Firms urged to buy abroad

|

|

|

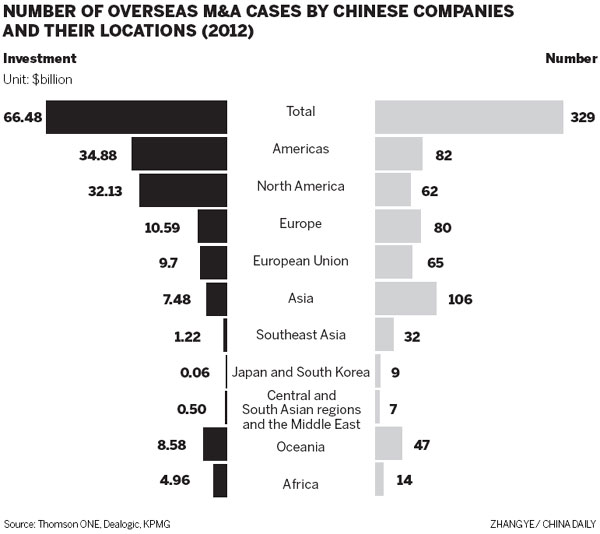

In 2012, there were 40 M&A deals valued at $11.1 billion involving Chinese companies in the United States, which, after Canada, is the second-largest destination for China's M&A capital, according to data from KPMG's Global China Practice. [Photo/China Daily] |

United States is major target for mergers and acquisitions

The United States is expected to be the No 1 destination for Chinese companies seeking mergers and acquisitions in 2013, industry experts from international accounting firm KPMG said.

"Because of the strong capability in high-end manufacturing, competitive energy prices in the US, the strong support from local governments and the huge potential of the consumer market, the US is quite attractive for Chinese investors," said Peng Yali, director of research with KPMG's Global China Practice.

In 2012, there were 40 M&A deals valued at $11.1 billion involving Chinese companies in the US, which, after Canada, is the second-largest destination for China's M&A capital, according to data from the company.

"We've met a number of US local government officials who are eager to bring Chinese investors to get involved in the construction of local infrastructure. Chinese entrepreneurs should take the opportunity to strengthen their investment in the infrastructure and real estate sectors, especially in developed economies," Peng added.

A number of Chinese property developers have already made some investments in the US this year.

China Vanke Co, the country's largest real estate developer by market value, for instance, has teamed up with US real estate firm Tishman Speyer Properties to jointly develop a plot of land in San Francisco.

Wang Shi, Vanke's chairman, said Vanke signed an agreement last month to invest in its first project in the US. It set up a special team last year to research business development in the US.

The move marked the developer's first venture into the US market and demonstrated its commitment to explore the international market.

Wanda Group, the country's largest commercial property developer, has revealed it plans to invest $10 billion in the US over the next decade, particularly in hotels, retail and commercial property.

The company last year took over AMC Entertainment for $2.6 billion to become the world's largest cinema chain.

According to Peng, there are many M&A opportunities in the country's high-end manufacturing and new-energy sectors.

"However, in the traditional natural resources field such as petroleum, Chinese companies may face more pressure in taking over local firms," said Peter Fung, global chairman of KPMG's Global China Practice.

Chinese investors will be quite active in looking for M&A opportunities in the resources, services, high-tech manufacturing and new-energy industries, KPMG's research showed.

Also, more Chinese companies will prefer cooperation in overseas M&A, such as the cooperation between State-owned enterprises and private firms, or involving other investors in third-party countries, it added.

Overall, in 2012, 329 China outbound M&A deals were completed and the value of 253 deals was revealed. The total value of these deals reached around $66.5 billion, an increase of 244 percent on a year earlier, KPMG statistics showed.

Because of the high value of some big deals completed in 2012, it was a harvest year for China's outbound M&A both in volume and in value, Fung said.

Meanwhile, private enterprise showed great potential in China outbound M&A deals. From the viewpoint of volume, the annual growth of private M&A deals overseas increased from 43 percent in 2009 to nearly 69 percent in 2012.

There is a great desire to use overseas M&A as a strategy for private enterprises to go global, to build international brands and to bring technology and know-how for use in the domestic market.

Although private enterprises take an active role in outbound M&As, quite a number of them are pretty low profile, Fung added.

"Because some governments are quite sensitive to Chinese State-owned enterprises' acquisitions in the resources sector, private enterprises may have a bigger chance in that field," said Fung.

But given the value of the M&A, State-owned enterprises will still dominate the market, he added.

On the inbound sector, there were 548 'announced' or 'completed' inbound M&As, totaling slightly more than $40 billion. This compares unfavourably with 2011, which saw more than 800 transactions totaling approximately $ 58 billion. The transaction size and number of transactions showed a more than 30 percent decline year-on-year.

huyuanyuan@chinadaily.com.cn