Trucking into the future

Logistics electrification is fast catching on in the Greater Bay Area. As Luo Weiteng reports, e-truck economics, policy support and a comprehensive charging network will tempt more Hong Kong logistics operators to dispel the doubts and come on board.

From dawn to dusk, endless fleets of heavy goods vehicles can be found on Hong Kong's highways with cross-boundary points intricately linked to container terminals, the airport and logistics nodes, claiming their stake in one of the world's busiest free ports.

In a sign of what might lie ahead, those vehicles are making their presence felt in a more sustainable manner - logistics electrification.

With more Hong Kong drivers embracing private electric cars, the city's journey toward green transportation is gaining speed. These passenger vehicles - smaller and with better access to charging facilities - generally, drive over 600 kilometers on a full charge, and are becoming economically competitive against their diesel counterparts.

But, what comes next is a fight with commercial vehicles - from small delivery vans to big rigs traveling across countries, once considered the least monitored and the hardest segment of road transport to electrify - forming the basis for a sustained demand for oil.

Of note are heavy-duty trucks used in regional distribution that normally travel 300 km on a single charge. However, there's much uncertainty over the availability of charging networks and vehicle performance testing for longer routes, says Xie Haiming, director of think tank, the Shenzhen Xieli New Energy and Intelligent Connected Vehicle Innovation Center.

The heaviest trucks account for over half of the transportation sector's greenhouse gas emissions in China, despite making up just 3 percent of the total number of vehicles on the road.

At the same time, the country is making strides in the clean-truck race, with sales of battery-electric and fuel-cell trucks picking up. More than 30,000 were sold in the first quarter of this year, almost triple that of last year.

These trucks are in the new-energy class that includes all-battery, diesel-electric hybrid and hydrogen-powered vehicles. "Currently, there's scaled adoption limited to shorter 50-km distances, such as round trips between factories and warehouses," says Xie.

Longer-range, regional transportation still stands in the way of wider use of clean energy-powered trucks with cross-boundary trucking between Shenzhen and Hong Kong seen as a "living laboratory". "Today, some 13,000 registered trucks are used for transporting daily supplies between Guangdong province and Hong Kong. This is vital to people's livelihoods and has remained stable even during the COVID-19 pandemic," says Xie.

Costs and policy gaps

Lawrence Iu Chun-yip, executive director of Hong Kong's Civic Exchange public policy think tank, calls vehicles operating on fixed short distance routes a "key entry point" in logistics electrification. This includes road-based crossings for goods vehicles, as well as refuse collection vehicles and tractors within container ports that "allow a tactical small-scale electric truck deployment" for future meaningful impact.

Carrying cargo for 300 km along a highway on a battery truck, which is common in the Guangdong-Hong Kong-Macao Greater Bay Area, is now technologically feasible, says Xue Lulu, senior associate and urban mobility lead at the World Resources Institute China.

Fixed origins and destinations along routes also make integrated planning, site selection and construction of charging facilities relatively accessible, she says. "The region is blessed, in a wide sense, with a good lead in logistics electrification."

Cities like technology hub Shenzhen are experimenting with it and, once they find the solutions for the right subsegments and duty cycles, they will adjust policy support and accelerate deployment.

According to Xie, Shenzhen plans to make some of its cross-boundary trucks battery-operated this year, clearing the way for Hong Kong to follow.

As truck usage patterns vary widely and it's uncertain which technology will win in each subsegment and duty cycle, Hong Kong is undecided over the path of new-energy heavy vehicles. "Given its scarcity of land resources, Hong Kong can't afford to take a multipronged approach and test the mix of drivetrain technologies," explains Xie. "That's why Hong Kong has to see more tangible results on our side before following suit."

In the special administrative region, while the number of new-energy trucks remains negligibly small, Ken Chung Hung-hing, chairman of the Chamber of Hong Kong Logistics Industry, sees no shortage of logistics companies with a "decent sense" of emissions-free trucking. "The problem is just a lack of motivation to make the switch."

Citing sweeping tariffs as an aggravating factor, he attributes such reluctance to mounting concerns over a general slump in road freight and gloomy prospects for construction projects, making vehicle operators wary of spending on electric trucks.

Beyond macro uncertainties, most Hong Kong logistics companies, faced with a dearth of drivers, harbor lingering doubts over the range involved, load capacity and a supporting ecosystem of maintenance and refueling.

The most likely motivating factor lies in estimating that battery trucks can undercut the economics of equivalent diesel rigs by 2027 in urban delivery, port operation and drayage duty cycles on the Chinese mainland.

For regional delivery, e-trucks are expected to be on parity with the total cost of ownership by 2030, considering factors like fuel and maintenance costs during the lifetime of these vehicles, says Xue.

Steadily improving e-truck economics should be more evident in the SAR, where electric vehicles are notably cheaper to power, says legislator Jesse Shang Hailong, comparing the difference in regular fuel prices of Hong Kong and Shenzhen with that of charging rates.

"While Hong Kong drivers have to pay HK$10 ($1.28) per liter more to refuel internal-combustion-engine vehicles than their Shenzhen counterparts, it merely costs HK$1 to 1.5 more in electricity bills based on the average local per-kilowatt-hour rate," Shang notes. "Such a huge energy cost gap offers the biggest incentive to go electric."

Cheaper batteries add to vehicle affordability. Last year, a 49-metric-ton new energy tractor featuring a 400 kilowatt-hour battery on the mainland was priced below 50,000 yuan ($6,877), down from 80,000 yuan, according to Xue. For Hong Kong, where diesel trucks are generally more expensive, this is tempting enough.

Xue paints a rosier picture with a package of policies adopted, such as subsidies for procuring vehicles and fuel expenses, tax rebates, toll cuts, right of way, reduction in carbon prices and financing costs, where e-trucks in China could be cost competitive in most transport applications this year.

Policy support too has a role to play in Hong Kong.

This March, the Transport Department allowed electric goods vehicles with a minimum rated power of seven kilowatts to travel on expressways without a permit, while in December, the Environment and Ecology Bureau offered subsidies for trying out hydrogen fuel-cell heavy vehicles under the New Energy Transport Fund.

The funding program only covers the procurement cost gap between hydrogen-powered and fossil-fueled vehicles. "There's real funding pressure to consider. For a medium-sized logistics company, going electric means having a dozen new energy trucks," says Chung, adding that much of the work is still being tested, with various government entities working in silos.

Citing Hong Kong's underperformance in taxi electrification due to licensing curbs, Xue calls for greater efforts to systematically prepare the city beyond technological feasibility and economic competitiveness as its embrace of electric vehicles continues apace.

She hopes that growing opportunities for creative financing and business models help the e-truck market scale up by reducing upfront capital commitments and transferring risks, including vehicle depreciation and random fluctuations in the freight market.

Rental business based on separating battery and vehicle ownership offers a glimpse of innovation. Fleet operators pay rents monthly or in accordance with the intensity of use, while leasing companies capitalize on strong balance sheets to buy and own fleets or batteries, Xue says.

Since the seeds for new energy heavy trucks were sown in China a decade ago, Xue has seen many early movers in Shenzhen purchase vehicles with separately leased batteries.

But even today, the leasing model is of limited use in the country owing to high expenditure and credit risks involving self-employed vehicle operators. This is where innovative support from government entities and financial institutions is vital, by encouraging rental companies to tap into green and blended finance, allowing acceleration of vehicle depreciation for greater tax deductions, and offering first-loss guarantee if vehicle operators default, Xue adds.

Chung sees the leasing model as a viable option to tackle some electrification barriers although the conventional wisdom in many corners of Hong Kong's logistics market regards vehicles as a means of production, with operators keeping a grip on the most predictable elements of their delivery activities.

"At the end of the day, with scant willingness from freight buyers to pay for green logistics, fleet operators see no reason to make the first move," he says. "Cleaning up the heaviest vehicles on the roads never happens overnight. The time has come for Hong Kong to take this crucial step with concerted efforts from government entities, and stakeholders along the logistics chain."

Collaborative roadmap

For cross-boundary clean trucking to get off the ground, Chung highlights the need for a unified roadmap and timeline for policymakers across jurisdictions working in sync, with a higher-level platform set for master planning and resource coordination.

There shouldn't be any illusion that it will be smooth sailing in an initiative involving numerous traffic regulations, and complex standards for vehicles, charging and emissions. Much work has to be done to facilitate standardization, mutual recognition of driving qualifications, and data sharing.

Xue points to the different regulations in weight limits for zero-emission trucks in the Greater Bay Area, where not every city allows two tons of extra gross weight to compensate for the heavier powertrain, such as batteries. This makes overloading a real issue in regional delivery.

Indeed, the initiative fleshes out a mega project for zero-emission freight corridors across the region. Chung has devised a down-to-earth entry point - thematic products for cross-boundary freight transportation, such as fresh food and prefabricated components for buildings, to kickstart logistics electrification.

"What matters is a common, phase-based goal for collective efforts in the Greater Bay Area to get more e-trucks on the roads, keep charging infrastructure well in place, and accelerate the speed of transition," he says.

As the nation's most productive, vibrant region, the Greater Bay Area is hailed by Shang as the "one and only" place with all the elements required to lead the pack in logistics integration, decarbonization and smart connectivity.

"Known as a manufacturing hub of global significance, an innovation powerhouse where a constellation of tech firms call home, and a premier logistics cluster with convenient traffic and flourishing trade, the region is born with the demand for high-tech, high-efficiency and low-carbon solutions," says Shang, who also serves as a strategic consultant of Hong Kong-based artificial intelligence company SenseTime.

Pioneering experiments, such as greener cross-boundary trucking, are, by no means, a publicity stunt. Instead, it goes with tangible economic and social benefits, and near-unlimited potential to set a precedent worldwide, he says. "This also explains why logistics electrification makes the most sense in the region. Its sheer power can be justified through diverse urban and long-haul applications here to address many of the 'pain points', rather than 'itchy points', on the path to regional integration and sustainability."

Whatever the hurdles, Shang has high hopes of Hong Kong being in the driving seat of greener trucking. With the Northern Metropolis emerging as a catalyst for infrastructure development, the city could test zero-emission trucks in live operations and gain much firsthand experience.

For now, it all comes down to action.

Amid talk of new quality productive forces, some may believe that aim will remain out of reach. "But, zero-emission trucking, right under our nose, is here to stay for those with the foresight to jump on the bandwagon," says Chung.

Contact the writer at [email protected]

- More opportunities open up for disabled people

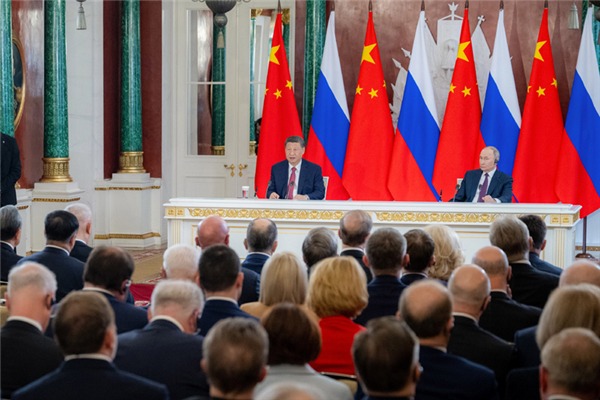

- Xi meets Serbian President Vucic

- Cutting-edge industries gather for Beijing expo

- Man transforms village through livestreaming and local specialties

- Shanghai's Yangpu district to lure more creators and graduates

- China to boost vocational training for professionals in domestic services