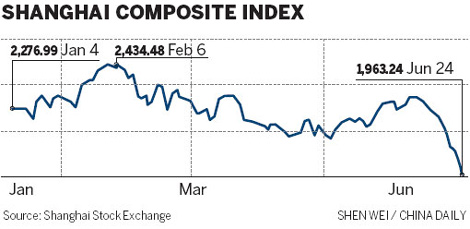

Equities sink 5.3% to fresh 2013 low

|

|

Chinese stocks sank more than 5 percent on Monday to a fresh 2013 low as investors concluded the government would not take any steps to boost the market.

The central bank issued a statement in the day, saying that the credit market is not facing an imminent crisis and banks should improve their liquidity management.

The statement from the People's Bank of China was taken by many analysts as a clear signal that the government had no plans to intervene in the market. Analysts said some investors took the statement as a sign to cut their losses, while others simply stayed on the sidelines.

The benchmark Shanghai Composite Index fell 5.3 percent, the biggest single-day slump in four years, to 1,963.24 points. Turnover contracted sharply to 88 billion yuan ($14.36 billion) from 334.7 billion yuan on the previous trading day.

Bank shares led the slump, with major losses among property, brokerage, nonferrous metal and aviation stocks as well.

Hong Kong's benchmark Hang Seng Index declined 2.22 percent to 19,813.98.

The Hang Seng Finance Index, a gauge of mainland banks listed in Hong Kong, turned in a fifth day of losses, retreating 2.3 percent. Industrial and Commercial Bank of China Ltd sank 3.03 percent to HK$4.48 (58 US cents). Bank of China Ltd fell 2.6 percent to HK$2.99.

"That is a collapse. The market was expecting the central bank to inject liquidity, but the hopes were chilled. It seems the authorities are determined to maintain a prudent stance to reduce leveraged operations in the financial market," said Jason Yue, senior analyst with an investment company in Shanghai.

Interbank interest rates have been setting record highs since mid-June. Rumors were spreading about major banks defaulting amid funds shortages and urging the central bank to cut the reserve requirement ratios.

Money market jitters soon spread to the stock market, where panicked investors began to cash out.

The central bank issued a statement on its second-quarter monetary policy committee meeting on Sunday evening, saying that the committee had agreed to "fine-tune policy when necessary".

- Stock market to lift ban on shares worth $5b

- Restoring faith in the stock market essential to economy

- Is the Chinese stock market oversold?

- Investors confident of stronger stock market performance

- Investors expect a bullish stock market this year

- Stock market an economic barometer

- Stock market needs to grow up