Top Biz News

Blowing up a property bubble

By Andrew Moody, Zhang Qi and Xin Zhiming (China Daily)

Updated: 2009-11-04 08:24

The average cost of residential property in China's 70 largest cities has already risen by 2.8 percent in the 12 months up to September, show figures released by the National Bureau of Statistics.

James MacDonald, head of research at estate agents Savills in Shanghai, said these statistics could even underestimate what is really happening. "In certain cases, you might be expecting prices to be 10 to 30 percent higher than in the second quarter of last year," he said.

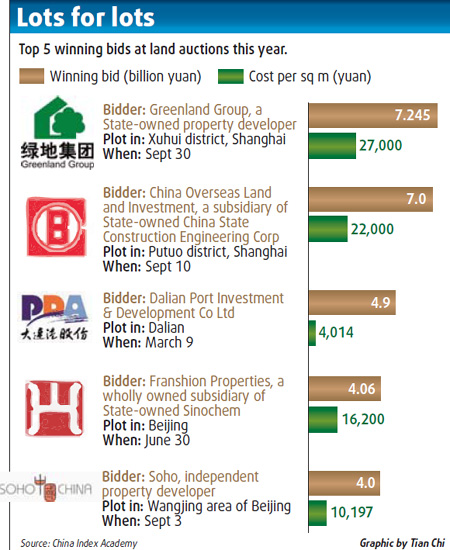

He explained that those paying top price for land now will aim to recoup the original outlay when development is complete, signaling further price hikes in the future.

"For companies to turn a profit they need to sell the property for a value above the costs of land, construction, labor and administration. It means the buyers of the land are speculating on a further increase in property prices," he added.

But many fear this model is not sustainable, including Zhang at A.T. Kearney, who said many people are already stretched to the limit.

"The average graduate salary upon leaving university is 24,000 yuan a year, but that is the average price of just 1 sq m of a property in a Chinese city. It would therefore take the graduate 80 years to buy an average-sized apartment," he said.

The one inevitability about a bubble is that it will burst, he added. "I am not saying it is going to happen next year as it is very difficult to predict a time. But it could certainly happen in three or five years. When it does it will have serious repercussions for the economy because a lot of industries depend directly on the property market."

It would be difficult to distance the nation's SOEs from the property market. Of the 130 enterprises under the State-owned assets commission, 80 are involved in real estate and no fewer than 16 are property development companies.

Wang Yulin, a senior researcher with the Ministry of Housing and Urban-Rural Development, said it would be wrong to bar State-owned companies from investing in the property sector, and dismissed suggestions SOEs are free to become land speculators.

"Large SOEs are closely monitored in terms of expenditure and they will not spend money willfully. Whatever the ownership of an enterprise, it has the right to enter a sector and do business," he said.

SOEs have little alternative but to invest in property, added Larry Lang, professor of finance at the Chinese University of Hong Kong, who said the companies were the major recipients of funding from the stimulus package but lacked other rewarding projects to invest in. "They have opted to use the money to buy stocks and land," he said.

Exactly how much of the stimulus pot has gone to the land-grabbing SOEs remains a mystery. Dong Xia-nan, chief macroeconomics analyst for brokerage firm, Industrial Securities, said: "It is something that is hard to verify."

However, many analysts fear a repeat of the scenario witnessed in Japan during the 1990s, the country's "lost decade", when it endured a long period of recession after a massive collapse in house prices.

MacDonald at Savills, however, said there was no need to panic about the immediate effect of the recent purchases on house prices.

"It will take two or three years for this land to be developed and the properties go on sale. By that time, the property market could look very different from the way it does now," he said. "Average incomes are growing 10 percent a year, so prices can go up more than 30 percent over that time and the affordability ratios will remain the same."

Meanwhile, SOEs have been warned they may regret their "land king" rush, with analysts predicting they will one day have to pay for their excesses.

"They will regret paying these high prices and history will prove they were not acting in a rational manner," said Ronnie C. Chan, chairman of Hong Kong-listed Hang Lung Properties Ltd.

Li Jing contributed to the story.