|

|

|

Stock investors at a securities brokerage in Hangzhou, Zhejiang province, on Monday. [Photo/China Daily]? |

It's been five years since China's last bull market retreated in late 2007.

A lot has changed since then: a global financial crisis has come and gone, many eurozone countries are still struggling; the Chinese central bank has adjusted its benchmark interest rates more than a dozen times.

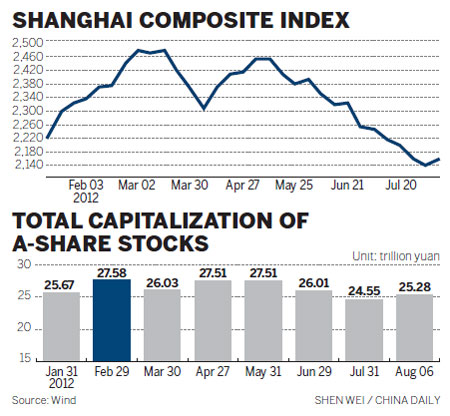

But despite all this, and more, China's main stock index - the Shanghai Composite Index - at 2157.62 points at Tuesday's close, has been largely unmoved.

In China, up to 85 percent of A-share market capitalization is in the hands of individual investors, according to China Securities Regulatory Commission, the country's top securities regulator.

Many of those investors suffered the most painful losses when the country's major stock index plummeted from more than 6000 points to 2000 points in just a few months in 2007 and 2008.

Their clamor and anticipation have increased in recent months, with the introduction of various pro-growth policies that were expected to add market liquidity.

Many said they have waited long enough for the bull to return.

"The stock market has been miserable for so long that it's time that the government do something to shore up the market," said Liu Liyang, a shop assistant in Shanghai who suffered "great losses" in the dark days of 2008.

Analysts said it is certainly reasonable for investors to have become impatient.

After the People's Bank of China, the central bank, cut the benchmark lending and savings rates for the second time in a month on July 6, many expected that easier credit would boost the stock market.

Economist consensus is that the GDP growth will bounce back in the second half after hitting a three-year low in the second quarter.

Experts have suggested that as a precursor for a return to a stronger economy, the stock market will be a beneficiary of rising investor confidence.

"All the recent news points to a stronger stock market, which should see a rally sooner or later in the second half," said Li Daxiao, director of Yingda Securities Institute, in a message on his micro blog.

However, the Shanghai Composite Index has been down 2.97 percent this month, and 1.90 percent year-to-date.

The weak performance, despite the favorable signs, prompted one frustrated investor to suggest online this week that "the country is brewing a huge plot to take advantage of its investors".

There are various explanations being offered for the continued bear market.

Zhang Qi, a stock analyst with Haitong Securities Co Ltd, suggested that the "intensive issuing of new shares is definitely one of the dampers on the market".

By the end of July, 765 companies had filed applications with the regulator and were awaiting examination for an initial public offering, according to the securities regulatory commission.

In July, more than 70 percent of the candidates examined were given a green light.

Wang Jianhui, chief economist with Southwest Securities Co Ltd, agreed with Zhang that new issues affect the market.

He said that issuing new shares "siphons" funds and drags down the market.

"The bigger the pool, the shallower the water," he said.

Moreover, little of the liquidity flowing from interest rate cuts goes into the stock market, he added.

In times of economic uncertainty, China's State-owned lenders have generally been encouraged to make the real economy - which concerns the production of goods and services, rather than the part that is concerned with buying and selling on the financial markets - a priority.

In July, when the central bank reduced rates, a total of 67.3 billion yuan ($10.6 billion) flowed out of the stock market, following an outflow of 87 billion yuan in June.

It is also important to note that few of the investment decisions made in China's stock market are based on economic or company fundamentals.

In a market so often driven by speculation, it becomes irrelevant whether the economy is getting better or not.

Speculation is so rampant that Guo Shuqing, chairman of the China Securities Regulatory Commission, advocated publicly for "rational investments" earlier this year.

He even recommended blue-chip stocks to investors, in a rare comment on market dynamics, that won him an unenviable nickname for someone in his position - the "stock analyst".

A bull market is always started by institutional investors, and only gets into full swing as retail investors pile in.

Institutional investors remain wary because the market is still under selling pressure, five years after the last bull ended.

"Many individual investors were - and still are - traumatized by the big slumps of 2007 and 2008.

"They will sell all locked-in shares when markets get just a little better, and stay away from equities forever," suggested one Shanghai-based analyst who refused to be named.

"That kind of selling will nip any bull market in the bud."

Sun Huixin, a 50-year-old investor in Shanghai, added: "I just don't believe in the Chinese stock market anymore.

"I will sell all my shares when prices recover a little bit."

Morgan Stanley, however, actually argued that a new bull is already here.

In a research note published on May 16, the investment bank said that the last bear market ended on Jan 5 this year, after 884 days.

Chinese equities, it added, were 130 days into the bullish phase, with returns of 11 percent by then. It added that an average bull market lasts 414 days for 245 percent return.

gaochangxin@chinadaily.com.cn