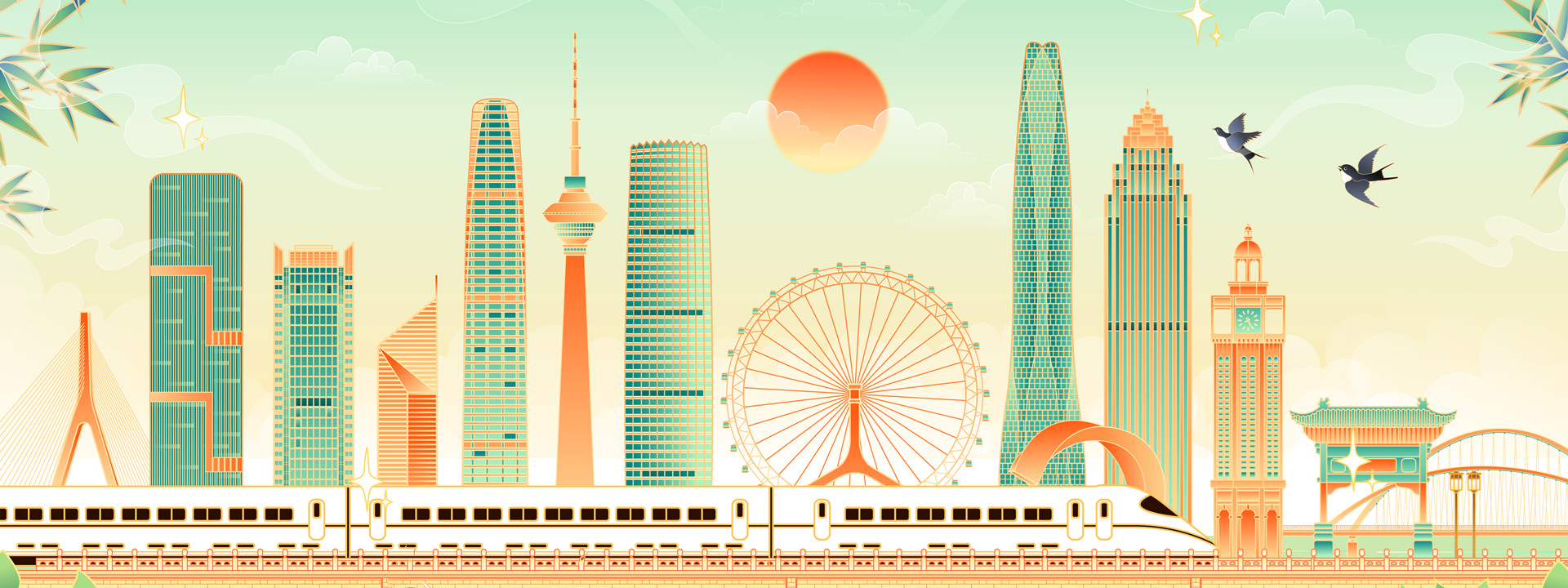

Tianjin Updates

2025-07-23

Smart elderly care changing twilight years for the better

An innovative elderly care center in Tianjin's Hexi district is offering a glimpse into the future of aging in China, combining artificial intelligence with community-based services to improve the lives of older residents.

read more- Tianjin University scientists achieve breakthrough in human DNA assembly

- Smart cities key to driving SCO's intl influence

- Inspired by tour, Tianjin visitors show confidence in enhanced regional ties

Copyright ©? Tianjin Municipal Government.

All rights reserved. Presented by China Daily.

京ICP備13028878號-35

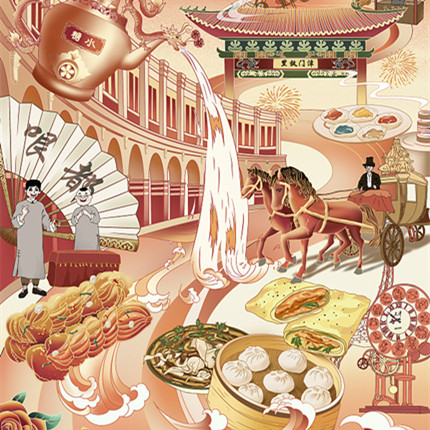

Why Tianjin

Why Tianjin Investment Guide

Investment Guide Industry

Industry Industrial Parks

Industrial Parks

Health

Health Visas

Visas Education

Education Sports and recreation

Sports and recreation Adoption

Adoption Marriage

Marriage