|

BIZCHINA> Top Biz News

|

|

Growth rate of forex reserve falls

By Wang Xu (China Daily)

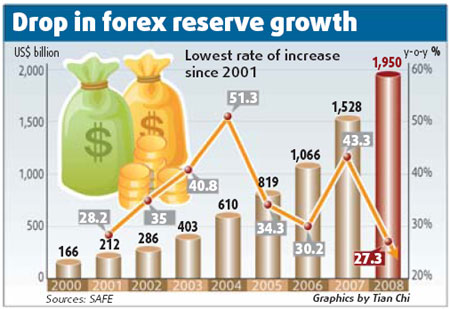

Updated: 2009-01-14 07:32 The country's foreign exchange (forex) reserve increased by $417.8 billion last year, $44.1 billion less than in 2007, the People's Bank of China (PBOC) said on Tuesday. The central bank also said the supply of money and loan growth picked up in December, reflecting the government's effort to boost the economy through proactive fiscal and moderately loose monetary policies. The country's forex reserve increased by less than $45 billion in the fourth quarter to $1.95 trillion by the end of 2008, a PBOC report said. The reserve growth slowed over the months last year. The total reserve was up 27.34 percent over 2007, the lowest rate since 2001.

The fall in the growth rate is the result of a shrinking trade surplus and a possible slowdown in the inflow of "hot money", analysts said. But despite the slowing of the reserve growth for the whole of last year, the monthly reserve for December increased $61.3 billion, up $30 billion year-on-year, the PBOC said. The fourth quarter's reserve, though, dropped compared to the same period in 2007. Guo Tianyong, a Central University of Finance and Economics professor, said expectations that the yuan would weaken and extraction of capital from the domestic market to help stabilize the supply of capital in the West were major factors that caused a year-on-year drop in the fourth quarter reserve. December saw a sharp rise in the reserve as the Central Economic Work Conference vowed early that month to keep the yuan stable - at a reasonable and balanced level - he said. That reversed expectations of a weaker yuan. The government has been worried over "hot money" being brought into the country by businesses and individuals speculating on the continuous rise of the yuan. It fears that it would create asset bubbles and increase the pressure for the yuan's revaluation, making the domestic financial system vulnerable.

The flow of "hot money" into the country, however, began to dry up after some developed countries de-leveraged their financial markets to overcome the global financial crisis, the analysts said. Money supply As the money supply picked up in December, M2, which includes cash and all types of deposits and indicates overall liquidity in the financial system, increased 17.8 percent year-on-year. It had risen 14.8 percent in November. Banks extended 772 billion yuan in new loans in December, compared to 476.9 billion yuan in November. That helped the annual loan growth to accelerate to 18.76 percent in December, up 2.66 percentage points year-on-year. The annual growth of money supply including cash in circulation and demand deposits, or M1, was 9.06 percent in December compared to a 6.8 percent in November. The growth suggests the recent aggressive cuts in banks' reserve requirement ratios have helped improve liquidity, said Jing Ulrich, chairman of China equities at JPMorgan. The PBOC has cut interest rates five times, totaling 2.16 percentage points, since September. It has reduced the amount of deposit that lenders have to set aside to boost liquidity, too. Earlier, policymakers said the government would try to ensure a 17 percent M2 growth this year despite the economic slowdown. The moves, the analysts said, are expected to encourage banks to issue new loans, which are crucial for the government to deliver the $586-billion stimulus package. But some economists fear that increased lending could lead to a spurt in bad loans because returns from infrastructure projects are less predictable than what they were a decade ago. Ten years ago, the government began building a wide network of highways and other infrastructure as part of its fight against the Asian financial crisis. "The boost to the economy is obvious in the short term," said Ha Jiming, an economist with China International Capital Corporation. "But we need to keep an eye on the risk for lenders."

(For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 日本国产在线 | 中文一区在线观看 | 波多野结衣视频在线 | 久久久久久久久网站 | 波多野结衣一级视频 | 久久久婷| 福利国产视频 | 一级爱做片免费观看久久 | 国产第二页 | 国产乱肥老妇精品视频 | 亚洲网站黄色 | 九九久久免费视频 | 91婷婷射| 美国毛片aaa在线播放 | 国产一级内谢a级高清毛片 国产一级片毛片 | 亚洲欧美一区二区三区国产精品 | 成人在免费视频手机观看网站 | 99久女女精品视频在线观看 | 国产麻豆入在线观看 | 国产永久在线观看 | 欧美成本人视频 | 国产日韩精品欧美一区 | 日本手机看片 | 中国美女黄色一级片 | 亚洲第一在线播放 | 国产精品免费综合一区视频 | 久久高清一区二区三区 | 国产日韩精品欧美一区喷 | 亚洲精品手机在线 | 欧美在线 | 欧美 | 国产视频久久久久 | 久久狠狠一本精品综合网 | 国产一区二区三区免费在线视频 | 久久久久国产精品美女毛片 | 国产成人a福利在线观看 | 欧美三级久久 | 久久视频精品36线视频在线观看 | 亚洲精品一区二区观看 | 久久国产欧美日韩精品免费 | 日韩在线一区二区三区视频 | 一个人看的免费高清视频日本 |