Meticulous as it is, the first step the US Federal Reserve has taken to end its addiction to cheap money could still spell more trouble for the fragile global recovery than the euphoric initial response might suggest.

|

|

|

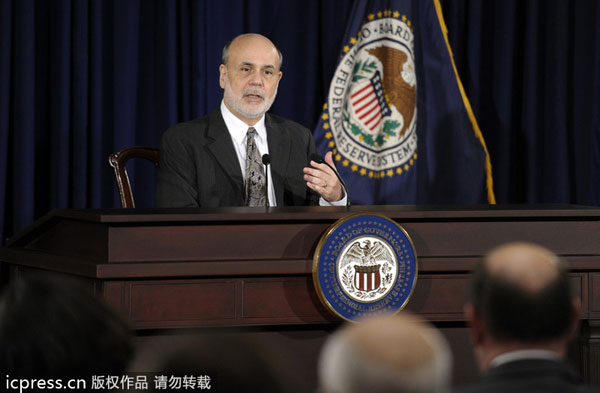

US Federal Reserve Chairman Ben Bernanke speaks during a news conference at the Federal Reserve in Washington, Dec 18, 2013. [Photo/icpress] |

Chinese policymakers who are eager to roll out sweeping economic reforms should thus brace themselves for a possible increase in external uncertainties.

On Wednesday, at his last press conference as chairman, Ben Bernanke announced that the Fed will taper its monthly asset buying from $85 billion to $75 billion starting next year.

As the one who started controversially attempting to save the US economy with newly printed money five years ago, Bernanke must hope that it is coming to an end and the US economy is now on the mend.

And with US shares soaring to record highs, the initial investor response seemed to indicate many believe that the Fed's decision can be deemed a signal that the US growth prospects are bright enough to withstand less stimulus spending.

But the fact that the Fed has, at the same time, gone to great lengths to assure the market that it will keep the short-term interest rate target at zero while making its withdrawal from its quantitative easing policy contingent on the US economy does not justify too much confidence.

Worse, inadequate attention has been paid to the impact of the Fed's move on the global economy.

A number of developing economies have already suffered from the jittery reversal of capital flows when the Fed first floated the idea that it was planning an exit from its cheap money policy early this year. There is no reason for them to lower their guard in the hope that the world's largest economy has given more consideration this time to the effects its monetary policy will have overseas.

As the largest holder of foreign exchange reserves, China is definitely much better positioned than before for the possible chain reaction in exchange rates and other central banks' monetary policies the Fed's decision may trigger.

But policymakers should better prepare for a less rosy scenario than the initial investor response suggests.

If the Fed's unconventional QE policies have indeed worked the magic of supporting US growth after the global crisis in 2008, how can its withdrawal occur without equally significant, if not dire, consequences?