Chinese regulators are promoting the opening-up of the capital markets by expanding quotas for foreign investment at a record pace, aiming to attract more overseas funds to boost the economy and accelerate the market-based reform of the financial system.

These moves might be the starting point for an accelerated capital account opening, and more foreign money inflows are expected to be involved in China's long-term investment projects in the coming months, analysts said.

The China Securities Regulatory Commission has decided to raise the amount available for qualified foreign institutional investors, or QFII, by $50 billion, the largest increase since the launching of the pilot program in 2002.

The total QFII quotas now stand at $80 billion, a statement from the CSRC said on its website on Tuesday.

A surge of inward foreign investment could boost the country's economic development, which is being affected by slowing exports and a cooling property sector, said Cao Yuanzheng, chief economist with the Bank of China Ltd.

"It is a signal of the further liberalization of China's capital account, which is laying the foundation for the complete convertibility of the yuan and pushing a deeper reform of the financial system," Cao said.

The government may continue to improve the QFII investment program to draw more foreign long-term funds into the domestic capital market, said the CSRC statement.

Premier Wen Jiabao said on Tuesday in Fujian province that slower GDP growth and the potential expansion of companies' losses might figure prominently in this year's economic situation.

Wen stated a goal at the start of this year to draw international investment into the domestic capital market.

"The country should ensure certain liquidity in the financial market and maintain a proper amount of bank loans," said Wen, who pointed out that the current economic situation is "steady and sound".

Since 2003, China's regulators have approved a total of $24.6 billion to allow 129 foreign institutes to launch investment services in the mainland.

As of March 23 this year, 74.5 percent of the investment volume under the QFII program had been injected into the domestic stock market, with 13.7 percent in bonds and 9.6 percent in bank deposits, the CSRC statement said.

About 1.1 percent of the A-share market's value comes from QFII investment, the statement said.

"Good days are coming, thanks to the large expansion of QFII quotas," said Philippe Couvrecelle, executive chairman of the board with La Compagnie Financiere Edmond de Rothschild Banque, a French asset management company.

In January, the company doubled the total amount under the QFII program to $200 million, compared with the level when it obtained its investment license in 2006. "We are seeking a permanent, effective mechanism with support from China's regulators to invest in the A-share market," said Couvrecelle.

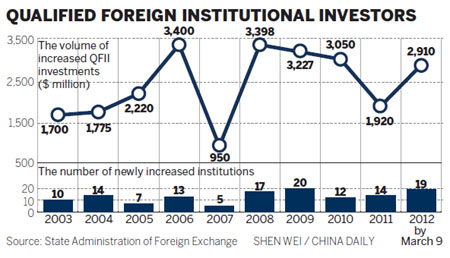

China's regulators approved QFII licenses for 19 new foreign investment institutions between Jan 1 and March 9, granting a record high $2.91 billion in quotas, according to the State Administration of Foreign Exchange.

The total amount of QFII quotas in 2011 was $1.9 billion.

chenjia1@chinadaily.com.cn