|

|

An investor checks share prices at a securities brokerage in Jiujiang, Jiangxi province.[HU GUOLIN / FOR CHINA DAILY] |

New policies including the launch of the registration-based initial public offering system will boost IPO activities in the A-share market next year, with the number of IPO deals likely to surpass 350, accounting firm Ernst & Young LLP predicted on Monday.

Chinese bourses, both on the mainland and in Hong Kong, led the global IPO market in 2015, with 372 IPOs raising $60.3 billion, according to EY.

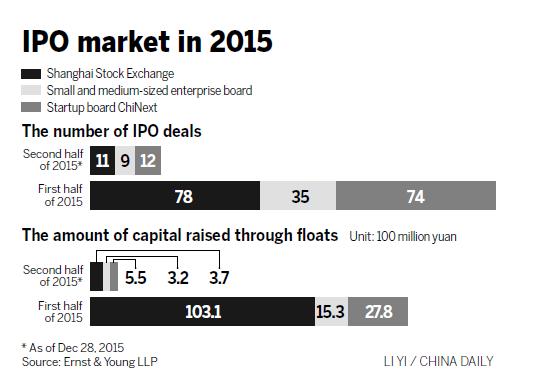

The A-share market, in particular, saw 219 IPOs, raising 158.6 billion yuan ($24.45 billion). The total value of funds raised in 2015 increased by 102 percent from the level in the previous year.

The introduction of the registration-based IPO system will further accelerate the growth of the IPO market next year and will have a comprehensive impact on the Chinese capital market, Terence Ho, head of the strategic growth markets business for China at EY, said at a news conference in Beijing.

"The additional influx of new shares may bring down A-share valuations along with lower returns from IPO subscriptions," he said.

In 2015, the average year-to-date gain on IPOs was 473 percent in the A-share market, which compared to 126 percent in Hong Kong and a 1 percent loss in the United States market, according to EY.

China's top legislature on Sunday approved the State Council to launch the much-anticipated registration-based IPO system by March at the earliest.

"It means that legal hurdles for introducing the new system have been removed. The new IPO mechanism is now in the process of implementation," said Li Daxiao, chief economist at Yingda Securities Co.

Amid concerns that the new IPO system will dampen demand for existing equities, investors dumped A shares on Monday, with the benchmark Shanghai Composite Index declining 2.59 percent, the biggest loss in a month, to close at 3,533.78 points.

Ho said that the restrictions on new share issuance will be lifted step by step in order to avoid a huge supply of new stocks, adding that companies from the industrial, technology, media and telecommunication sectors will continue to dominate IPO activities in the coming year.

Meanwhile, the introduction of the new IPO system will make the A-share market a more attractive listing destination, posing a direct challenge to the US and Hong Kong markets, experts said.

According to the report from EY, the total number of Chinese companies listed in the US market was eight in 2015, raising a total of $361 million.

The number of deals declined by 47 percent while the value of funds raised dropped by 99 percent from the level of the previous year.

"Hong Kong will face a substantial challenge in 2017 after the IPOs in the pipeline are listed next year," Ho said.

The Hong Kong Stock Exchange topped the global IPO market in 2015 with 121 IPOs raising a record $33.7 billion. The New York Stock Exchange was ranked second with IPOs raising $19.6 billion, followed by $17.5 billion raised in the Shanghai Stock Exchange, according to EY.