New vision on Belt and Road financing connectivity

BEIJING — The Belt and Road is starting a new journey, with an international gathering earlier this month charting its future course. As a priority for the next stage, financial cooperation and connectivity are seen as a key to success.

Looking into the Belt and Road Forum for International Cooperation, there is much waiting to be explored to facilitate development along the route.

Large investment demand

A joint communique was issued at the forum, vowing to work on a long-term, stable and sustainable financing system, as well as to enhance financial infrastructure connectivity, by exploring new finance models, platforms and services.

The investment needs will be large due to the initiative's sheer size, according to World Bank President Jim Yong Kim at the forum, who said that the benefits of the initiative were broader than one project or country.

The projects will require innovative financing mechanisms - a mix of public and concessional finance and commercial capital, Kim said.

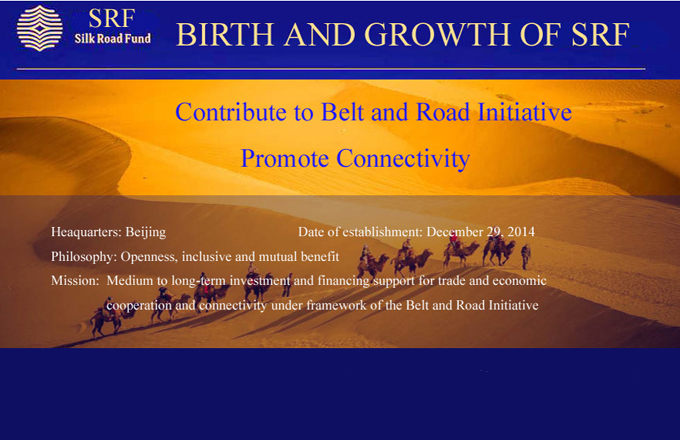

One of the eye-catching outcomes of the forum was China's hefty financial support to advance the initiative, including an additional 100 billion yuan ($14.5 billion) to the Silk Road Fund.

Yi Gang, vice governor of Chinese central bank, said that the expansion of the Silk Road Fund was necessary and that he believed the funding would further attract resources and funds from Belt and Road countries and international organizations.

Cao Honghui, a renowned economist, said the additional funding would help improve the investment environment along the Belt and Road and be a good example to attract other funds.??

Stronger connectivity

Meanwhile, besides the actual fund injection, economists said future cooperation would gradually extend from the building of hardware such as roads and ports to softer sectors such as management and services.

Zhao Jinping, from the Development Research Center of the State Council, said funding services and financial support would be one of the service and institutional improvements that would take more shares in the next round of Belt and Road construction.

Nine Chinese-funded banks have set up 62 direct branches and representative offices in 26 countries along the Belt and Road as of the end of 2016, offering tailored services to local clients.

At the same time, 54 commercial banks from 20 countries and regions along the Belt and Road have established branches, financial companies or representative offices in China, seeking opportunities with the initiative.

According to the Guiding Principles on Financing the Development of the Belt and Road, governments along the Belt and Road should coordinate to provide favorable policy environments for financing.

The guiding principles also suggest letting the private sector play a larger role in the initiative, and encouraging financial innovation while enhancing cooperation on financial regulation.

Innovation drive

To help the construction of financial arteries along the Belt and Road, a new financing model should be created to support strong investment and financing demand, according to a research note from Bank of China (Hong Kong).

The bank suggested ways of leveraging public-private partnerships, syndicated loans and infrastructure bonds, as well as creating integrated financial services for industrial parks and economic corridors along the Belt and Road.

Christine Lagarde, managing director of the International Monetary Fund, has stressed the power of financial technology in promoting the initiative, such as mobile banking and cross-border payments based on virtual currencies.

In a recent move, an additional 11 Chinese commercial banks joined a payments innovation initiative launched by SWIFT, a global financial messaging service provider, to offer faster, more transparent and traceable cross-border payments.

This brings the number of Chinese banks taking part to 13, joining 110 banks operating across more than 200 countries and regions, including almost all Belt and Road countries.

However, Lagarde also noted significant challenges in financial innovation, including the risk of money laundering and terrorist financing.

"Fintech providers, financial regulators, central bankers, and international organizations will need to work together to ensure that financial systems are safe and inclusive," she said.

- Nepal's former PM calls for projects to be developed under Belt and Road framework

- Belt and Road Initiative offers us infinite possibilities and opportunities

- IBF initiative putting titles on Belt and Road

- Khorgos shows the way to Belt and Road cultural exchanges

- Macao Foundation establishes Belt and Road scholarship