|

BIZCHINA> Top Biz News

|

|

Nation may have bigger say in restructured IMF

By Wang Xu (China Daily)

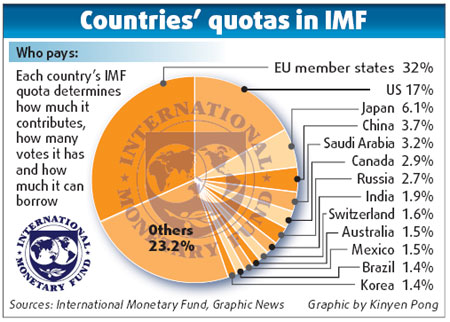

Updated: 2009-05-14 07:37 China may leapfrog Japan to have the most say after the United States in the International Monetary Fund (IMF) after a structural reform of the fund's governance, a senior IMF official said yesterday. "There is a possibility that China's quota will rise to second, when the reform concludes by 2011," Daisuke Kotegawa, IMF's executive director for Japan, told China Daily. Each member country is assigned a quota, based broadly on its relative size in the global economy; and the quota determines its maximum financial commitment to the IMF as well as its voting power. China's current IMF quota is 3.72 percent, the sixth largest. The US and Japan hold 17.09 and 6.13 percent.

"But the eventual outcome still depends on negotiations among member nations," Kotegawa said. "And it's not clear whether the Chinese government is willing to shoulder the rising responsibility accompanying a greater say." In March, Vice-Premier Wang Qishan wrote in the British newspaper The Times that it is necessary to press ahead with reform of the international financial system, and increase the representation and voice of developing countries in the IMF and the World Bank. Sun Lijian, dean of Fudan University's Economics School, said: "A meaningful reform should not only increase the voting power of developing nations, but also remove America's de facto veto power in the IMF. "If the US continues to dominate IMF decisions, there will be little change in the international financial system." Currently, some major decisions at the IMF need 85 percent of the vote but the US' 17 percent vote gives it effective veto power. IMF Managing Director Dominique Strauss-Kahn said last month that he would support reducing the majority needed to make major decisions at the fund from 85 percent, noting that the US veto power makes some decisions difficult to make. The Group of 20 leaders agreed to triple the IMF's funds to $750 billion from $250 billion in the April summit held in London so it can play a more effective role in tackling the global financial crisis. Hu Xiaolian, a vice-governor of the People's Bank of China, told an April 10 media briefing in London that China is in discussions with the IMF and will contribute to the fund by buying its bonds denominated in special drawing rights (SDRs). The IMF created the SDRs in 1969 to support the Bretton Woods' fixed exchange rate system. Their value is based on a basket of international currencies made up of the dollar, the euro, the Japanese yen and the British sterling. But Liu Jing, associate dean of Cheung Kong Graduate School of Business, is not convinced that China needs a substantially bigger role in the IMF. "It could be difficult for China to make a major increase in its contribution to the IMF. It may be better for the nation to spend its foreign exchange reserves on its own economic development, given its low per capita GDP and status as a developing nation."

(For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 一本久久综合 | 91九色视频无限观看免费 | 欧美成人做性视频在线播放 | 看久久 | 巨乳激情 | 国产在线观看高清精品 | 香蕉超级碰碰碰97视频在线观看 | 久久午夜国产片 | 亚洲午夜精品在线 | 色国产精品 | 欧美日韩免费做爰视频 | 99久久久国产精品免费播放器 | 亚洲综合国产一区二区三区 | 久久精品免看国产成 | 色偷偷在线刺激免费视频 | 91最新91精品91蝌蚪 | 国产精品久久久久久影视 | 97久久精品一区二区三区 | 各种偷拍盗摄视频在线观看 | 久久国产成人午夜aⅴ影院 久久国产成人亚洲精品影院老金 | 日韩男人天堂 | 日本精品视频一视频高清 | 免费人成在线观看播放国产 | 在线观看亚洲精品专区 | 欧美三级在线观看不卡视频 | 成人精品一级毛片 | 亚洲综合色一区二区三区另类 | 三级理论手机在线观看视频 | 一级毛片视屏 | 欧美日韩在线播放一区二区三区 | 美女视频网站永久免费观看软件 | 国产欧美视频在线观看 | 精品久久久久亚洲 | 伊人手机视频 | dy888午夜国产午夜精品 | 不卡精品国产_亚洲人成在线 | 亚洲一区二区三区四区 | 欧美手机手机在线视频一区 | 亚洲欧美在线播放 | 精品自拍视频 | 97精品国产手机 |