|

BIZCHINA> InfoGraphic

|

|

New VC funds mostly in yuan

By Zhang Ran (China Daily)

Updated: 2009-03-09 07:49

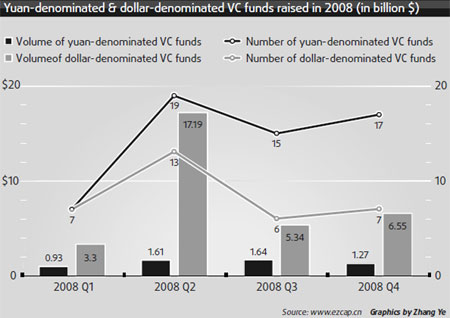

China's venture capital (VC) market had 91 new funds in 2008, a 57 percent increase from 2007, according to a recent report released by EZCapital & HolyZone, a consulting firm.

There were 58 yuan-denominated funds (63 percent) and 33 dollar-denominated funds (37 percent), mostly due to the government's efforts to promote such funds. Yuan-denominated funds accounted for 43 percent of new venture capital funds in 2007. China released new statutes and codes to regulate the mainland venture capital market, giving local funds a healthy development environment and made progress on setting up a trading board for start-up companies, the Growth Enterprises Board (GEB), which will further boost yuan-denominated funds. But most of the yuan-denominated funds were small. Their average value was around 672 million yuan ($96 million), one-ninth the average of the dollar-denominated funds.

The top three yuan-denominated funds were Hony Capital (the investment arm of Legend Holdings), the Overseas Chinese Investment Fund and Tianjin Binhai New Area Venture Capital Guiding Fund. Hony Capital was raised in September and has a value of 5 billion yuan. Tianjin Binhai New Area Venture Capital Guiding Fund, which is operated by the Tianjin municipal government, was raised in March and is worth 4.7 billion yuan. The Overseas Chinese Investment Fund, raised in April, has a value of 5 billion yuan. The financial crisis may have helped the number of new dollar-denominated venture capital funds last year as nervous investors sough safer investment in China. Australia-based CVC Capital Partners Asia-Pacific III L.P (Fund III) raised $4.1 billion to invest in well-running businesses in the Asia-Pacific region last April. Fund III is the region's largest. In August La Salle Investment Management raised $3 billion. CDC Capital Partners raised $2.9 billion in December. (For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 美国一级做a一级视频 | 亚洲国产成人精品激情 | 性欧美巨大| 亚洲综合免费 | fefe66免费毛片你懂的 | 日本妞xxxxxxxxx69 | 韩国v欧美v亚洲v日本v | 一本本久综合久久爱 | 国产欧美一区二区三区在线 | 91原创视频在线观看 | 99久热在线精品视频观看 | 国产成人一区二区三区高清 | 久久亚洲精品无码观看不卡 | 国产手机精品视频 | 亚洲欧美自拍一区 | 中国性猛交xxxxx免费看 | 亚洲乱码国产一区网址 | 久久国产精品女 | 欧美大片毛片aaa免费看 | 女教师的一级毛片 | 亚洲成av人影片在线观看 | 日本韩国欧美在线观看 | 97在线观看免费版 | 欧美一级美片在线观看免费 | 欧美一级久久久久久久大片 | 天海翼精品久久中文字幕 | 日韩免费一级毛片欧美一级日韩片 | 久久精品国产99国产 | 欧美一级毛片高清毛片 | 国产精品视频免费观看调教网 | 国内美女福利视频在线观看网站 | 国内国产真实露脸对白 | 欧美一级aⅴ毛片 | 免费一级欧美大片在线观看 | 成人高清无遮挡免费视频软件 | 国产精品一级香蕉一区 | 欧美日韩精品乱国产 | 欧美经典成人在观看线视频 | 国产成人cao在线 | 久久精品国产99国产精品 | 成年人在线免费观看网站 |