Transparency improves in real estate sector

By Hu Yuanyuan (China Daily)

Updated: 2008-10-31 09:34

Updated: 2008-10-31 09:34

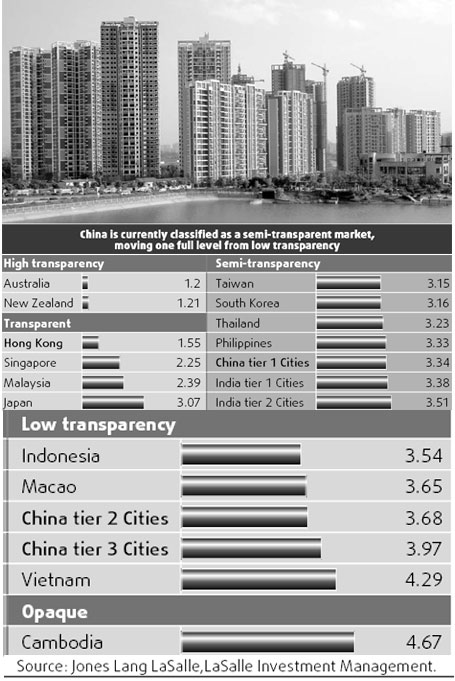

According to the latest China edition of the Global Real Estate Transparency Index from Jones Lang LaSalle and LaSalle Investment Management, its global real estate investment management subsidiary, China is currently classified as a semi-transparent market, moving up one full level from low transparency.

"The successful staging of the 2008 Olympic Games has shifted the focus of investors from around the world not only onto Beijing but indeed China as a whole," said Denis Ma, head of the research department of Jones Lang LaSalle Beijing, adding that the index serves as an excellent tool for potential first-time investors in China's real estate market.

In addition to the differences between the three tiers of cities on the mainland, Hong Kong is one of the world's most transparent real estate markets, Taiwan has a slightly higher level of semi-transparency and Macao has low transparency below mainland first-tier cities but slightly higher than second- and third-tier cities.

"China's property markets are as diverse as the country itself. The inclusion of China's second- and third-tier cities in this year's survey helps users of the index better understand their different challenges," Ma added.

This is the first China edition of the index and it highlights the key findings of the 2008 transparency survey in relation to China's different tiers of cities. Previous China ratings reflected only first-tier cities (constant since 1999), so the marked improvement is significant for China, which has moved to a higher level than India for the first time.

Based on the findings, the report said there are four key reasons for China's improvement:

1) Globalization, a major force behind real estate transparency, with increasing capital and companies in China expediting the requirement for accurate market information and adoption of global practices;

2)Openness of real estate's direct correlation to the growing volume of investment transactions;

3)Increasing number of public listings by property developers and more market information through annual reports; and

4)Central government policies and more publicly available information through the China Real Estate Intelligence Services (CREIS).

"The steady improvements in China's transparency level reflect not only the emerging maturity of the country's real estate markets but also the government's commitment to opening up the markets to overseas investors," said Julien Zhang, deputy managing director of Jones Lang LaSalle Beijing.

Of the six areas used to determine market transparency, China improved most in the regulatory and legal field and had the lowest score in market fundamentals. These two areas showed the greatest variance between the different tiers of cities.

"We are confident about China and anticipate further transparency improvements in its real estate market over the coming years, primarily in terms of market fundamentals, regulations and legal issues. By 2010, we project the transparency score will move from 3.3 to 3.1 or 2.7, putting China at the upper end of the semi-transparent category and on a par with current transparency levels in Russia and Brazil," said Ma.

China's improved transparency, together with the ongoing market correction, seems to make the country's property sector more attractive for investors.

Contracted investment in the real estate sector in Shanghai accounted for 27 percent of all foreign direct investment in the first half, double the same period last year, according to the latest report from the city's statistics bureau report.

"In fact, the number of investors hasn't changed much. The higher transaction volume is mainly due to more attractive prices in this fluctuating market," said Eric Chan, deputy managing director of the Beijing branch of Savills, a UK real estate service provider.

Property price growth in China's 70 major cities has dropped for six months in a row, with shrinking transactions and tightened monetary policy putting pressure on property developers' cash flow.

Industry insiders said Morgan Stanley is raising $10 billion for a global property fund and plans to put $1.5 billion or more of that into China, despite fears the nation's property market will slide further.

Other foreign funds, including Blackstone and Carlyle, are also looking for new investment opportunities in high-end residential and commercial properties in China.