|

Visitors look at models of a housing project at the Nanjing (Spring) Real Estate Trade Fair on April 12. Average home prices in 100 Chinese cities fell 0.71 percent year-on-year in April, the first such drop since June 2011. [Photo/China Daily] |

Institutions focus on commercial, office space as residential sector remains weak

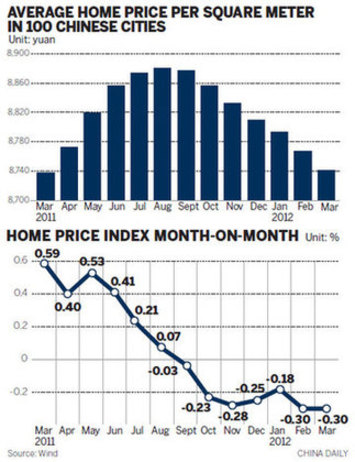

Average home prices in 100 Chinese cities fell 0.71 percent year-on-year in April, the first year-on-year drop since June 2011, the country's largest real estate website said on Wednesday.

The prices fell 0.34 percent month-on-month, the eighth consecutive fall, according to the China Real Estate Index System, which is affiliated with SouFun Holdings Ltd.

"That indicates a further cooling down in the country's real estate market amid persisting tightening measures," said He Tian, director of research at China Index Academy, a Beijing-based real estate research institute.

"As property developers' cash flow further tightens, we believe property prices in key cities such as Beijing and Shanghai will slide 5 to 10 percent this year, while second- and third-tier cities may see a drop of more than 10 percent," He added.

|

|

CREIS said the average home price in the 10 biggest cities was down 2.6 percent year-on-year at 15,391 yuan ($2,443) a square meter in April, the fourth consecutive fall on a yearly basis.

According to Standard Chartered Bank, developers are a little more confident about apartment sales, and price cuts of 10 to 20 percent are apparently helping demand.

"Inventories are still rising. Developers expect more cuts of up to 20 percent," said Stephen Green, an economist at Standard Chartered Bank. The bank presented the results of a survey of 30 residential developers in eight second- and third-tier cities taken in February and March.

As of last Thursday, 103 domestically listed developers had released first-quarter reports. Their net profit fell 1.33 percent to 7 billion yuan. The biggest four developers had net profit of 2.52 billion yuan, down 4.26 percent.

With property curbs set to continue, developers face increasingly tight cash flow in the second half of the year, and more small developers will go bankrupt, industry analysts said.

Chinese banks made 242.7 billion yuan in property loans in the first quarter, down 54 percent, central bank data show. Property lending fell 38 percent in 2011.

Standard Chartered Bank said financing conditions for developers remain tough but have not deteriorated since the fourth quarter.

Bank loans to developers appear to have increased in recent months. Developers think financing pressure will rise as many trust-company loans fall due in the second and third quarters.

Most developers are buying fewer sites, even though land prices have fallen.

According to the China Index Academy, sites purchased by the top 10 developers fell 77 percent year-on-year in the first quarter and 25 percent quarter-on-quarter. China Vanke, for example, only bought one site.

Auction failures are up, as are sales of land by developers to other developers, according to Standard Chartered Bank.

According to Huang Yu, vice-president of the China Index Academy, there will be more merger-and-acquisition deals in the second half of the year.

"In the first half, potential buyers will be more cautious about the market and their liquidity, while sellers continue betting on a rebound of property sales, so deals aren't easily concluded," said Huang. "If the market cools further in the second half, prospects for M&A deals will improve."

Real estate consultancy E-Commercial China said six large-scale deals (each with their value exceeding 50 million yuan) were signed in Beijing in the first quarter.

Four were in the residential sector, including two deals involving foreign institutional investors.

The value of large-scale deals tracked by E-Commercial China in Beijing and Shanghai exceeded 14 billion yuan in the first quarter.

This year will be "a good time for property investors with a sound balance sheet to seek bargain projects, and there will be more M&As emerging, especially in land parcels and projects under construction," said Tsui Yik, director of valuation & investment services for E-Commercial China.

Despite opportunities in residential property, analysts said commercial property is the first choice of foreign institutions, especially those seeking lower risks.

Jack Ye, national director of investment and capital markets of Cushman & Wakefield China, said housing controls are making office and retail properties appealing for investment.

"Offices in Beijing and Shanghai remain a hot spot for investment, while retail markets in first- and key second-tier cities are also a focus for institutional investors," he added. "We expect to see more offshore funds investing in those projects, and also an increase in land transactions in second- and third-tier cities."

According to E-commercial China, commercial complexes will remain favored by institutional investors this year.

"Commercial sites in prime locations are the focus for deals with a transaction price exceeding $10 million," said Yin Baojun, vice-president of E-Commercial China.

huyuanyuan@chinadaily.com.cn