Eurozone downgrades 'won't deter' investment

Updated: 2012-02-15 09:31

By Wei Tian (China Daily)

|

|||||||||||

|

|

|

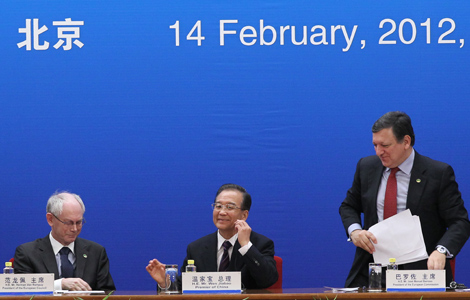

Premier Wen Jiabao, President of the European Council Herman Van Rompuy (left) and President of the European Commission Jose Manuel Barroso attend the China-EU Summit at the Great Hall of the People in Beijing on Tuesday. Experts say the problems in the eurozone have provided China with an opportunity to lend a helping hand. [Photo / China Daily] |

Crisis seen as opportunity to take part in global financial restructuring

BEIJING - Though another wide-ranging ratings downgrade for eurozone countries is further dampening investor confidence, it also offers opportunities for China to participate in Europe's rescue plan, economists said.

Moody's Investor's Service on Monday cut its ratings on six European nations including Italy, Spain and Portugal. It also warned another three - Austria, France and the United Kingdom - that their top ratings could be at risk, citing the weakening prospects for an overhaul in Europe.

The downgrade was the latest such move by a major global ratings agency. Standard & Poor's and Fitch Ratings each cut ratings for the eurozone last month.

Analysts said the move wouldn't affect China's possible investment in Europe, because sovereign credit ratings are a guideline for commercial investors but have little reference value for actions by a country.

"The problems in the eurozone have helped sustain China's determination to lend a helping hand, because the nation sees them as an opportunity to take part in the reconstruction of global financial institutions," said Yuan Gangming, an economist with the Chinese Academy of Social Sciences, a top government think tank.

Yuan said China should take the opportunity to secure a larger position and more influence if it invests in the European Financial Stability Facility.

Premier Wen Jiabao said last month that China was willing to "involve itself more" in efforts to resolve Europe's debt crisis, but he also called on the Europeans to create an "objective and positive environment" and provide China with "proper investment products".

Yuan said that 40 billion euros ($52.8 billion) to 50 billion euros would be an appropriate amount for China to invest in the EFSF initially, and more capital would follow after China's move stabilized market confidence.

"There might still be disputes within the EFSF, such as between Germany and France, on whether to accept China's offer, but China is now in a better position in the negotiations as the downgrades have further reduced Europe's financing ability," he said.

In an online explanatory report, Moody's said the uncertainty over institutional reform in the eurozone's fiscal and economic framework and the inadequate resources available to deal with the crisis were weakening macroeconomic prospects.

The US-based agency said these factors would continue to affect market confidence, which was likely to remain fragile, with a high potential for further shocks to funding conditions for stressed sovereign nations and banks.

Lian Ping, chief economist with Bank of Communications Ltd, said there might be two ways in which Europe's problems could have a direct impact on China.

The first negative impact was market volatility, which would spread to China, resulting in more capital outflows and adding to pressure on the domestic stock and bond markets.

Secondly, Lian said, exports would be influenced by the downturn in Europe, China's largest trade partner.

But these challenges would also bring opportunities. Ding Chun, director of the Center of European Studies at Fudan University, said that longer-term weakness in the euro could contribute to the process of yuan internationalization.

Ba Shusong, an economist with the Development Research Center of the State Council, said the large debt repayments due in Europe this year would provide an opportunity for Chinese enterprises.

Ba said that Chinese companies would be in a stronger position in negotiations with their European counterparts, which are struggling with financing difficulties.

Related Stories

Downgrades add to euro woes 2012-01-18 08:02

Euro expected to drop more 2012-01-20 07:28

Merkel urges support for euro 2012-02-03 08:08

Euro crisis: risk and opportunity 2012-01-09 07:59

Fiscal measures to 'save euro from collapse' 2011-12-11 08:55

- Beijing lends a hand to debt-ridden Europe

- New data system to prevent manipulation

- Freezing weather heats up demand for down products

- Stats go straight to national database

- Biological industry development plan got

- Factory caught using child labor

- VC, PE firms show appetite for food industry

- China's economy to see soft landing