BOE ramps up R&D, AI integration; seeks growth drivers in emerging biz

BOE Technology Group Co Ltd, a major Chinese display panel maker, is expanding its presence in emerging business segments like solar cells, and bolstering the integration of artificial intelligence technology with manufacturing, operation and products to achieve sustainable development, said a senior executive of the company.

Feng Qiang, CEO of BOE, said the company is transitioning from a semiconductor display enterprise into an internet of things firm, with about 7 percent of its annual revenue spent on technological research and development, especially in low-power consumption technology.

According to Feng, the company has launched an AI Plus strategy to advance the deeper application of AI in areas such as intelligent manufacturing, product innovation and operation management, in a bid to enhance product competitiveness, reduce resource waste, lower production costs and improve operational efficiency.

BOE has vowed to achieve carbon neutrality across the entire group by 2050 and join hands with global partners to promote the green transformation and upgrading of the display industry, Feng said.

He highlighted that sustainable development is vital for the survival of companies, which is of great significance to reinforce Chinese companies' competitive edge on the global stage and lay a solid foundation for business diversification. The company has gradually elevated sustainable development to its core strategy.

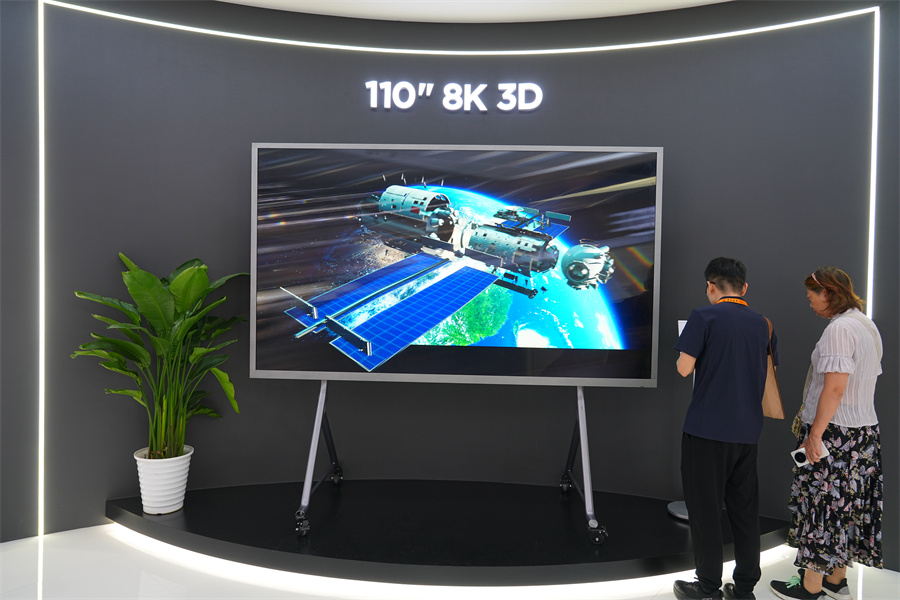

At present, BOE has marched into a wide range of fields, including the internet of vehicles, smart energy, industrial internet, ultra high definition displays and digital art, while continuously exploring new development opportunities based on its advantages in the display sector, he added.

By the end of 2024, it had accumulated more than 100,000 independent patent applications, and carried out extensive cooperation with both domestic and foreign research institutes, top universities and enterprises in the upstream and downstream of industrial chains.

BOE reported that its total revenue reached 198.38 billion yuan ($27.3 billion) last year, marking a 13.66 percent year-on-year increase, while its net profit attributable to shareholders stood at 5.32 billion yuan, surging 108.97 percent year-on-year.

BOE is increasing investments in technological innovation, especially in fundamental and forward-looking technologies, and banking on new-generation semiconductor displays represented by organic light-emitting diodes or OLED, which boast immense application potential in various fields such as smartphones, televisions, vehicle-mounted displays and wearable gadgets.

The company has stepped up its push to expand in sensors, mini LED, IoT and intelligent healthcare and promote the integration of cutting-edge digital technologies like 5G, big data and the IoT with semiconductor displays.

Data from market research firm Omdia showed that BOE secured the top position nationwide in the shipments of flexible OLED panels in the first half of 2024, and ranked second across the globe.

China is speeding up industrialization in emerging display technologies, and is driving fiscal support to promote the development of innovation in the new-generation display industry. New display technologies will usher in speedy growth, along with the maturity of such technologies and continuous decline of costs, experts said.

Against the backdrop of increasing external uncertainties, more coordinated efforts are required to resolve bottlenecks and increase investments in basic research and strategic forward-looking technologies, said Chen Duan, director of the Digital Economy Integration Innovation Development Center at Central University of Finance and Economics.

Chen called for efforts to expedite the translation and application of key scientific and technological breakthroughs and support leading high-tech companies — which play a critical part in technological innovation — to pour more capital into cutting-edge technologies to better serve the country's development strategy.

Li Yaqin, general manager of Sigmaintell Consulting, a Beijing-based market research firm, said demand for flexible OLED panels used in foldable smartphones will continue to rise on the back of 5G commercial applications. Panel makers should further improve their yield rate capacities and reduce production costs.

According to CINNO Research, a Chinese flat panel display consultancy, Chinese display manufacturers accounted for a 50.7 percent share in the global smartphone OLED display market in the first half of 2024, surpassing South Korea for the first time.