Clarity key to local govt debt

There is a popular saying among advertisers that "we know half of what we spent was wasted - unfortunately, we just don't know which half".

The same now can be applied to China's local government debts.

"We know maybe half of their debts have repayment problems, we just don't know which half."

This is why China's National Audit Office's latest campaign to investigate all government debts is a welcome move.

Since the end of 2010, when the National Audit Office conducted a nationwide audit and concluded that local government debts stood at 10.7 trillion yuan ($1.75 trillion), there has been no official nationwide survey.

Although the consensus is China's local government debt experienced another round of rapid expansion in 2012, when the central government allowed another stimulus program in face of economic slowdown, how much the debt exactly is, and how much will mature over the next year has became a wild guessing game among experts, foreign investment banks, credit rating agencies, investors and even the government itself.

Vice-Finance Minister Zhu Guangyao admitted earlier this month that the government did not know precisely how much debt local governments had built up.

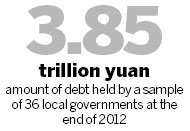

The lack of clarity is down to the absence of thorough investigation since 2010. Although the audit office in June put total debt of a sample of 36 local governments at 3.85 trillion yuan ($628 billion) at the end of 2012, the whole picture cannot be seen.

The lack of clarity is also because of the nature of the local government debts. Because most Chinese local governments are not allowed to issue bonds directly according to the budget law, they have borrowed heavily through the so-called "local governments financing vehicles". At first glance, these LGFVs, titled "investment and development corporation of X city" or "asset operation and management corporations of X city", look like independent companies and the bonds they issue are counted as corporate debts. But their operation is under the direct disposal of local governments and their debts are implicitly guaranteed by local governments. Because no law required disclosure of these companies' liabilities, the size of the debt is largely vague. They have been described by the Chinese media as "black holes".

Chinese banks do not know the size of these debts exactly either, although they are the ultimate lender to these corporations. This is because they actually do not have to conduct professional credit ratings for these bonds. The implicit government endorsement behind LGFVs made them adorable apples of the eyes of banks. Banks know that even if LGFVs default, the government will repay, either by public finance stock or sale of land.

Banks also do not know the exact borrowing cost of LGFVs because they do not directly offer loans to them, instead using trusts firms or other agents. Channeled through these agents, local government borrowing rates were raised. But local governments still prefer these channels because the rate is lower than that of a bank loan.

The LGFV bonds were so popular that trust firms chased behind local governments to buy them. Tang Jianwei, an economist with Bank of Communications, said the amount of total social financing was boosted in the first half of this year primarily because of LGFVs and property companies. The two industries, largely barred by regulators from taking out bank loans, managed to borrow from the shadow banking system and are estimated to contribute to about 70 percent of the total social financing in the first half.

This has made them "the sword of Damocles" hanging over China's banking industry. According to Liu Dongmin, a researcher with the Institute of World Economic and Politics under the Chinese Academy of Social Sciences, bonds issued by LGFVs accounted for 84 percent of China's corporate bonds in 2011.

But Liu also said the possibility of massive default is very low, because many of the projects in which local governments invested have decent returns. Even if revenue from the project itself could not repay the debts, local governments could use their fiscal revenue to repay them.

The problem is, how can we get to know exactly how large a proportion of China's projects have a decent return and are financially sustainable? Guan Qingyou, assistant dean of the Minsheng Securities Research Institute, said so long as the projects have good cash flows, repayment is not an issue. But the problem is we have no clarity regarding these projects. This has made China vulnerable to foreign institutions' accusations that the local government debt problem is a "time bomb" in China's financial system, because there is no solid data to deny it.

This is why transparency is so important to the issue. Government inertia is in danger of causing foreign institutions' collectively to be pessimistic. Investors, home and abroad, are eager for the findings of the National Audit Office, even the result may be worse than people have imagined.

Talking about debt is hardly a sexy topic. Think about information technology, 3D printing, cloud computing - just about anything is more exciting than debt. But if new technologies represent the future, debt is the past. We can never arrive in the future unless we figure out what the past is.

- No crisis over local governments' debts

- Audit targets local government debt

- For local government debts, transparency seen as a necessity

- Boost local government debt management: Minister

- MOF focuses on local government debt

- Tackling local government debt

- China never underestimates local government debt: NAO

- China's local government debts exceed 10t yuan