|

|

US dollar and Yuan notes are seen in this picture illustration taken at the Korea Exchange Bank in Seoul in this November 10, 2010 file photo.[Photo/Agencies] |

An increasing number of people have been asking banks to change the Chinese currency into dollars, Guangzhou Daily reported on Monday.

Since last week, they have also been buying more foreign currency-denominated financial products, with most using up their annual currency exchange quota, the report said.

According to the State Administration of Foreign Exchange, the country's top foreign exchange regulator, mainlanders can each exchange renminbi for a maximum amount of $50,000 annually, or the equivalent in other foreign currencies.

Another Guangzhou-based newspaper, Nanfang Metropolis Daily, reported that the regulator has given guidance to mainland banks on controlling their dollar supplies. Employees have also been told not to suggest foreign exchange products to clients.

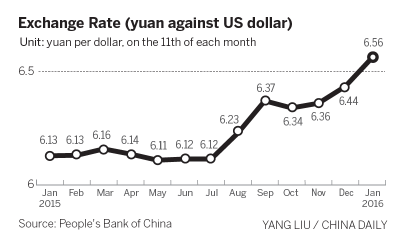

The renminbi traded on the Shanghai-based China Foreign Exchange Trade System has fallen by more than 1.5 percent against the dollar in the past week.

This is the largest weekly decline since August 11 last year when the People's Bank of China, the central bank, announced a foreign exchange rate reform.

Market watchers are speculating that the bank may tolerate faster depreciation of the renminbi and introduce a more flexible foreign exchange policy this year.

Guan Tao, a former official with the regulator, said the rush to sell the renminbi will increase capital outflow pressure and lead to more irrational activities in the market.

On Monday, the central bank stabilized the daily reference rate of the renminbi, which restricts onshore movements to a maximum rise or fall of 2 percent, at 6.5626 renminbi per dollar.

This compares with the multiyear low of 6.5646 on Thursday that triggered a halt to trading in onshore equity markets for two days last week.

A report by Xinhua News Agency said there is no need for the majority of households to exchange the Chinese currency for dollars to preserve the asset value, as the renminbi is unlikely to fall sharply. The return on renminbi-denominated investment products is also still higher than on US dollar-denominated ones.

Regulator names new head

People's Bank of China Deputy Governor Pan Gongsheng is to replace Yi Gang as head of the State Administration of Foreign Exchange, while also retaining his post at the central bank, the currency regulator said in a statement.

It said the regulator will proceed with plans to make the yuan convertible "in an orderly fashion" and will tackle violations of foreign-currency regulations.

China has "relatively abundant foreign-exchange reserves", it said.

Pan previously worked at Agricultural Bank of China and before this held a number of positions at Industrial and Commercial Bank of China, the nation's largest lender.