Adjustments to monetary policies eyed

Market stability, liquidity management emphasized to achieve growth targets

China will adjust the intensity and pace of monetary policies at the right time to support the achievement of annual economic targets, officials said on Tuesday, reaffirming the market's accommodative monetary environment for 2025.

Taking the domestic economic situation as the main consideration in setting policy, central bank officials vowed to expand the scope of interest rate cuts and optimize policy tools that are supportive of the stock market, while warning against excessive speculation on the decline in the yields of Chinese treasury bonds.

Xuan Changneng, deputy governor of the People's Bank of China, the country's central bank, said at a news conference that macroeconomic policies will continue to enhance countercyclical adjustments to support the achievement of annual economic and social development goals.

"We will adjust and optimize the intensity and pace of policies at the right time, based on domestic and international economic and financial conditions, as well as the operation of financial markets," Xuan said, adding that the resilience of the yuan exchange rate has provided the conditions for China's monetary policy maneuvering.

A comprehensive use of monetary policy tools, such as interest rates and the reserve requirement ratio, which is the proportion of deposits that banks must keep as reserves, will be employed to ensure ample liquidity and an accommodative financing environment, he said.

To tamp down the financing costs that enterprises and individuals face, Xuan said the central bank will reduce banks' liability costs by maintaining deposit market order while stepping up capital replenishment of banks, financed by government bond issuances.

Wang Tao, head of Asia economics at UBS Investment Bank, said that policymakers "are showing a clear determination to stabilize economic growth". Wang predicted that the PBOC will cut the policy benchmark of interest rates by 30 to 40 basis points this year, after cuts of 30 basis points in 2024.

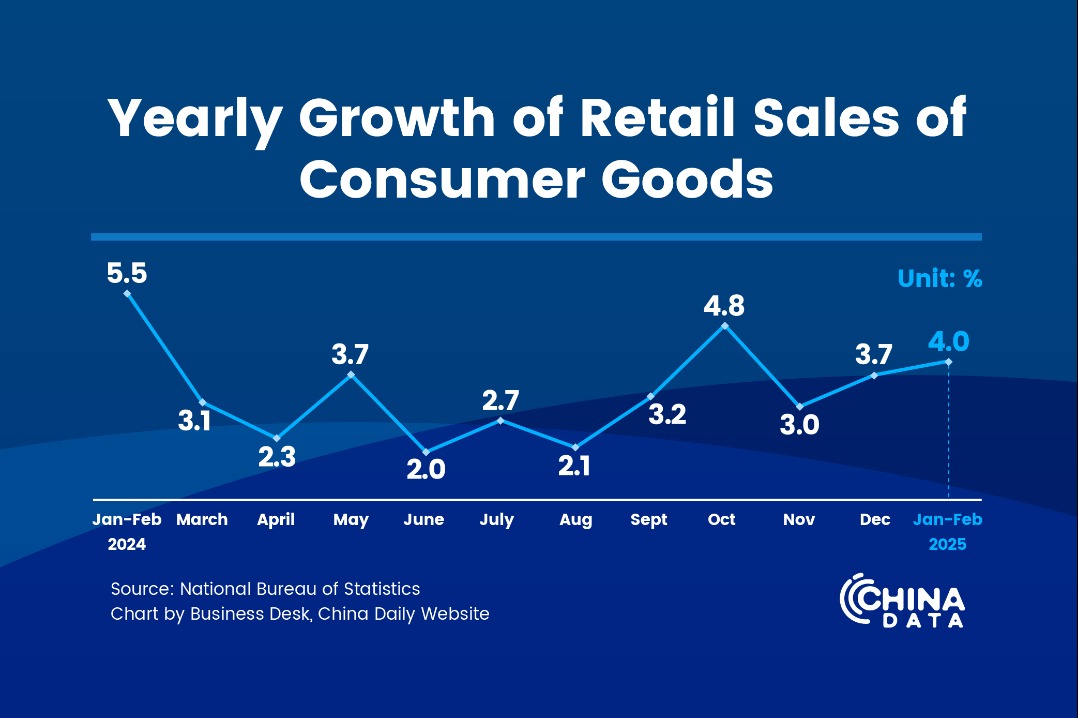

As the country launched incremental policies to revive economic growth and increased government bond issuances late last year, China's broad money supply, a leading economic indicator, recovered in December.

China's broad money supply, or M2, stood at 313.53 trillion yuan ($42.8 trillion) as of the end of 2024, up 7.3 percent year-on-year. The growth was up from 7.1 percent a month earlier, the central bank's data showed on Tuesday.

"Improvements in the expectations of economic growth will eventually be reflected in treasury yields," said Zou Lan, head of the PBOC's monetary policy department, warning against the risk of betting on a consistent decline in Chinese long-term treasury bond yields.

The PBOC said last week that it will suspend open market treasury bond purchase operations starting this month, after the 10-year Chinese treasury yield hit a historical low. Bond yields go in the opposite direction of prices.

Zou said the decision was aimed at avoiding an exacerbation of bond market fluctuations, adding that the central bank is using other tools to inject liquidity.

Xiong Yuan, chief economist at Guosheng Securities, said that with the central bank suspending its purchases of government bonds, the need for cutting the reserve requirement ratio to maintain ample liquidity has increased, and such a cut could come as early as the end of this month.

Zou added that the PBOC will optimize the design of two newly launched policy tools to stabilize the stock market, making it more convenient for enterprises and financial institutions to obtain ample funding to boost investment.

As of the end of 2024, the PBOC and financial institutions had swapped more than 100 billion yuan of securities via the securities, funds and insurance companies swap facility, to help financial institutions get liquid assets, the central bank said. Financial institutions exchange low-liquidity securities for high-liquidity ones, and then use these securities to finance the purchase of stocks.

Meanwhile, the issuance of panda bonds — onshore renminbi bonds issued by overseas financial institutions and enterprises — reached almost 200 billion yuan in 2024, a 32 percent increase from the previous year, while the issuance of offshore yuan bonds grew 150 percent year-on-year, according to the PBOC.