Foreign exchange reserves decline; bank not worried

China's foreign exchange reserves fell in August due to short-term depreciation, but there are signs of stabilization for the coming months, economists said.

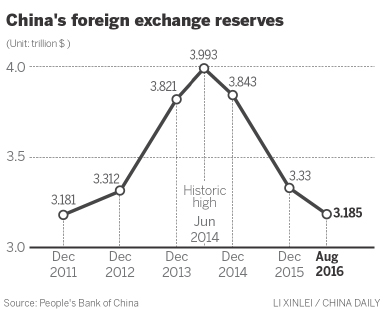

The country's foreign exchange reserves fell by $15.89 billion to $3.185 trillion in August, official data released last week showed. It was the second consecutive monthly decline, hitting their lowest point since December 2011.

Yi Gang, vice-governor of the People's Bank of China, the central bank, said that China has an adequate cushion for maintaining financial stability, and its currency will continue to be stable in the long term. China has the largest foreign exchange reserves in the world, Yi said.

Wang Youxin, an economist at the Institute of International Finance, a think tank under the Bank of China, said the monthly fluctuation of foreign exchange reserves has a lot to do with the movement of the US dollar.

Since July, the market had expected the US Federal Reserve to raise interest rates. Those expectations intensified in August after a central bankers' meeting in Jackson Hole, Wyoming, as analysts widely expected the hike to come in September.

"The change in mood led to the depreciation of the yuan by 0.15 percent and 0.45 percent in July and August, respectively, with more capital flowing out of the country," he said.

"Existing market expectations for an interest rate hike by the US Fed in December-although it is not imminent-would support the dollar and point to continued pressure on the Chinese currency and its foreign exchange reserves."

For China, however, the pressure would not be heavy, according to Xu Yang, an economist at Shanghai-based Guojin Securities Co.

Xu said worries about large capital outflows have been lessening as foreign exchange reserves have shrunk in recent months.

China's capital outflow was $156.1 billion in the first quarter, and it was reduced to $49.1 billion in the second quarter, indicating an improving capital flow balance.

"The central bank has been less willing to intervene in exchange rates through capital controls," Xu said, adding that there would not be sustained pressure from capital outflows.

Tom Orlik, chief Asia economist at Bloomberg Intelligence, expected the yuan to stabilize soon. He based that on what he said were recent signs of the country's resilient growth, a reduced likelihood for a US Federal Reserve rate hike at its September meeting and the yuan's formal inclusion in the Special Drawing Rights basket next month.

"The Chinese currency's inclusion in the SDR basket will take effect in October, when it will become a reserve asset. That will increase capital inflows and somewhat balance the fluctuation of cross-border capital flows," said Liang Hong, chief economist at China International Capital Corp.