|

BIZCHINA> Top Biz News

|

|

Gold fever grips Chinese investors

By Wang Ying (China Daily)

Updated: 2009-05-29 09:38

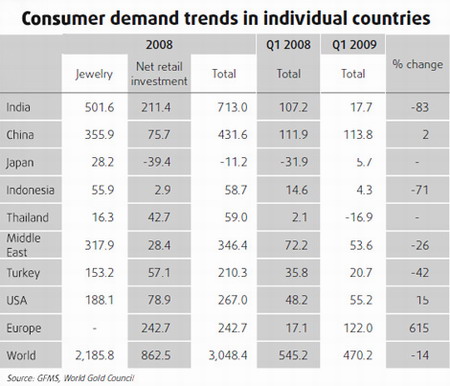

Bitten by the gold bug, Chinese investors are now rushing to hoard the yellow metal as fears over the global recession deepen. The increased sales of gold bars and gold jewelry in Shanghai, Beijing, Guangzhou and other large cities are reflected in the precious metal's price surge on the Shanghai Gold Exchange (SGE), which trades in gold contracts for forward deliveries. Gold prices quoted on the SGE have increased by an average 6.74 percent in the past month to the current level of about 209 yuan a gram. "Gold demand in China in the first quarter rose to 114 tons, up 2 percent over the same period last year, solely boosted by an increase in jewelry demand," according to the latest Gold Demand Trends report for the first quarter of 2009 published by the World Gold Council.

Inspired by the increase in the government gold reserves, the more savvy investors are also buying shares of Chinese gold producers on the Shanghai Stock Exchange and the smaller Shenzhen Stock Exchange. In late April, Hu Xiaolian, the head of China's foreign exchange agency, said China's gold reserves had risen 75.67 percent to 1,054 tons since 2003. Analysts said they expect the Chinese government would continue to raise its gold holdings as the renminbi becomes increasingly internationalized. "China's gold reserves may serve as backing for the yuan as Beijing is stepping up the promotion of its use overseas," said Albert Cheng, director of the World Gold Council's Far East Division. "As we know, in late April, the People's Bank of China announced its gold reserves had risen 454 tons since 2003 to 1,054 tons, a signal that the central bank is taking gold as a reliable hedge against financial uncertainties," said Cheng. According to Cheng, China now plays a greater role in the global gold market. Based on its increased holdings, China is fifth-largest gold reserve nation after the United States, Germany, France and Italy. In addition, China is also the world's largest gold producer and the second-largest gold jewelry consumer next to India. "China's demand for gold bullion reached 68.9 tons in 2008, up 176 percent from 25 tons in 2007," said Cheng. Cheng said gold differs greatly from other investments. "You cannot make a fortune overnight from gold trading, but you won't lose your shirt instantly in gold trading, either," he said. For personal investors, Cheng's advice is: it is never too late to enter the gold market, because gold purchases pay off in the long run.

"The declining value of the dollar along with the worsening economic outlook is forcing investors to seek other anti-inflationary investment tools, like gold," said Xiao Zheng, analyst, Ping An Securities. Immediate-delivery gold prices reached a three-month high on May 22 in New York at $959.75 per ounce, the highest since Feb 26, a reflection of growing fears on worsening global economic outlook and devaluation of the greenback, analysts said. The precious metal has moved up by 19.73 percent from this year's low of $801.59 an ounce on January 15. Gold prices on the Shanghai Gold Exchange (SGE) also saw a monthly growth of 6.74 percent, from 195.42 yuan on April 22 to 209.05 yuan on Monday.

The global economic indicators have also not exactly been rosy. The latest figures released by the US Commerce Department showed a further sign of economic decline. Buildings permits fell 3.3 percent to a record low of 494,000. The Dollar Index, a measure of the greenback against Euro, Japanese yen, British pound, Canadian dollars, Swiss franc and Swedish krone, lost 3.4 percent this week on speculation that the US government's creditworthiness may be weakening. "Key indices are pointing to a downside trend. Investors prefer to stock value-retaining gold," said Xiao. He added that gold outperforms other non-ferrous metals. Huang Hao, analyst, Sealand Securities, said the recovering demand from India, the world's largest gold consumer in May is also an important reason for the recent gold price hike. (For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 久草在线观看视频 | 免费一级毛片在线播放放视频 | 亚洲三级在线免费观看 | 国产成人无精品久久久 | 久久国产欧美另类久久久 | 日韩欧美自拍 | 极品精品国产超清自在线观看 | 高清免费国产在线观看 | 男人和女人在床做黄的网站 | 久草视频在线免费 | 日本免费人做人一区在线观看 | 久久99精品热在线观看15 | 在线成人毛片 | 色噜噜国产精品视频一区二区 | 久草福利资源在线观看 | 国产区91 | 亚洲国产中文字幕 | 久久久黄色大片 | 国产又粗又黄又湿又大 | 免费人欧美成又黄又爽的视频 | 特黄特黄| 美女被男人cao的爽视频黄 | 午夜美女网站 | 亚洲午夜网站 | 国产精品无圣光一区二区 | 天天综合色一区二区三区 | 免费看香港一级毛片 | 日韩国产精品99久久久久久 | 久久亚洲精品成人 | 欧美一级在线免费观看 | 久久福利精品 | 男女男精品视频在线播放 | 成人a毛片免费视频观看 | 免费萌白酱国产一区二区三区 | 色综合久久88色综合天天提莫 | 亚洲天堂欧美 | 呦视频在线一区二区三区 | 亚洲精品一区二区三区在 | 国产一级一片免费播放 | 午夜国产亚洲精品一区 | 蜜臀91精品国产高清在线观看 |