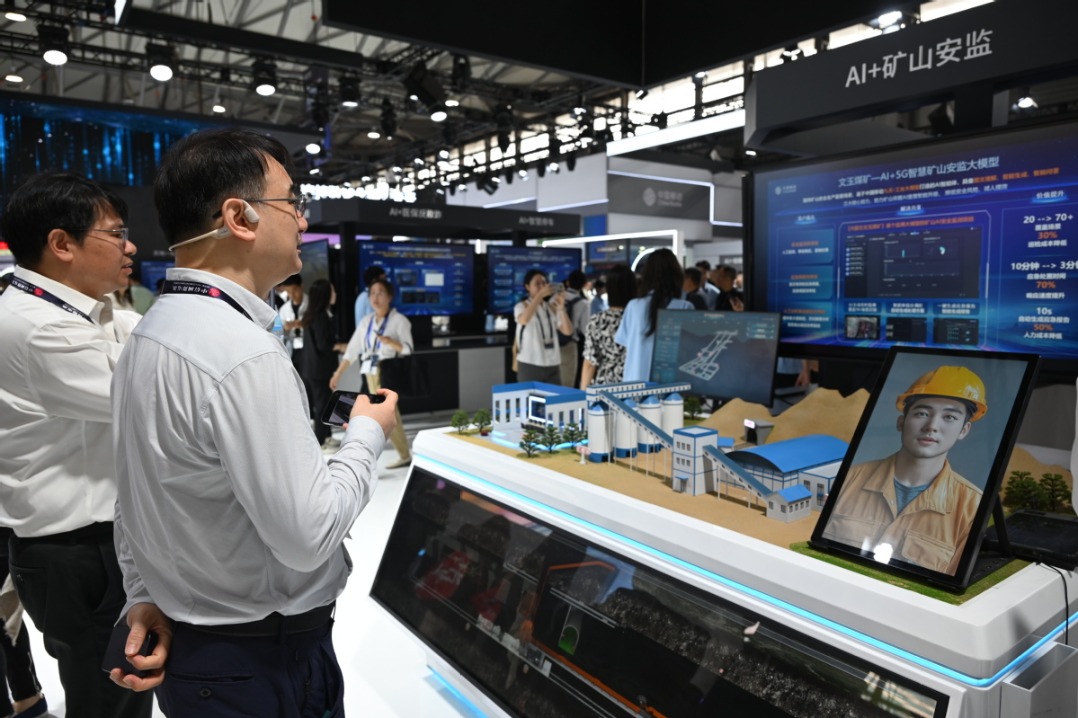

Platform enterprises gather a large amount of data resources and record the identity and transaction information of operators on the platform. These data are an important basis for industry supervision that is crucial to identify tax-related illegal activities such as tax evasion, and can promote the compliance operation of platform enterprises.

The draft regulations stipulate the reporting channels, scope and time of tax-related information of operators on the platform, and clarify the legal responsibilities of platform enterprises, emphasizing that platform enterprises should be responsible for the authenticity, accuracy and completeness of the tax-related information they report.

The tax-related information reporting work will be done by the platform companies. Operators and employees on the platform do not need to report separately. The tax-related information that should be reported will not involve the information about the business model and market strategy adjustments of platform companies, nor will it affect their income, cost and profit indicators.

The regulations particularly emphasize that the income information of employees engaged in distribution, transportation, housekeeping and other work closely related to people's livelihoods does not need to be reported.

The pilot projects of the draft regulations carried out by the taxation authorities in some places show that the tax burden of more than 90 percent of operators on the platform will remain unchanged after the information reporting. Only those who make false declarations, try to evade tax, and especially high-income earners who operate in noncompliant ways will have an increase in tax burden compared with before. A binding taxation system is a must to a fair business environment under the rule of law.

In order to ensure the tax-related information reporting system can realize its intended effects in promoting the standardized development of the platform economy and achieving mutual benefit and win-win results for all parties, the regulations require strict implementation by the authorities, compliance from the platform companies, and understanding and support from operators on the platforms.

-Economy Daily