Economy

High trade surplus 'likely to remain'

By Ding Qingfen (China Daily)

Updated: 2010-08-11 08:55

|

Large Medium Small |

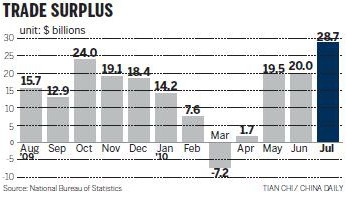

BEIJING - The country's high trade surplus will likely remain for the rest of the year as domestic demand continues to shrink from government attempts to curb the property bubble, Chinese analysts have said.

In July, exports grew to $145.5 billion and imports increased to $116.8 billion.

The higher trade surplus "was mainly driven by the larger-than-expected slowdown in imports", said Nomura Global Economics in a note on Tuesday.

Growth in imports fell to 22.7 percent, from 34.1 percent in June, although China's imports from the United States and European Union reached the highest since February, rising by 33 percent for US imports and 34 percent for EU imports year-on-year, Customs figures showed.

Despite the strong growth of imports in auto, grain, mechanical and electrical products, imports of industrial goods, including crude oil, iron ore, copper and finished steel products, all fell.

These reflected "weakening commodity prices, shutdown of inefficient and heavily polluting producers, and flooding which caused weak manufacturing activity", Nomura said.

As government policies on curbing real estate speculation continue and commodity prices are expected to stay low, the country's imports of "most industrial materials" will continue to shrink, said Yan Jinny, an economist from Standard Chartered Shanghai.

Trade surplus will stand at above $20 billion in the coming months, she said.

Li Jian, a senior researcher of the Academy of International Trade and Economic Cooperation affiliated to the Ministry of Commerce, agreed.

"In the rest of the year, the trade surplus is very likely to range from $20 billion to $25 billion," Li said.

"China's export growth has stayed surprisingly resilient, as the European debt woes are yet to exert negative impact on the demand for the nation's goods. We will have to wait to see the real impact until September when Christmas orders are made," Yan said.

For the rest of the year, slowdown in export growth will continue but it will be moderate, as China's exporters are shifting more focus onto Asian and emerging markets from the US and EU, Yan said.

Exports to South Korea and Singapore accelerated to 40.3 percent and 11.2 percent in July, from 37.4 percent and 8.4 percent in June, Customs figures showed.

Analysts said China must also be prepared for a fresh round of international pressure led by the US to raise the value of the yuan, as the US and EU will possibly "launch more trade remedy cases against China" in the second half of the year.

A number of analysts worry that the large surplus will give developed nations such as the US a good excuse to further pressurize China on its trade policies.

"Anti-dumping and anti-subsidy cases against China, especially from the US, will grow in the second half," said He Weiwen, deputy director of the China Institute for Open Economy of the University of International Business and Economics.

Over the weekend, the US said in its preliminary ruling that it will impose anti-dumping duties as high as 429 percent on imports of drill pipe used for oil wells from China.

Yan from Standard Chartered said "a sizable trade surplus means that the Chinese government has less justification to interrupt the appreciation of its currency".

A number of trade experts have called on the Chinese government to launch more policies to stimulate imports, especially high-tech and valued-added products, to balance the foreign trade and to fend off the criticisms.

Last weekend, the Ministry of Finance, together with four other ministries, released a policy on remitting import value-added tax and import tax on selected high-tech products, which analysts said is a sign that China is taking imports seriously.