|

BIZCHINA> Center

|

|

US treasury bonds 'still the best option'

By Xin Zhiming (China Daily)

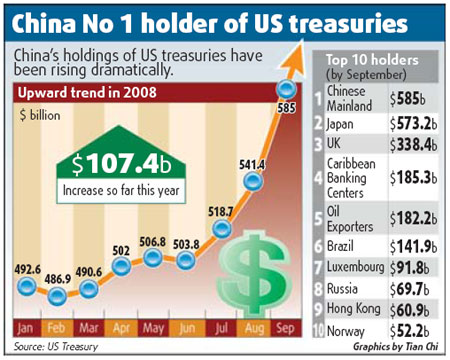

Updated: 2008-11-20 09:46 China is likely to continue increasing holdings of US treasury bonds even after becoming the No 1 holder because it is the best way to deploy its $1.9 trillion foreign exchange reserves, economists say. On Monday, US Treasury data showed that China had replaced Japan to become the top holder of US treasury debt in September.

With a $43.6 billion increase in holdings of US treasury securities in September, China's overall holdings amounted to $585 billion. Japan cut its holdings to $573 billion from $586 billion in August. Net foreign purchases of long-term US securities totaled $66.2 billion in September, up from $21 billion in August and $18.4 billion in July. Treasury data suggests that foreign investors still regard the US as a relatively better place to invest when markets worldwide are crumbling, analysts said. "That's why China has increased its holdings," said Dong Yuping, senior economist at the Institute of Finance and Banking affiliated to the Chinese Academy of Social Sciences. As the US financial crisis worsens, Washington is in dire need of capital to fund its massive market rescue plan; but some domestic economists argue that China should not use its foreign exchange reserves to purchase US bonds for fear that it may incur huge losses.

"But China may not have many options," Dong said. The US economy, though hemorrhaging from the crisis, remains the largest and strongest; and the EU and Japan are not yet a serious challenge to US pre-eminence. Investment in dollar assets, therefore, carries the least risk, he said.

"China and the US are in the same boat," he said. "You may not like it, but China has to move along this path," said Yan Qifa, senior economist with the Export-Import Bank of China. And now that many countries are increasing holdings of US treasury bonds, China's potential returns from the bonds will increase, said Chen Gong, chief economist and chairman of Anbound Group, a Beijing-based consulting firm. "So China may continue to increase its holdings," he said. However, some experts argue that Beijing use its considerable financial leverage to set conditions such as the US opening its financial markets more to Chinese funds, and allowing exports of high-tech products to China. (For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 九九精品在线视频 | 女人张开腿让男人桶免费网站 | 国产va精品网站精品网站精品 | 成人性色生活片全黄 | 亚洲一级特黄特黄的大片 | 国产高清在线精品一区a | 中文字幕久久久 | 一区二区三区在线免费观看视频 | a毛片在线还看免费网站 | 91久久精品国产免费一区 | 成人区精品一区二区毛片不卡 | 亚洲涩涩精品专区 | 国产合集91合集久久日 | 国产一级做a爰片久久毛片 国产一级做a爰片久久毛片99 | 欧美日韩亚洲另类 | 亚洲国产毛片 | 在线播放一区二区三区 | 精品香蕉99久久久久网站 | 韩国本免费一级毛片免费 | 萌白酱粉嫩jk福利在线观看 | 美女视频一区二区三区 | 日韩黄在线观看免费视频 | 九九久久精品国产 | a级在线观看 | 国产精品线在线精品国语 | 久久成人在线 | 成人福利网站在线看视频 | 天天激情站 | 成年网站视频在线观看 | 精品午夜寂寞黄网站在线 | 国产一级片播放 | 亚洲综合爱久久影院 | 成人爽a毛片在线视频 | 亚洲性网 | 亚欧美图片自偷自拍另类 | 高清国产美女一级a毛片录 高清国产亚洲va精品 | 日本色网址| 国产草草影院ccyycom软件 | 久久er热视频在这里精品 | 亚洲成人免费网站 | 日韩精品福利视频一区二区三区 |