Deals signed for yuan loans

|

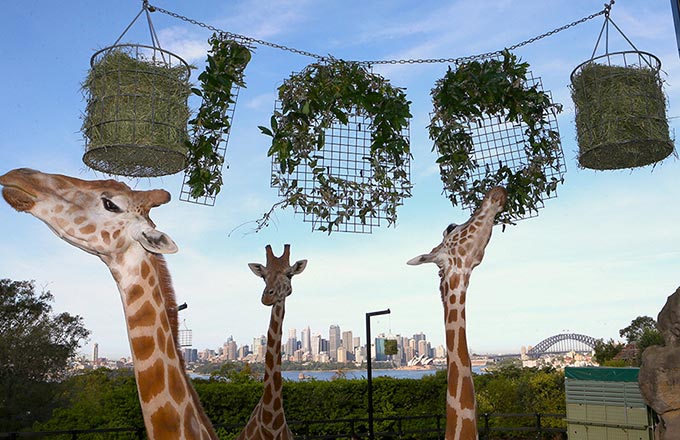

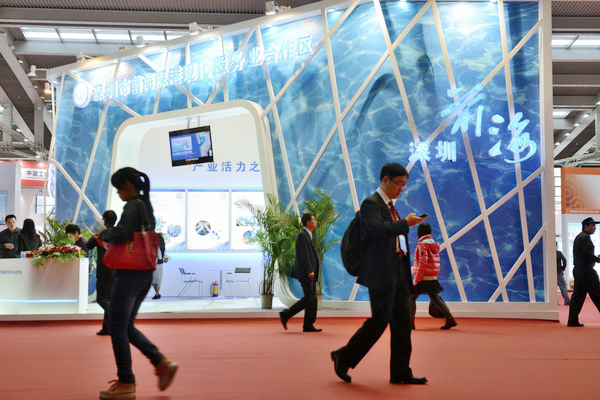

A stand for the Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone at an international financial expo in Beijing. Fifteen lenders, including HSBC Holdings Plc, signed agreements on Monday to extend 2 billion yuan ($321 million) of cross-border yuan loans to companies in the Qianhai district of Shenzhen. [Photo / China Daily]

|

Lenders provide 2 billion yuan in cross-border funding to Qianhai area

The first batch of cross-border yuan loans agreements were signed on Monday after the central government approved the Qianhai area in Shenzhen to test a freer yuan before it becomes a global reserve currency.

A total of 15 lenders, including HSBC Holdings Plc and Industrial & Commercial Bank of China (Asia) Ltd, signed agreements to extend about 2 billion yuan ($321 million) of cross-border loans to companies in the Qianhai district of Shenzhen.

Qianhai is a $45 billion "mini-Hong Kong" project approved in June to test, among other things, freer yuan use and capital account convertibility. One of the preferable policies in Qianhai is for companies to borrow from banks in Hong Kong, with terms and interest rates to be set independently.

The signing on Monday marks the first time that yuan loans will not be extended according to benchmark lending rates set by the central bank. Interest of the loans will be set freely by borrowers and lenders, but the loans must fund projects from government-approved industries.

Dariusz Kowalczyk, a senior economist and strategist at Credit Agricole CIB, wrote in a research note: "We see this as a major development in testing interest rate liberalization, which will subsequently be allowed in the whole mainland."

Interest rate liberalization has been on the forefront of China's financial reform in recent years, as many economists believe that a government-managed interest-rate system stalls growth by misallocating financial resources. In a show of the government's determination to reform the system, the central bank last year for the first time allowed lenders to float their rates around the benchmark.

"The 2 billion (yuan) amount is not so big. But what is big is that the government for the first time is taking a hand-off approach and allowing lenders and borrowers to make their deals," said Wang Jianhui, chief economist with Southwest Securities Co Ltd.

|

|

The one-year lending rate is around 6 percent at the onshore market and 4 percent in Hong Kong, giving Hong Kong lenders an edge over their mainland counterparts. But Wang shrugged off worries that opening a channel would reduce the pool of yuan deposits in Hong Kong.

"The move is only a test and under government control. I don't see the scenario where yuan deposits in Hong Kong shrink very fast in a short time," he said

Latest data from the Hong Kong Monetary Authority show that yuan deposits in Hong Kong has reached 603 billion yuan at the end of 2012.

As the loans come from Hong Kong, the move is a test of further capital accounts opening by allowing offshore funds to be transferred to the mainland.

Previously, offshore yuan could flow back to the mainland only through yuan-denominated trade and renminbi qualified foreign institutional investors.

"Cross-border yuan loans are an important step in Qianhai's exploration of the offshore yuan's flow-back mechanism and marks a milestone in the 'go-out' of the currency," said Lin Qingde, CEO & executive vice-chairman of Standard Chartered Bank (China) Ltd in a statement.

He added that the yuan is marching gradually and steadily toward becoming a global currency, and he expects more breakthroughs on that front this year.

Oliver Chiu, head of research and investment advisory in the wealth management unit of Citibank (China), said that more backflow channels of offshore yuan will increase deposit rates for yuan and the willingness among individuals and companies to hold the currency.

"Once a stable backflow mechanism is formed, the central bank won't need to reply on purchasing foreign exchanges to guarantee money supply into the market," he said.

Contact the writers at gaochangxin@chinadaily.com.cn and wangxiaotian@chinadaily.com.cn

Previous reports

Standard Chartered Bank signs reminbi lending deal with Qianhai

HK-Shenzhen finanical zone 'permissible'

Tight yuan liquidity may cap new loan biz

Rule OKs loans from Hong Kong to Qianhai

- China to pursue RMB internationalization

- Citibank completes cross-border lending deal in yuan

- State Council approves policies for Qianhai

- HK to expand offshore RMB business

- Chinese companies' cross-border M&A rising

- Property investors rush to cash in on 'mini-HK'

- Qianhai poised to be hub of cooperation