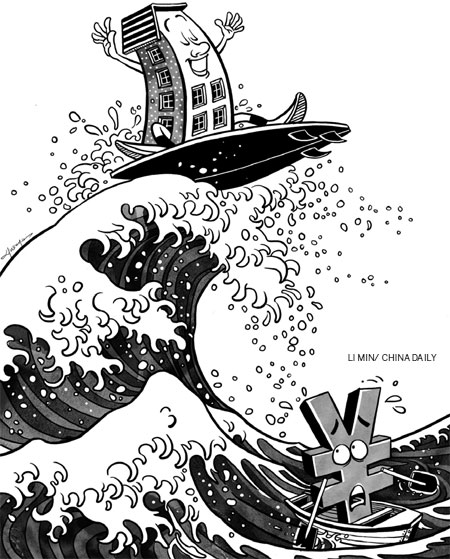

China's frozen property market is showing signs of a thaw. Sales took off in the second half of June and prices are rising for the first time in months.

Real estate developers will no doubt be heaving sighs of relief. The weakness of sales over the last two years has left them with large quantities of unsold property. If sales continue on their upward trend, developers will finally be able to start selling this unwanted inventory.

But the warming market will be eliciting sighs of anxiety among prospective homebuyers. Before, they were wondering how much further prices might fall. Many are starting to wonder whether they should buy now, before prices rise too far. Rising prices can have a momentum of their own. In turn, a sustained pickup in purchases could lead to a new round of construction activity as developers start to anticipate stronger demand a year or two ahead.

A revival of sales and construction activity will be welcomed by some of those concerned about the health of China's economy. The view that China is on the brink of a "hard landing" tends to be rooted in pessimism about property. It is certainly true that weaker investment in housing contributed to China's economic slowdown last year.

And if the property market continues to pick up, local officials can start to count on a revival in land sales, which until recently brought in one-third of local government revenues. Inside China and elsewhere, producers of commodities, household appliances and furniture will also breathe a little easier knowing that demand is likely to increase.

Yet despite the undoubted benefits it could bring, a rebound in property investment would probably end up doing more harm than good. For a start, China already has plenty of property to meet current demand, even taking into account recent stronger sales. It will take months to clear the backlog of completed but unsold property already on developers' books. On top of that there are countless nearly finished housing projects around the country that were put on hold until the outlook brightened. The risk of oversupply will continue to hang over the market and could worsen if developers hastily launch new projects.

It should also be remembered that the original property slowdown was deliberately induced by the government two years ago in an attempt to rid the economy of some dangerous distortions. Unfortunately, those distortions remain.

Admittedly, property has become more affordable in the last two years. Price rises slowed, then stalled, while average incomes have continued to rise. But, contrary to popular opinion, high prices were never the primary concern. The major problem was that investment in the sector was growing at an unsustainable rate due in part to speculative demand.

Indeed, the share of total spending in China's economy accounted for by residential real estate investment doubled in the last decade, reaching levels rarely seen elsewhere in the world. Some of the increase was justified by China's rapid growth and the deterioration of its housing stock. But there is clear evidence in the empty apartment blocks dotting China's cities that residential demand did not explain all of the building frenzy. Rich individuals were buying multiple properties as a place to store their wealth rather than somewhere to live. One recent survey suggested that nearly one-third of residential property in Beijing lies empty.

The necessary correction to return the property sector to long-term health has not yet begun. A first step would be for real estate investment to slow so that it grew no faster than the wider economy. Last year though, residential property investment rose further as a share of GDP. Hopes that it might stabilize or drop this year would be dashed if investment were now to rebound.

That explains why the government is so keen to stress that its property market controls remain in place despite the fact that the sector has become a drag on the wider economy. Holding that line will require some nerve, particularly if other key parts of the economy, such as export-focused manufacturing continue to struggle.

The challenge for the government is to put aside short-term concerns about growth and focus on taking the steps needed to guarantee the medium-term health of the economy.

The author is chief Asia economist at Capital Economics, an independent, global macro-economic consultancy.?