|

|

|

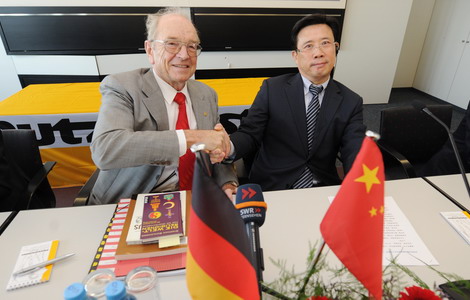

Liang Wengen, chairman of Sany Heavy Industry, greets Karl Schlecht, founder of Putzmeister, one of Germany's leading industrial enterprises, before their joint news conference in Aichtal, Germany, last week. [Photo / China Daily] |

As Chinese enterprises seek to build their global profile, Germany offers a target for those seeking a toehold in Europe, despite a troubled outlook for the debt-burdened region.

"Chinese investors have broad prospects in the German market, although they are still at a fledging stage and (the Ministry of Commerce) encourages competitive companies to invest in the country, actively developing mutually beneficial investment cooperation between China and Europe," Sun Yongfu, head of the ministry's department of European affairs, told China Daily.

Chinese companies have cumulatively invested $2 billion in the German market, representing only 10 percent of German companies' investment in China. But there is huge potential.

Germany Trade & Invest, the country's foreign trade and inward investment agency, has said that China leapfrogged the United States and became Germany's largest overseas investor in 2011.

Sun said Chinese companies' rising investment in Germany will help boost the country's economy and jobs.

Influenced by the eurozone's debt crisis, Germany's economy is predicted to expand less than 1 percent this year.

"Given the current global economic situation, Chinese companies have good opportunities to invest in Germany ... and mergers and acquisitions can be good avenues for investment," said He Weiwen, co-director of the China-US-EU Study Center at the China Association of International Trade.

European companies are probably undervalued due to the debt crisis, and it's a good time for Chinese companies to tap into the European market through M&A deals, according to He.

The debt crisis has opened a door. The market value of the eurozone's 50 biggest companies fell 17 percent in 2011, though it has recovered about 8 percent this year, Reuters reported.

China's M&A investment in Europe accounts for 34 percent of its total overseas direct investment.

Chinese companies have been exploring investment opportunities in Germany, Europe's largest economy and home to many companies famed for technological know-how and mature brands, which are especially attractive for Chinese companies.

One example of such a deal is that involving China's largest construction equipment manufacturer, Sany Heavy Industry, which announced the acquisition of Germany's leading concrete machinery enterprise Putzmeister in January.

The deal will give Sany Heavy control of Putzmeister's worldwide sales network and the German company's production label.

Officials at Germany Trade & Invest told Chinese media that many Chinese enterprises are seeking opportunities to develop their own brands and technology by investing in Germany, instead of solely acting as raw materials suppliers.

According to He, China's investment should focus on advanced technology and renewable resources.

The EU is China's most important source of technology and top trading partner.

Germany is China's most important trading partner in the European bloc.

To transform its economy, China needs to increase imports of equipment, key spare parts and better-quality consumer goods from Germany, combining Germany's industrial advantage and China's market demand, Sun said.

In 2011, bilateral trade reached $169.2 billion, up 18.9 percent from a year earlier, accounting for 30 percent of the nation's total trade with the EU.

"Sino-German trade will post moderate growth this year and China is confident about the development of bilateral trade," Sun said.

When visiting China in February, Germany Chancellor Angela Merkel said China is likely to become Germany's biggest trading partner. At present, China is Germany's third-largest trading partner, following France and Poland.

Experts say capital inflows stemming from China's rising trade and investment in the Europe may help Europe with its debt crisis.

Premier Wen Jiabao vowed in February to start negotiation on a China-EU investment agreement that could facilitate M&As by Chinese companies in Europe while helping investors from Europe, gain a greater market share in China.

Wen is on a tour of four European countries - Iceland, Germany, Sweden and Poland - and will attend a series of economic and industrial forums.

baochang@chinadaily.com.cn