|

|

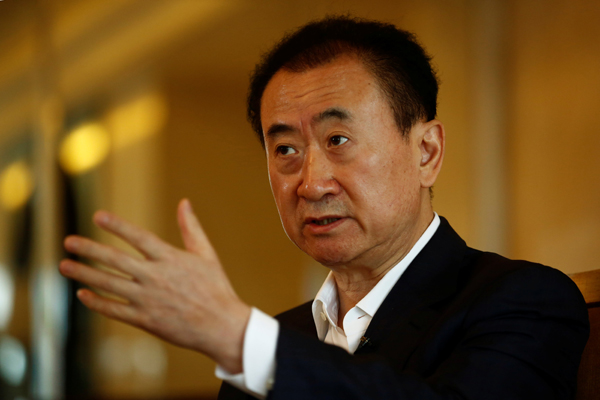

Wang Jianlin, chairman of the Wanda Group, speaks during an interview in Beijing, August 23, 2016. [Photo/Agencies] |

Real estate and entertainment conglomerate Dalian Wanda Group Co expects to seal two billion-dollar film-related deals in the United States this year, chairman Wang Jianlin said on Tuesday, as China's richest man steps up his push into Hollywood.

After completing the acquisition of two non-production film companies - each worth above $1 billion - Dalian Wanda's next target would be a so-called "Big Six" movie studio, Wang told Reuters in an exclusive interview.

"My goal is to buy Hollywood companies and bring their technology and capability to China," Wang said.

He declined to elaborate on the two deals in the pipeline, which would further bolster Wanda's motion picture empire.

In January, Wang splashed $3.5 billion to buy a controlling stake in US film studio Legendary Entertainment, behind hits such as "Jurassic World", making Wanda the first Chinese firm to own a major Hollywood studio.

Dalian Wanda, which was added to the Fortune Global 500 list this year, aims to triple revenue from its cultural division, led by entertainment, sports and tourism, to 150 billion yuan ($22.6 billion) by 2020.

Reuters reported last month that Wanda has held talks with Viacom Inc about acquiring its stake in Paramount Pictures, one of Hollywood's "Big Six" studios that also include Twentieth Century Fox, Warner Brothers, Walt Disney, Universal Pictures and Columbia.

"We are interested not only in Paramount, but all of them. If one of the Big Six would be willing to be sold to us, we would be interested," Wang said.

"Only the six are real global film companies, while the rest are not. If we are to build a real movie empire, this is a necessary step."

Dalian Wanda is leading a slew of Chinese firms that are investing in Hollywood. They include Fosun International, which has invested in Studio 8, a production company started by former Warner Brothers executive Jeff Robinov, and Huayi Brothers Media Corp, which is producing films with STX Entertainment, a studio invested in by Chinese private equity company Hony Capital.

Dalian Wanda would also start co-investing in global blockbusters next year, Wang added.

A screen near you

The Chinese conglomerate, which began as a property developer in the northeastern city of Dalian, was also looking to extend the world's biggest motion picture theatre network, Wang said.Following the completion of its acquisitions of London-based Odeon & UCI Cinemas Group and Carmike Cinemas Inc in the United States, Dalian Wanda would control 15 percent of global box office revenues, Wang said, and may reach its goal of controlling 20 percent earlier than its target of 2020.

Wang, who has also bought Swiss sports marketing firm Infront Sports & Media AG and World Triathlon Corp, owner of the "Ironman" franchise, said he was primarily interested in acquiring entertainment and sports companies in the United States and Europe.

"If the target company fits our appetite, there is no upper limit for budgeting," he said.

But he cautioned that too many investors were rushing into the "hot" film market.

"Most of the money invested in China, and even the global film industry, is silly money. Only a little is smart money," he said.

"As China's film industry growth slows to below 20 percent, or even 10 percent, 8 percent this year, some will be washed out. It's like Warren Buffett said, 'you only find out who is swimming naked when the tide goes out'."

IPO or backdoor listing

Separately, Wang said that Dalian Wanda Commercial Properties Co, Wanda's real estate flagship, would re-list on the Shanghai stock exchange either through an initial public offering (IPO) or a backdoor listing.Shareholders of the Hong Kong-listed firm last week approved a buy-out offer that would see the firm privatised.

The company said earlier this month it planned to de-list from the Hong Kong stock exchange on Sept. 20.

Wang said both options were on the table for the planned Shanghai re-listing. Approval for an IPO could take two or three years, while a backdoor listing would require more than a year, he added.

Mainland-listed firms typically command higher valuations than those traded in Hong Kong, helped by a large pool of retail investors.

But Wang said the "core problem" that triggered the de-listing plan was not the low valuation of the company's Hong Kong shares, but the lack of liquidity.

"We only listed 14 percent of the company in Hong Kong, which means 86 percent of shares are neither liquid nor could be pledged as collateral," Wang said. "That's not a real listed company."