Coming global drive by Chinese big firms

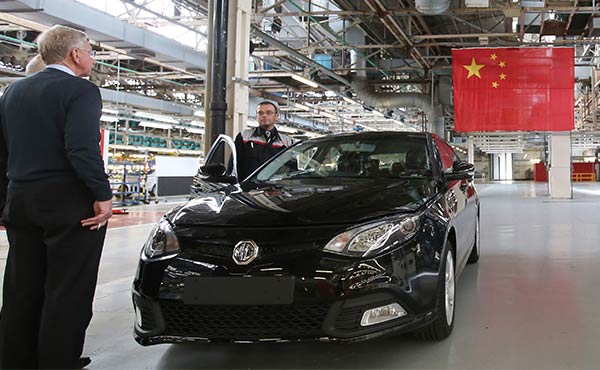

Staff making pre-delivery inspections of an MG car in a manufacturing plant in Birmingham in the United Kingdom. While China accelerates its step in going abroad, the domestic companies' desire for international expansion can create real opportunities for win-win partnerships with Western firms. [Photo / Xinhua]

|

When China's largest automaker, Shanghai Automotive Industries Corp, opened its new US headquarters in suburban Detroit last year, even General Motors Corp - SAIC's joint venture partner in China - was caught off guard.

It seems that no one on the Chinese side had bothered to tell them. And SAIC isn't the only Chinese firm with global ambitions: Chinese outbound direct investment has more than quintupled over the last 10 years.

Although these new Chinese multinationals have tried to tread quietly, many observers in the West have taken notice and are beginning to get worried. Indeed, some even talk of a new economic Cold War, suggesting China's unique brand of State capitalism is poised to decimate the traditional laissez-faire capitalism of the West.

In reality, few Chinese firms are ready to compete with their Western counterparts, at least in developed markets. Many remain contract manufacturers of labor-intense, low-added-value products for Western consumers, while others, such as China's automakers, including SAIC, remain far behind their Western competitors from Detroit, Wolfsburg and Tokyo, lacking not only core power train and other technologies, but also advanced management systems, decision-making routines and, in some cases, even the governance and incentives systems to become world-class competitors any time soon.

If most Chinese firms aren't close to being globally competitive, what in the world are they doing in places such as Detroit? Why do they think they can be successful in far away developed markets without the cutting-edge technology, strong brands and other firm-specific advantages required to overcome their "liability of foreign-ness" instead of simply expanding first into other emerging markets in neighboring Southeast Asia?

The surprising answer is that many Chinese multinationals are investing overseas not to gain access to new markets, but rather to become more competitive at home.

China's economic development strategy of trading off access to its seemingly inexhaustible supply of cheap labor and billions of new customers for vast amounts of FDI and the transfer of Western technology hasn't been consistently successful. It's worked very well for high-speed rail, but not at all in, for example, automotive assembly, because Western firms have been reluctant to share most advanced know-how with their Chinese partners.

Chinese firms have thus increasingly turned to overseas markets to acquire the knowledge they need to survive at home. This behavior goes a long way toward explaining why they have been unusually focused on acquisitions as opposed to organic expansion, especially compared with the Japanese and South Korean firms that preceded them, and why most of their M&A deals have been concentrated in the seven industries where the domestic competition between Chinese and global firms is particularly intense: automobiles, electronics, energy, home appliances, machinery, resources and telecommunications. Other factors favoring acquisitions include the large number of Western targets following the 2008 financial crisis as well as generous financing and other support from the government.

However, although certainly sensible in theory, this strategy too has been unsuccessful in practice, primarily because it requires another set of world-class capabilities that most Chinese firms simply don't possess yet, including turnaround management (the acquired firms are often financially and strategically distressed), integration management and international experience.

Despite these setbacks, Chinese companies' desire for international expansion can create real opportunities for win-win partnerships with Western firms, which often urgently need to capture new growth opportunities in emerging markets but may lack the critical capabilities to do so. The best Chinese firms actually do possess distinctive capabilities that could be quite useful to Western firms in other emerging markets.

Perhaps most obviously, Chinese and foreign firms could jointly develop "good enough" versions of existing world-class products for other emerging markets by removing non-essential features to make them more affordable to emerging-market customers. Alternatively, they could add features to existing low-end products to make them more attractive to mid-market customers, or, of course, design entirely new low-priced products from scratch. Either way, such mid-market products will typically have to be supported by completely different business models and specialized capabilities. Huawei Technologies Co Ltd's recent partnership with Microsoft Corp to sell smartphones in Africa is a good example. Microsoft leverages its Windows 8 operating system and technical expertise, while Huawei contributes its low-cost manufacturing capabilities and extensive experience in African countries.

Once the partners have developed a product for emerging markets, they may discover latent demand for such a product also exists in developed markets. Firms in developed markets may not have introduced such low-cost products before to avoid cannibalizing existing sales of more profitable high-end products or because anticipated volumes may not have been large enough to justify the required investment.

Less obviously, there may also be win-win opportunities for Sino-foreign partnerships in sunrise industries - especially when there are "leapfrog" opportunities in emerging markets to adopt next-generation technologies from developed markets without having to overcome an installed base of users and investments in the old technology. Occasionally, there may even be true breakthrough opportunities to jointly develop entirely new products and technologies in an emerging market, even though the initial sales potential may be higher in developed markets.

Opportunities for Sino-foreign partnerships abound, precisely because the two sides often possess complementary capabilities. Each can achieve its own objectives by addressing the other's challenges and, in the process, develop new competitive advantages for themselves.

The author is a partner at Booz & Co.