Opinion

Addiction to cheap money

(China Daily)

Updated: 2010-11-05 14:26

|

Large Medium Small |

The fresh round of quantitative easing launched by the US Federal Reserve Board (Fed) shows that the world's biggest economy, instead of abstaining, has become even more addicted to abnormally cheap credit.

In an all-out effort to shore up the US economy, on Wednesday, the Fed announced plans to purchase an additional $600 billion of longer-term US Treasury securities by the middle of next year.

The move, nicknamed QE2, does not bode well for the world economy, which is struggling to find a way out of the worst global recession in more than half a century.

Emerging market economies, the main engine of global growth, should take action to prevent the flood of cheap US money from sending their domestic inflation through the roof.

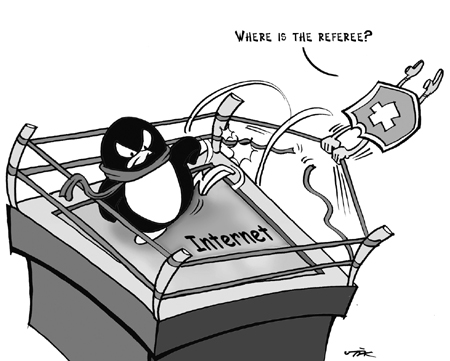

More importantly, the international community must work together to persuade the United States to give up its growing addiction to cheap money that, in all likelihood, will cripple any global effort to seek a rebalanced and lasting recovery of the global economy. There is little chance that the Fed can foster more employment while maintaining price stability with such an irresponsible monetary policy.

Compared with the painful fiscal consolidation that most debt-laden rich countries are undertaking to get their fiscal houses in order, quantitative easing, a roundabout process of printing money, looks a more tempting way to address debts and other economic woes. But, that will only be true if such cheap credit helps quicken a fundamental transformation of the US economy away from over-consumption toward investment-led growth.

The fact is that previous quantitative easing only prompted US banks to excessively increase reserves that are now a pool of inflationary fuel just waiting for the match of credit demand.

Worse, QE2 may even cause the US dollar to fall further, exerting a huge destabilizing influence on the rest of the world. The unevenness of the fragile global recovery means that most of the fast-growing developing countries are likely to fall victim to a surging inflow of international capital driven by the flood of cheap US credit.

| |||||||

Given the self-enhancing nature of this US addiction to cheap money, it is time to give the US a warning against going too far in its attempts to reflate its way out of the crisis.

It is irresponsible for the country with the world's major reserve currency to uphold the motto of "our currency, your problem". Nor is it fair for a rich economy to dilute its debts at the cost of the stability of the global economy and financial system, with developing countries bearing the brunt of its impact.

For the long-term benefit of itself and the world, the US should overcome its addiction to cheap money.