Banking

Bank reserve requirements raised

By Wang Xiaotian (China Daily)

Updated: 2011-02-19 09:11

|

Large Medium Small |

BEIJING - Banks' required reserves were raised by 50 basis points on Friday and further interest rate rises to tackle inflation were not ruled out by Zhou Xiaochuan, governor of the People's Bank of China.

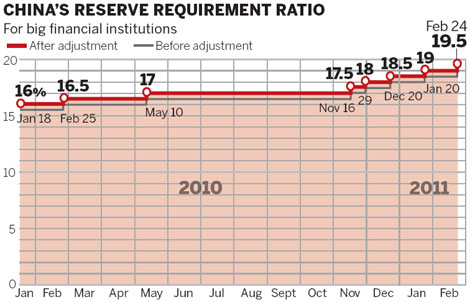

The move by the central bank was the eighth hike since the beginning of 2010 to control inflation in the world's second-largest economy.

The measure will be effective from Feb 24, after which the reserve requirement ratio for big commercial banks will be 19.5 percent. The move is estimated to mop up about 350 billion yuan ($53.2 billion) from the market.

Zhou said raising the reserve requirement is just one weapon in the fight against inflation.

"We can't really say that it's the only method that we'll use to battle inflation, it's about using all means including rates and currency," he was quoted by Bloomberg as saying.

"One method doesn't exclude the other," said Zhou, who was attending a gathering of G20 finance ministers and central bankers, following the announcement.

Lu Zhengwei, chief economist at the Industrial Bank, said the move is within expectations because of the robust growth of new yuan lending in January, which was 1.04 trillion yuan compared with 480.7 billion yuan in December.

"The strong momentum of credit expansion demonstrated that economic growth remains solid. Considering rising inflation, the government has to continue the tightening to confine liquidity to a reasonable level," he said.

China's consumer inflation picked up to 4.9 percent in January from 4.6 percent in December. It hit 5.1 percent in November, a 28-month high. The recent drought in some major grain-producing areas, together with international grain price hikes, has led to increasing worries about rising inflation.

"The latest move made it clear that the central bank won't hesitate to combat inflation. As the Spring Festival holiday fades out, the market can afford to have less liquidity," said Li Mingliang, analyst at Haitong Securities.

Asset bubbles are also a major concern for policymakers. New home prices rose in January from a year earlier in 68 out of the 70 cities monitored.

To soak up excessive liquidity to help curb increasing inflation and asset bubbles, the central bank raised interest rates in February for the third time since mid-October.

Guo Tianyong, an economist at the Central University of Finance and Economics, said the reserve requirement hike is also connected with rising liquidity caused by the trade surplus.

China's trade surplus fell by 53.5 percent to $6.46 billion in January, according to the General Administration of Customs. Exports rose 37.7 percent to $150.73 billion from a year earlier while imports climbed 51 percent to $144.27 billion.

The Industrial Bank's Lu predicted another reserve requirement hike in March, with the figure for required reserves for big lenders reaching close to 23 percent sometime during this year.

Further policy tightening is on the cards, a senior economist said.

| ||||

He predicted consumer inflation could hover at around 5 percent between February and May, and then surge in June to 5.8 percent before falling gradually toward 4 percent at the end of the year.

In global markets, prices of copper, crude and the currencies of commodity exporters such as Australia, which are sensitive to Chinese demand, all weakened. European stocks and US index futures fell.

China's stocks fell on Friday on concerns that the government may tighten monetary policy again. The benchmark Shanghai Composite Index dropped by 0.93 percent to close at 2,899.79.

| 分享按鈕 |