Chinese commercial banks are expected to see an increase in non-performing loans this year amid the rising possibility of borrowers being unable to repay their loans.

With the economic slowdown, many companies have a lower cash flow and suffered a drop in net profits, which may lead them to violate loan covenants.

"The quality of banking assets is expected to decline at least until the fourth quarter, especially for small and medium-sized banks," said Mao Junhua, an analyst from China International Capital Corp Ltd.

At the same time, major banks' non-performing loans account for a high proportion of overdue loans, he added.

If China's economic growth slows rapidly this year, non-performing loans may rise by two to three percentage points, the International Finance newspaper quoted Liao Qiang from Standard & Poor's Financial Services LLC as saying.

Chinese lenders' bad loans continued to grow in the first quarter, and the number of the listed banks with increasing non-performing loans is growing.

In the first quarter of this year, listed joint-stock banks' non-performing loans rose 7.2 percent and those for city commercial banks increased 1.3 percent.

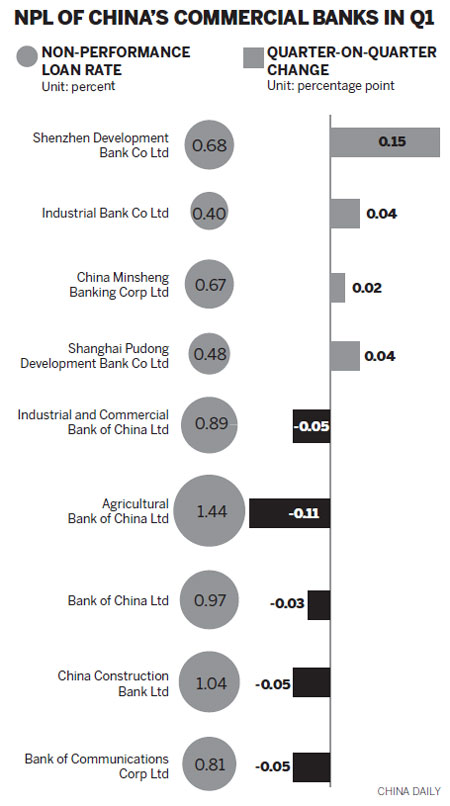

Shenzhen Development Bank, Industrial Bank Co Ltd, China Minsheng Banking Corp Ltd and Shanghai Pudong Development Bank all saw increases in their non-performing loan balances and non-performing loan rates in the first quarter.

Among them, Shenzhen Development Bank ranked first with a non-performing loan rate of 0.68 percent, up 0.15 percentage point in the first quarter. The bank had 4.4 billion yuan ($700 million) in bad loans by the end of the first quarter, an increase of 1.15 billion yuan quarter-on-quarter.

The bank's earnings report said small and medium-sized enterprises in Jiangsu and Zhejiang provinces exported less and were short of capital, influenced by the sluggish global economy and the private lending crisis in Wenzhou, Zhejiang province. Their operating costs also rose rapidly.

The new bad loans were mainly concentrated among small and medium-sized enterprises in Wenzhou, the Oriental Morning Post quoted an unnamed official at Shenzhen Development Bank as saying.

Although the non-performing loan balance and rate grew in the first quarter, overall risks still remain under control, said the bank's earnings report.

China Minsheng's non-performing loan balance was the highest, at 8.4 billion yuan, up 850 million yuan quarter-on-quarter.

The banks' first-quarter earnings reports show that Chinese commercial lenders have entered a downward cycle.

Small and medium-sized banks will be first to bear the brunt. Their profits are expected to fall noticeably in the coming quarters, experts said.

mengfanbin@chinadaily.com.cn