Bank of China has the most extensive foreign operations among Chinese lenders, which Chen said he expected to contribute more to earnings this year as the United States and Europe show clear signs of recovery.

Last year, Bank of China's overseas pre-tax earnings jumped 20.6 percent to $6.7 billion, while total overseas assets reached $630.8 billion, accounting for over 25 percent of its total assets of 13.87 trillion yuan.

"Overseas operations will be our key focus this year," said Chen.

People's Bank of China Governor Zhou Xiaochuan said on March 11 that control of deposit interest rates, the last remaining step in the country's interest rate liberation, will be scrapped in one to two years.

Zhou said that rates will likely rise in the short term amid stepped-up competition for deposits.

Valuations of Chinese bank shares have been at low ebb more for than two years, as investors fear rate liberation will hurt profitability.

On Wednesday, Bank of China shares rose 2.48 percent to HK$3.30 (43 cents).

Standard Chartered Plc said that the bank's warrants have attracted new funds, an indication of market confidence.

Warrants entitle the holder to buy the underlying shares at a fixed exercise price until a fixed date.

Barclays Plc has issued a "Buy" rating on Bank of China shares in Hong Kong, with a target price of HK$4.60. JPMorgan Chase & Co also recommended buying the shares, giving a target of HK$4.35.

Another reason investors have been shunning bank shares is because of concerns that nonperforming loans will rise as China's economic growth decelerates.

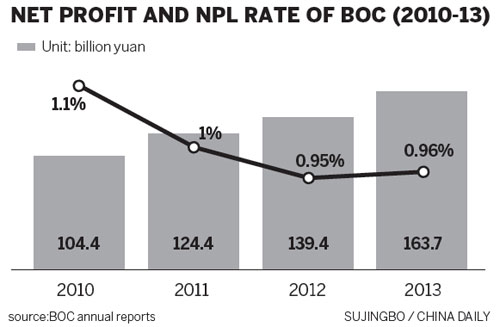

At the end of 2013, Bank of China had 73.3 billion yuan in NPLs, translating into a bad loan ratio of 0.96 percent, 0.01 percentage point higher than a year earlier.

As of Dec 31, 2013, Bank of China had extended loans of 853.5 billion yuan to the real estate sector, local government financing platforms and industries with severe excess capacity.

The three sectors are considered most likely to default in an economic slowdown.

Chen said that the bank is "combing through" the loan book to evaluate the possibilities of defaults this year.

"Overall, the bank's asset quality risks are controllable this year," said Chen.

|

Yuan eases on widened trading band |

|