CITIC 'plans domestic IPO' to boost capital

|

|

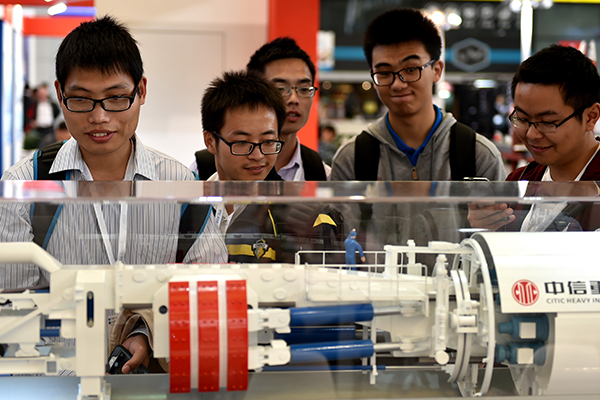

Visitors take a look at a model of a road tunnel boring machine manufactured by CITIC Heavy Industries Co Ltd, at a heavy machinery exhibition in Shanghai. [Photo/China Daily] |

BEIJING-CITIC Trust Co, China's largest trust firm, is planning an initial public offering on the domestic stock market to boost its capital, according to sources.

CITIC Trust General Manager Li Zimin announced the IPO plan in an internal meeting on Friday, said the sources. The source asked not to be identified as the matter hasn't been publicly disclosed. No firm timetable has yet been set for the listing.

CITIC Trust is owned by Chinese conglomerate CITIC Ltd, and has roughly 1.7 trillion yuan ($247 billion) of assets under management. The firm has been actively exploring an IPO, which is one of its key strategies, a Beijing-based press officer at CITIC Trust said on Tuesday, while declining to elaborate.

Some of China's trust companies need to raise money to comply with tougher capital rules as industry assets have expanded rapidly in recent years, reaching 18 trillion yuan as of end-September. The trust business has been one of the fastest-growing areas of China's shadow banking system, fueled by demand from wealthy investors for higher yielding assets and by corporate borrowers unable to access regular loans from Chinese banks.

Shandong International Trust Co earlier this month won approval from the China Securities Regulatory Commission for a first-time share sale in Hong Kong, which would represent the first IPO by a mainland trust company in more than two decades.

China's 68 trust companies pool money from investors and buy assets including stocks, bonds, art and wine, as well as financing projects in sectors such as property and coal mining.

Beijing-based CITIC Trust was established in 1988 and had 12.9 billion yuan of net capital as of end 2015, according to its latest annual report. The China Banking Regulatory Commission, which supervises the trusts, introduced tougher capital rules for the industry in 2010, requiring net capital to exceed 40 percent of net assets.

China's securities regulator said earlier that it will allow more companies to list on its stock market as part of efforts to boost the Chinese economy, dismissing concerns that new issues would depress the market.

????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????? BLOOMBERG