Markets bite back: Bond Vigilantes vs US policies

"Bond Vigilantes" refer to market forces in the bond market that spontaneously correct governments' improper, irrational, and anti-market policies. When authorities implement misguided measures, investors respond by selling government bonds, driving up yields and increasing financing costs for governments. This serves as a powerful warning signal to compel policy adjustments and restore market confidence. The concept was first coined by economist Ed Yardeni in the 1980s.

Following the Trump administration's "Liberation Day" tariffs, among all existing constraint mechanisms observed to date, the swiftest and most forceful reaction emerged almost instinctively from these "Bond Vigilantes" in the US treasury market. Their actions effectively drew red lines against unreasonable and abnormal policies.

At its core, the "Bond Vigilantes "mechanism represents a form of market self-regulation. It demonstrates real-time price feedback from bond assets to misguided policies, embodying characteristics of "spontaneous order". This phenomenon reveals that even when confronting state power, markets retain certain "autonomy" and "disciplinary capabilities".

When institutional constraints fail and political checks weaken, markets may serve as the last line of defense. More fundamentally, the market operates as a collective cognitive system embedded with institutional constraints — it speaks through interest rates and expresses judgments via pricing.

The term "Bond Vigilantes "emerged in close connection with the US fiscal crisis of the 1980s. During this period, ballooning government deficits forced Washington to rely heavily on treasury issuance for financing, triggering investor alarm in bond markets.

A defining case unfolded during the Clinton administration. As bond markets grew increasingly discontent with widening budget shortfalls, investors dumped treasuries, causing yields to spike. From October 1993 to November 1994, the 10-year treasury yield surged from 5.19 percent to 8.05 percent, significantly raising government borrowing costs.

This compelled the Clinton administration to abandon plans such as middle-class tax cuts and pivot to deficit-reducing austerity measures. By October 1998, restored market confidence drove yields down to 4.16 percent.

Recognizing the Bond Vigilantes' role in curbing fiscal excess, Clinton's political adviser James Carville famously quipped: "I used to think that if there was reincarnation, I wanted to come back as the president or the pope. But now I want to come back as the bond market. You can intimidate everybody."

The typical operational logic of "Bond Vigilantes" unfolds as follows: governments or central banks introduce misguided, anti-market policies; markets anticipate rising inflation or unsustainable debt; investors sell government bonds; bond prices fall and yields rise; government financing costs surge, leading to fiscal unsustainability; potential financial crises; forcing policymakers to adjust course.

"Bond Vigilantes" are not organized entities but rather countless bond investors acting in self-interest after losing confidence in government policies. Fearing that inflation or unsustainable debt could erode returns, they collectively dump bonds, driving up yields to penalize irresponsible policymaking.

Well-functioning financial markets are the prerequisite for "Bond Vigilantes" to operate effectively. In such markets, bond prices act like a real-time "poll of money". When governments enact irrational or ill-advised policies, the sovereign debt market casts a "vote with its feet "through mass sell-offs, expressing distrust via spiking yields and compelling policy corrections.

It must be emphasized that the US treasury market holds unique status as the cornerstone of the global financial system. Compared to US equities, it exerts more direct and profound influence on US policymaking and the global economy, representing an "ironclad constraint "that US policymakers cannot ignore.

This stems from the treasury market's dual role: it not only determines government borrowing costs but also serves as the global anchor for "risk-free assets" and the "risk-free rate".The assumption that US treasuries are "risk-free" underpins global capital pricing, credit risk assessment, and the stability of dollar credibility and the financial system.

Specifically, due to their high liquidity, low risk, and price stability, US treasuries form the bedrock of central bank reserves worldwide and a critical component of institutional safety buffers. Globally, most financial products derive their pricing and interest rates from US treasury yields as the benchmark.

So long as investors maintain faith in treasuries' "risk-free" status, the dollar system and US global dominance endure. Should this premise falter, markets would face a triple shock wave: first, surging treasury yields straining public finances; second, margin call pressures triggering credit and liquidity crises for financial institutions; and in extreme scenarios, widespread doubt about treasuries' "risk-free" status could collapse global pricing anchors, spark capital flight, de-dollarization, and systemic financial meltdowns.

While such doomsday scenarios remain hypothetical, the erosion of treasuries' risk-free aura and the dollar's reserve currency primacy continues unabated, quietly accumulating uncertainties and tangible risks for the future.

On April 2, the Trump administration announced its "Liberation Day "tariff package, including baseline and reciprocal duties set to take effect on April 5 and April 9, respectively. US stocks immediately plunged, shedding over $6 trillion in market value within two days. President Trump, however, remained unmoved.

Starting from April 5, a sell-off began in the US treasury market, with the 10-year yield surging from 4.1 percent to 4.6 percent — the sharpest weekly rise in two decades. By April 9, panic selling peaked, driving the 30-year yield above 5 percent, a two-year high.

Markets witnessed an unusual "dual sell-off" in stocks and bonds — a departure from historical patterns where safe-haven funds fleeing equities typically flow into Treasuries, boosting bond prices. The simultaneous decline signaled growing investor skepticism about US debt's "risk-free" status. The 10-year term premium briefly hit 0.7 percent, its highest since 2014, reflecting concerns over long-term fiscal sustainability and demands for greater compensation.

These market warnings triggered swift policy reversals. Within 13 hours of the retaliatory tariffs taking effect, Trump suspended most of them and announced exemptions for critical electronics on April 11, stating: "The bond market is very tricky, I was watching it."

While the sell-off partly stemmed from fears that Trump's tariffs would fuel inflation and recession risks, the deeper catalyst was the market's sudden realization that Trump's radical economic agenda — outlined in the previously dismissed Stephen Miran's "A User's Guide to Restructuring the Global Trading System" — was being implemented. This blueprint proposes using tariffs and geopolitical pressure to force trade partners into accepting dollar devaluation, rebalance deficits, and overhaul global manufacturing and trade systems.

Certain proposals in the report, particularly a plan to pressure foreign economies into swapping short-term US treasuries for ultra-long-term bonds to reduce US interest costs, were seen as unilateral changes to debt terms-a breach of the "technical default" red line. It was this moment that began eroding treasuries' "risk-free" status.

The collective sell-off by "Bond Vigilantes" preemptively priced in potential forced debt restructuring and delivered an institutional rebuke to Washington's policy overreach. Their message was clear: rewriting contracts and undermining market trust carries severe consequences. In this first round of confrontation with Trump's extreme economic agenda, the "Bond Vigilantes" prevailed.

Upon temporary tariff suspension, markets stabilized, yet the US economy faces slowing growth, heightened recession risks, and mounting uncertainty. Eager to boost stocks and create an election-year "economic boom" narrative, Trump has repeatedly pressured Fed Chair Powell to cut rates.

The Federal Reserve, committed to its independent mandate of balancing inflation and growth, has resisted political interference. By mid-April, Trump escalated tactics, threatening to fire Powell and launching legal challenges to overturn precedents protecting Fed officials' tenure — a direct assault on central bank independence.

Fed independence remains critical to economic stability and market trust. Autonomous central banks do better balancing inflation and employment goals without succumbing to policymakers' growth biases. Historical evidence, including the UK's experience, shows independent central banks reduce long-term debt costs. For US treasuries, Fed autonomy is a cornerstone of their perceived risk-free status.

Trump's attacks triggered renewed bond sell-offs, yield spikes, and a rare "triple sell-off" in stocks, bonds, and the dollar. Capital flight emerged as the dollar index fell to a three-year low by April 21. Facing market backlash, Trump reversed course that same day, pledging to retain Powell and consider tariff reductions on Chinese goods. Markets responded positively, with equities, bonds, and the dollar rebounding.

Within weeks, "Bond Vigilantes "twice forced Trump to retreat, underscoring a fundamental truth: In a global economy anchored by trust, prices speak louder than rhetoric. Markets remain the ultimate constraint mechanism in modern governance.

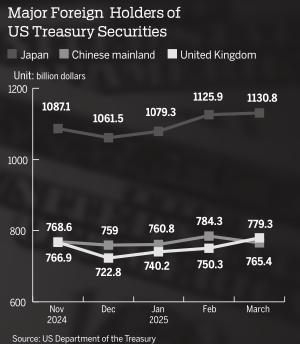

By the end of February, the outstanding US Treasury debt had reached $36 trillion, or 120 percent of US GDP. As much as $28 trillion is tradable debt, with foreign official institutions, including central banks, holding about $3.8 trillion. Japan and Chinese mainland's official holdings stood at $1.1 trillion and $780 billion, respectively, down 14 percent and 24 percent over the past three years.

For China, reducing holdings of US treasuries could, in theory, signal strategic discontent to Washington. However, such a move is not without risk. First, it could be interpreted by the US as a confrontational gesture, potentially triggering retaliatory measures. Second, abrupt divestment could undermine China's own financial stability and compromise its objectives of balancing reserve security with portfolio returns. As a result, most analysts view a gradual, managed reallocation as a more prudent approach.

The views do not necessarily reflect those of China Daily.

The writer is president of the University of International Business and Economics.