Experts call for break-up of SOE monopoly on debt concerns

|

|

Move would help innovation and economic restructuring

If you're still wondering why the Chinese stock market has persistently underperformed those of other major economies, despite above-average economic growth, consider this: Ballooning debt is acting like a millstone around the necks of many listed enterprises, dragging down profits, and possibly pulling them into the financial abyss.

The combined outstanding debt of all A-share listed companies at the end of 2012 was 8.2 trillion yuan ($1.33 trillion), according to research from investment newspaper Investor China.

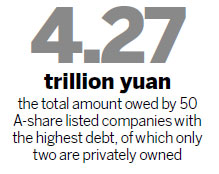

The 50 companies topping the debt list owed an aggregate 4.27 trillion yuan, or 52 percent of the total.

Of those 50, 37 are State-owned, while six are controlled by local governments. Just two can be classified as strictly privately owned.

Ready access to cheap credit from banks and other sources, including the capital markets, is one of the privileges that SOEs enjoy, said Liu Shengjun, the executive deputy director of CEIBS Lujiazui Institute of International Finance.

"SOEs and other enterprises with government backing can secure bank loans at preferential interest rates that are much lower than those that apply to private sector borrowers. The problem has been there for years," he said.

Private-sector enterprises often have to pay above 10 percent a year to secure loans, while the average interest their government-controlled counterparts pay was only about 5 percent, according to Investor China.

The interest for loans in the curb market, a market for trading in securities not listed on the stock exchange and a major source of funding for small-to-medium-sized enterprises in the private sector, is even higher, at 40 percent a year or more.

"To solve the difficulty of private companies seeking financing, liberalization of bank interest rates is inevitable," added Liu.

"Also, private capital should be allowed into banking. But on top of all that, the privilege of SOEs should be broken.

"Only when the monopoly of SOEs is broken can economic restructuring and innovation be possible."