|

BIZCHINA> Center

|

|

Related

Better stock performances expected in Q2

By Bi Xiaoning (China Daily)

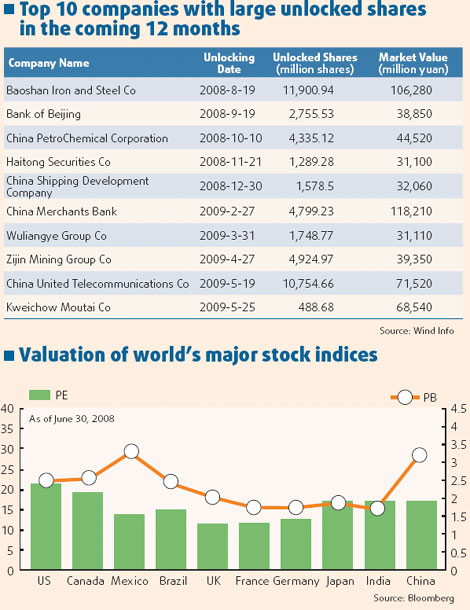

Updated: 2008-07-14 17:22 Mainland stocks are down, but the second-half performance is likely to improve moderately, experts say. The shares' price-to-earnings (PE) ratio and price-to-book (PB) have dropped to a reasonable level, according to a recent report released by Goldman Sachs. This point of view could be found in many research reports released by brokerages. "The Hushen 300 index represents a PE of 20 times and PB of 3.4 times, with 35 percent premium when compared with the average stock index in the world's main market. Yet, in the mature markets, the GDP growth rate is below 3 percent," Dan Chaoyang, an analyst with Great Wall Securities Co, says in a report. "So, the premium is reasonable as China's GDP can grow at least 8 percent this year." India, China's counterpart, represents a PE of 16 times and PB of 4 times. Looking ahead, mainland stocks may drop further but the fall will probably be slight, according to the report. Industry analysts have reached a consensus that China's economy might continue to decelerate as a result of slower industrial output growth and weakening overseas demand. Yet, they believe China's GDP growth rate can reach 10 percent this year, as two main driving forces, fixed-assets investment and domestic consumption, are still strong. "As long as China's GDP growth rate can maintain some 10 percent this year, the listed companies' profits can be assured with increase of about 20 percent," Fareast Securities says in a research report. "Currently, many stocks are undervalued and long-term investment opportunities appear." According to the statistic, the industry companies have realized 1.1 trillion yuan in profits in the first five months, up 20.9 percent year-on-year. Shenyin Wanguo Securities and Citic Securities predict that the companies' performance in the last quarter will be better than the third. So far, about 20 brokerages have given a specific prediction on range of stock points in the second half. Pacific Securities is the most opportunistic, predicting the "bottom" will appear in July and then see the market rebound to some 4,500 points. Bohai Securities is the most cautious, predicting that 2,100 points is likely to be the market's bottom line. As of July 1, the Shanghai Composite Index plunged about 51 percent from the highest of 6,092 points last October, among Asia's worst-performing indices. Concerns are mounting over large-scale sales of non-tradable shares, slowing economies and hiking inflation. It's widely accepted that the expiry of the lock-up period for a large number of non-tradable shares smashed the investors' confidence and made the performance of mainland stock even worse than the United States and Vietnam. Looking ahead, the threat from large-scale sales of non-tradable stock is still problematic. "The current non-tradable stock is about 1, 225.65 shares and the unlocked climax exists in 2009 and 2010, with more than 60 percent of total non-tradable shares are to be changed to tradable ones," Essence Securities says in a report. In April, China's Securities regulators ordered shareholders to sell stocks on the block trading system if they expect to sell more than 1 percent of a listed firm's total shares within a month. Some major shareholders have also volunteered to hold the newly tradable shares. As of July 9, major shareholders in more than 20 companies have promised not to sell any newly tradable shares within two to three years. The assurance helps ease investors' worry. According to Wind Info, a provider of financial data, the nearest climax for unlocked shares is in August, with about 23.85 billion non-tradable shares to be changed. Amid this, about half of the shares are from Shanghai Baogang Group Company, China's largest steel maker, with 11.9 billion shares to become tradable . "Actually, it's also possible for the government to take further measures to rule the issue, because about 58.88 percent of non-tradable shares centralize in only about 10 larger-scale State-owned companies," Forest Securities says in a research note.

(For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 自拍 亚洲 欧美 | 亚洲日本在线观看视频 | 69中国xxxxxxxx18 | 五月色一区二区亚洲小说 | 91精品自在拍精选久久 | 国内精品视频成人一区二区 | 成人毛片视频免费网站观看 | 免费高清一级欧美片在线观看 | 免费一级a毛片在线播放 | 99久热在线精品视频播放6 | 亚洲三及片 | 欧美亚洲视频 | 欧美一级毛片片免费孕妇 | 特色黄色片 | 精品国产亚洲一区二区三区 | 欧美精品videosbestsex另类 | 女人张开双腿让男人桶爽免 | 大美女香蕉丽人视频网站 | 午夜主播福利视频在线观看 | 国产美女视频网站 | 成人免费视频国产 | 国产精品久久久久久福利漫画 | 国产精品免费视频能看 | 久久精品免观看国产成人 | 免费一区二区 | 亚洲国产欧美目韩成人综合 | 亚洲第一成年免费网站 | 在线视频免费观看a毛片 | 手机在线毛片 | 欧美精品成人一区二区在线观看 | 欧美成人极品怡红院tv | 欧美性活一级视频 | 国产精品久久久久影院色 | 日韩乱码视频 | 国产香蕉在线视频一级毛片 | 成人黄色在线网站 | 久久精品免视看国产明星 | 久久国产精品视频 | 欧美最猛性xxxxx亚洲精品 | 久草小视频 | 日本精品高清一区二区不卡 |