Negative figures paint gloomy prediction for China's economy

China's rapidly slowing consumer inflation and falling industrial output prices are a potent reminder to economists of the potential risk of deflation, a sign of recession regarded as worryingly negative.

"Deflation" means a constructive decrease in the price of goods and services over a relatively long term.

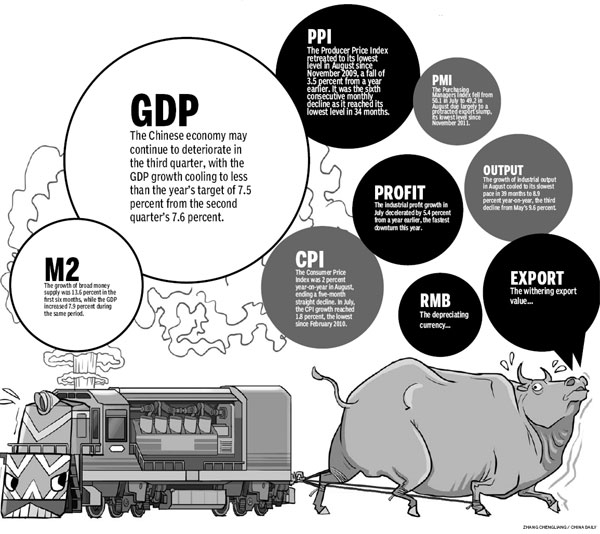

Concerns about it started in June when the Consumer Price Index dropped to less than 3 percent for the first time in more than three years.

The annual CPI, a main gauge of inflation, bounced back to 2 percent in August, ending a five-month straight decline, according to the National Bureau of Statistics.

In July, the year-on-year CPI growth reached 1.8 percent, the lowest since February 2010, compared with 2.2 percent in June. That was the first time the figure fell to less than 2 percent in 30 months.

|

Average output of China's crude steel stood at 2 million tons a day, with the industry being plagued by excessive production compared with the shrinking market demand. The National Bureau of Statistics reported a lower-than-50 manufacturing Purchasing Managers Index in August. It fell from 50.1 in July to 49.2, its lowest level since November 2011. Anything below 50 indicates contraction. [Photo/China Daily] |

"The Chinese economy is now facing a situation of disinflation, a slow-down in the inflation rate, but not deflation - when the inflation rate falls to less than zero," said Sun Lijian, deputy chief of the Economic School at Fudan University in Shanghai.

It is likely inflation may bounce back soon in the coming months because growth in money supply is high while the development of the economy is slowing, a situation that can lead to excess liquidity, said Sun.

In the first six months of this year, the growth of broad money supply, which is known as M2, was 13.6 percent, while the gross domestic product increased by about 7.9 percent during the same period, data from the National Bureau of Statistics showed.

Sheng Laiyun, an NBS spokesman, said it was impossible for China to face deflationary risks because the economy is developing at a "healthy" rate.

Some economists said that although consumer prices are still increasing, industrial sectors have already been exposed to dangerous deflationary pressures.

The Producer Price Index, an indicator of production output prices, retreated to its lowest level in August since November 2009, a fall of 3.5 percent from a year earlier. It was the sixth consecutive monthly decline as it reached its lowest level in 34 months.

When PPI declined 2.9 percent year-on-year in July, it was a warning that manufacturing companies' income had dropped rapidly, a development that might hold back additional investment in industrial sectors and further drag down the whole economy.

|

|

The NBS also reported the growth of industrial output in August, which cooled to its slowest pace in 39 months to 8.9 percent year-on-year, the third decline from May's 9.6 percent, after 9.5 percent in June and 9.2 percent in July.

The faster-than-predicted drop in output prices directly influenced the industrial companies' profitability. In the first seven months of this year total profits of big industrial enterprises declined by 2.7 percent from the same period in 2011 to 2.68 trillion yuan.

Monthly industrial profit growth in July decelerated by 5.4 percent from a year earlier, the fastest downturn this year. Among the 41 industrial sectors, 15 of them have seen profits drop while one sector suffered losses.

The falling production prices and shrinking profits are in line with flagging industrial output, which slowed to 9.2 percent in July, its weakest growth for 38 months, according to data from the national statistics agency.

Market confidence was consequently hit and many global investment institutions downgraded their expectations of industrial growth in the third quarter.

Although it is difficult to say for sure that the world's second largest economy has entered a deflationary era, the PPI is certainly foundering in deflationary territory, said Shen Jianguang, a Hong Kong-based economist at Mizuho Securities Asia Ltd.

Industrial manufacturers may suffer from difficulties across the entire year, with forecasts that both output and profit indicators are likely to be worse in the autumn, according to Yuan Lei, director of the industrial operation department with the Institute of Industrial Economics at China Academy of Social Sciences.

"Fundamental problems in the Chinese economy are starting to show and the downside risk is very hard to control," Yuan said pessimistically.

Uncertainty over overseas demand, retreating governmental supportive policies and tightening property control have all pushed the industrial companies into a chilling environment. However, deeper problems, such as the increase in labor costs and the slumping competitiveness of Chinese business, should be given more attention, Yuan said.

The NBS reported a lower-than-50 manufacturing Purchasing Managers Index in August. It fell from 50.1 in July to 49.2 due largely to a protracted export slump, its lowest level since November 2011.

The decline fueled worries about deflation in the industrial sector that troubled the economy from 1997 to 2003.