Top Biz News

Patient investors to reap rewards

By Jiao Xiaoyang and Li Xiang (China Daily)

Updated: 2010-01-27 08:02

|

Large Medium Small |

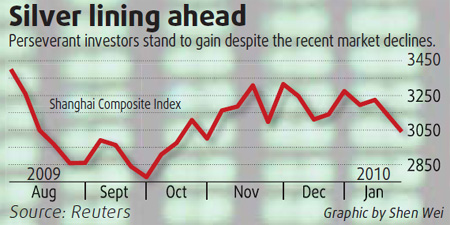

The outlook for the Chinese stock market in 2010 still remains robust with promises of rewards for those who are perseverant and resilient, notwithstanding the recent declines, a leading analyst said yesterday.

"Panic-selling of shares has stopped since 2008 and chances of a second crash are still remote," said Li Daxiao, head of the research institute with Shenzhen-based Yingda Securities.

According to Li, the dynamic price to earnings ratio of around 26 and the reasonable levels of market valuation indicate that the long-term prospects still remain strong, with occasional bouts of volatility, he said.

"With the economy and the performance of listed companies continuing to improve, the long-term valuations may gradually fall," he said.

Li, however, admits that the market is facing pressure after witnessing continuous declines in the past few weeks. Fears of an earlier-than-expected government exit from the stimulus policy, refinancing pressures and increasing numbers of non-tradable shares would hamper the market's performance in the near term.

The analyst also cautioned investors to not read too much into the market predictions.

"If we look at the situation in mid-2007 when the Shanghai Index was reaching the record 6124 points, market sentiment was crazy. You saw all kinds of predictions like 'a 10-year bull' and 'non-stop at 10000 points', and then the market collapsed soon," said Li.

"Now we hear cautious and even pessimistic predictions like the possibility of a second financial crisis and risks of asset bubbles, indicating the market is far from the crazy levels. So we probably shouldn't be too fearful," he said.

The upward momentum will, however, slow this year and the market may see downward challenges in the near term as it continues to absorb the possible repercussions of a government exit from stimulus measures.

Li is famous for his correct predications of the mid- to long-term trend of the stock market. In July 2006, he predicted the Chinese stock market would emerge from the doldrums and see a strong rally. He was proved right in 2007 when the Shanghai Composite Index hit a high of 6124 points.

The Shanghai Composite Index has retreated by nearly 7 percent this year after investor sentiment was dampened by a series of government policies to cool the economy.

It is widely expected that China's central bank may raise the benchmark interest rate earlier than expected in the first quarter of this year and it was also rumored that the authorities would re-impose stamp tax on stock purchases.

The government's seriousness to tackle asset bubbles in the real estate market and to cut back banks' lending growth has also triggered declines in property and bank stocks.

US President Barack Obama's plan to limit risk trading by American banks may also not augur well for the Chinese markets.

Gao Ting, a senior analyst with China International Capital Corporation, said the current correction proves the market often moves against the majority's expectations.

|

||||

He said the Chinese economy's strong growth has already been "factored in" the rally last year and it would take a while for the market to absorb the repercussions of the policy before moving up again.

The benchmark Shanghai Composite Index yesterday dropped to the lowest level in nearly three months by falling 2.42 percent to 3019.39 points amid concerns that the tightened credit policy may further hurt market liquidity.